global money supply trends, Bitcoin price prediction, cryptocurrency market growth

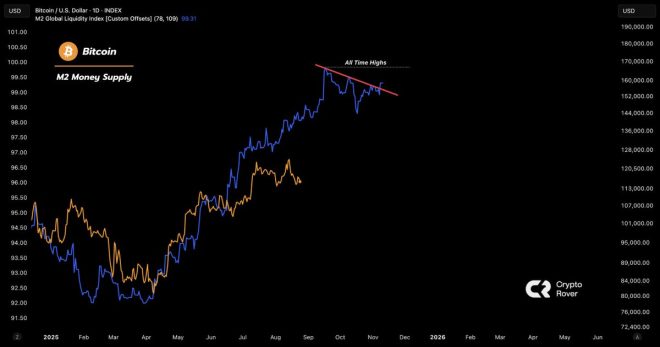

The global money supply is breaking out again.

Send it toward all time highs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This is extremely bullish for Bitcoin and Crypto. pic.twitter.com/JwBubU2jHA

— Crypto Rover (@rovercrc) August 25, 2025

The Global Money Supply is Breaking Out Again

The global money supply is breaking out again, signaling an exciting shift in the financial landscape. This surge is not just a number; it represents a significant increase in liquidity worldwide. As more money enters the system, it can lead to inflation, asset price increases, and a potential revaluation of currencies.

Send it Toward All-Time Highs

As the global money supply rises, we are witnessing a drive toward all-time highs. This phenomenon suggests that central banks are continuing to print money, which can have various implications for the economy. In this context, it’s essential to keep an eye on how this influx of capital affects different investment vehicles, particularly cryptocurrencies.

This is Extremely Bullish for Bitcoin and Crypto

This situation is extremely bullish for Bitcoin and crypto assets. With more liquidity in the market, investors often look for alternative assets to hedge against inflation, and cryptocurrencies have emerged as a popular choice. Bitcoin, in particular, has been known to thrive during periods of increased monetary supply, as it offers a decentralized alternative to traditional currencies.

Investors should consider this trend carefully. The rising global money supply can lead to increased demand for Bitcoin and other cryptocurrencies, driving prices higher. If you’re looking to diversify your portfolio or capitalize on this trend, now might be the perfect time to explore crypto investments.

Stay informed about these developments, as they can shape the future of finance and investment strategies. In a world where the global money supply is breaking out, being proactive could mean the difference between simply watching the market and actively participating in it.