Michael Saylor Bitcoin strategy, large-cap stock performance, cryptocurrency investment success

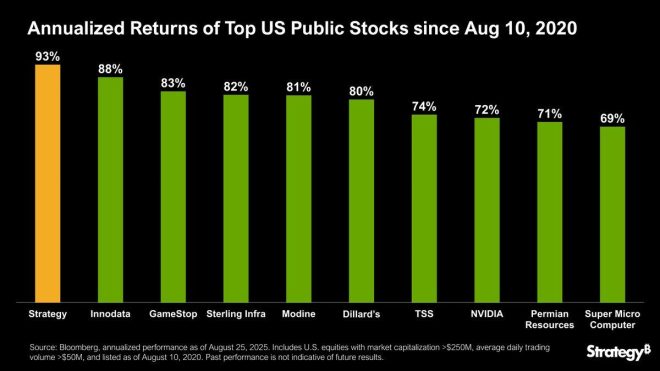

JUST IN: Michael Saylor’s STRATEGY is the #1 performing large-cap U.S. stock since adopting a Bitcoin standard in 2020. pic.twitter.com/lWFKoyh1yC

— Bitcoin Archive (@BTC_Archive) August 26, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Michael Saylor’s STRATEGY is the #1 Performing Large-Cap U.S. Stock

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has made headlines with his innovative approach to corporate finance. Since adopting a Bitcoin standard in 2020, Saylor’s strategy has positioned MicroStrategy as the top-performing large-cap U.S. stock. This bold move has not only attracted attention from investors but also sparked discussions about the long-term viability of Bitcoin as a corporate asset.

The Adoption of a Bitcoin Standard

In 2020, Saylor made the groundbreaking decision to convert MicroStrategy’s cash reserves into Bitcoin. This was a significant shift in how companies view digital assets. By embracing Bitcoin, Saylor aimed to protect the company’s value against inflation and economic instability. His strategy has proven effective, leading to impressive returns for shareholders and establishing a new benchmark for corporate investment strategies.

Performance Metrics and Investor Sentiment

Since adopting this Bitcoin standard, MicroStrategy’s stock has outperformed many of its peers. The company’s innovative approach has attracted a new wave of investors who are keen to capitalize on the potential of cryptocurrencies. Saylor’s commitment to Bitcoin has not only boosted the company’s financial performance but also reinforced the idea that traditional investment strategies may need to evolve in the digital age.

The Future of Corporate Investment

As more companies consider similar strategies, Saylor’s vision could reshape the landscape of corporate finance. Other firms are now examining how digital currencies can play a role in their portfolios. With MicroStrategy leading the charge, the conversation around Bitcoin as a legitimate corporate asset is gaining momentum.

In summary, Michael Saylor’s strategic shift to a Bitcoin standard has established MicroStrategy as a leader in both innovation and financial performance. This paradigm shift is likely to influence how corporations approach investment in the years to come.