Bitcoin market volatility, cryptocurrency trading strategies, digital asset liquidation trends

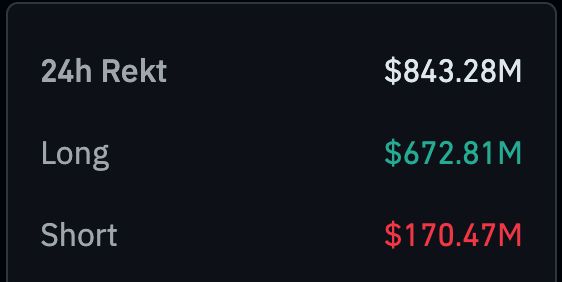

JUST IN: Over $840 MILLION Bitcoin and crypto liquidations over the past 24 hours. pic.twitter.com/S73gTOFwkZ

— Bitcoin Archive (@BTC_Archive) August 25, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Over $840 Million Bitcoin and Crypto Liquidations

Recently, the cryptocurrency market witnessed a staggering event, with over $840 million in Bitcoin and crypto liquidations occurring within just 24 hours. This significant liquidation figure highlights the volatility that often accompanies the crypto space, leaving traders and investors in a state of concern.

Understanding Liquidations

Liquidations happen when a trader’s position is forcibly closed by an exchange due to insufficient margin. In simpler terms, if the market moves against a trader’s position, and they don’t have enough funds to cover their losses, the exchange will liquidate their holdings to mitigate risk. This can lead to massive sell-offs, further driving down prices and potentially triggering even more liquidations.

The Impact on the Market

The recent $840 million liquidation event has sent ripples through the market. Prices dipped as traders rushed to minimize losses, causing a domino effect. Investors are now on high alert, closely monitoring market trends and price movements. It’s essential for anyone involved in cryptocurrency trading to understand the factors that can lead to such volatility.

Strategies to Mitigate Risk

To navigate the turbulent waters of the crypto market, consider implementing risk management strategies. Setting stop-loss orders can help protect your investments from sudden downturns. Additionally, diversifying your portfolio can spread risk across various assets, reducing the impact of any single liquidation event.

Stay Informed

For the latest updates on the cryptocurrency market, follow trusted sources like Bitcoin Archive on Twitter. Staying informed about market trends and liquidation events can help you make better trading decisions and safeguard your investments.

As the crypto landscape continues to evolve, understanding the implications of such significant liquidations is crucial for every investor.