cryptocurrency market manipulation, Bitcoin price volatility, Ethereum trading strategies

BREAKING:

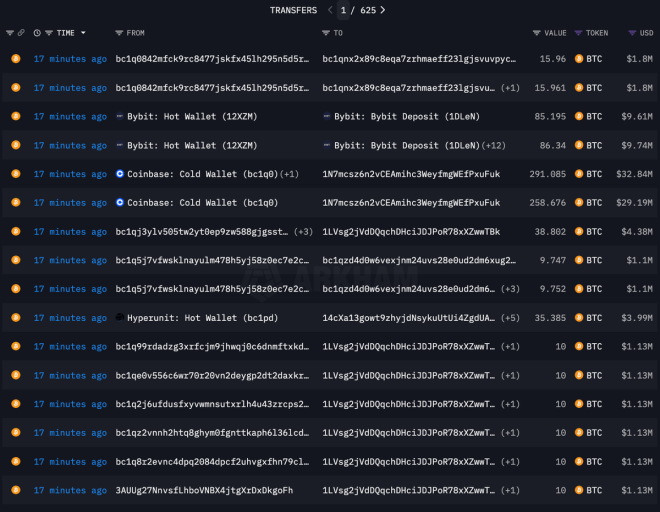

COINBASE AND BINANCE SECRETLY DUMPING $BTC AND $ETH TO LIQUIDATE LONGS

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

DO NOT GET SHAKEN OUT! pic.twitter.com/ksB7XrsIXQ

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) August 25, 2025

COINBASE AND BINANCE SECRETLY DUMPING $BTC AND $ETH

Recent reports have surfaced claiming that Coinbase and Binance are secretly dumping $BTC and $ETH to liquidate longs. This news has sent shockwaves through the cryptocurrency community, raising concerns among investors. Many are worried that these actions could lead to significant price drops in the near future.

UNDERSTANDING THE IMPACT ON THE MARKET

When major exchanges like Coinbase and Binance engage in such activities, it can create a ripple effect across the market. Liquidating long positions means that traders who bet on rising prices may be forced to sell their assets at a loss, further driving down prices. If you’re holding onto $BTC or $ETH, it’s crucial to stay informed and not get shaken out by market fluctuations.

STRATEGIES TO NAVIGATE THIS SITUATION

In times like these, it’s essential to have a solid strategy in place. Diversification can help mitigate risks, so consider spreading your investments across different cryptocurrencies. Additionally, staying updated with reliable news sources can provide insights into market trends and potential recovery signs. Remember, panic selling can often lead to missed opportunities when the market stabilizes.

STAYING IN THE LOOP

To keep abreast of developments, follow trusted Twitter accounts and cryptocurrency news platforms. Engaging with the community can also provide support and additional perspectives on market movements. Don’t hesitate to join discussions where you can share insights and learn from others.

In summary, while the news about Coinbase and Binance dumping $BTC and $ETH may be alarming, remaining calm and informed is key. Stick to your investment plan, and don’t let the fear of market volatility dictate your decisions.