Bitcoin investment strategies, cryptocurrency market trends, institutional crypto trading

BREAKING:

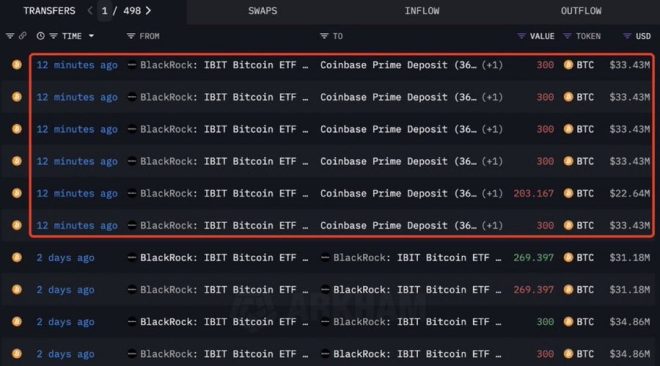

BlackRock just sold 1,703.17 Bitcoin worth $190M

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Are you buying, selling or holding? pic.twitter.com/8q3aMUbMRJ

— Jeremy (@Jeremyybtc) August 25, 2025

BREAKING: BlackRock Sold 1,703.17 Bitcoin Worth $190M

Recently, a significant move in the cryptocurrency market caught everyone’s attention. BlackRock, the world’s largest asset manager, announced that it sold 1,703.17 Bitcoin, valued at approximately $190 million. This decision raises important questions for investors: Are you buying, selling, or holding?

BlackRock’s actions are noteworthy because they signal a shift in institutional interest in Bitcoin. As more traditional financial institutions engage with cryptocurrencies, the market becomes more dynamic. If you’re considering your own investment strategy, this could be the perfect moment to evaluate your options.

Are You Buying, Selling, or Holding?

With BlackRock’s recent sale, it’s essential to consider the implications for your own investment. If you’re thinking about buying, it might be wise to analyze market trends and potential future movements. On the other hand, if you’ve been holding onto Bitcoin, now could be a good time to assess whether to maintain your position or take profits.

Understanding Market Movements

The cryptocurrency market is notoriously volatile, and significant transactions like BlackRock’s can create ripples that impact prices. Staying informed about these developments can help you make educated decisions. Engaging with communities on platforms like Twitter or cryptocurrency forums can provide insights and varying perspectives on the market’s direction.

In summary, the recent sale of Bitcoin by BlackRock is a pivotal moment for both institutional and retail investors. Whether you’re choosing to buy, sell, or hold, staying informed is crucial. Keep an eye on market trends to navigate this ever-evolving landscape effectively.