MSTR stock performance, Bitcoin investment strategy, large-cap stock analysis

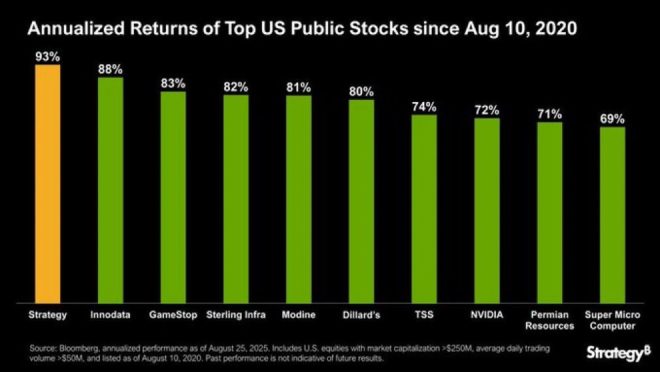

BREAKING:$MSTR IS THE #1 PERFORMING LARGE-CAP U.S. STOCK (OUT OF ~1,400) SINCE ADOPTING THE BITCOIN STANDARD. pic.twitter.com/CZY2qiqZRN

— Crypto Rover (@rovercrc) August 26, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: $MSTR is the #1 Performing Large-Cap U.S. Stock

In a stunning revelation, MicroStrategy Inc. ($MSTR) has emerged as the top-performing large-cap U.S. stock, outperforming approximately 1,400 other stocks since adopting the Bitcoin standard. This significant achievement highlights the growing trend among corporations to incorporate cryptocurrencies into their financial strategies.

MicroStrategy’s journey into the world of Bitcoin began as a bold move to hedge against inflation, and it has proven to be a game-changer. By investing heavily in Bitcoin, MicroStrategy has not only secured its financial future but also positioned itself as a leader in the crypto-adoption movement. This strategic pivot has resonated well with investors, driving up its stock price and attracting a wave of interest.

For those unfamiliar, the Bitcoin standard involves a company holding Bitcoin as a primary reserve asset. This innovative approach has led to increased stock performance, and MicroStrategy has set a benchmark for other firms contemplating a similar strategy.

The surge in $MSTR’s stock price reflects investor confidence in the long-term potential of Bitcoin and its increasing acceptance in the corporate world. As more companies explore cryptocurrency as part of their financial portfolios, MicroStrategy serves as a compelling case study for the benefits of embracing digital assets.

If you’re looking to understand how the cryptocurrency market influences traditional stocks, keep an eye on MicroStrategy. Their continued success illustrates the powerful intersection of technology and finance, making them a company to watch.

Stay updated on the latest developments by checking out more insights from financial analysts and crypto enthusiasts. You can follow discussions about $MSTR and its performance on platforms like Twitter.