Bitcoin market crash, whale cryptocurrency trading, Bitcoin investment strategies

JUST IN: A single whale caused today’s $310M Bitcoin flash crash by dumping 24,000+ BTC.

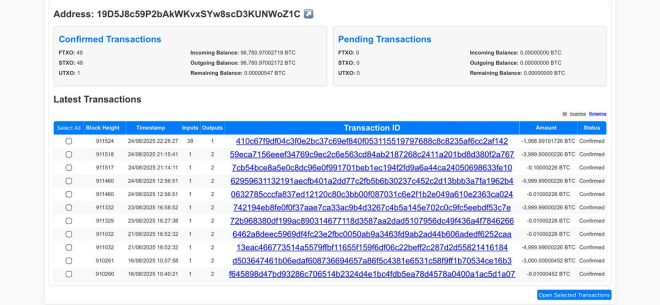

The entity still holds 152,874 BTC across linked wallets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The funds trace back to HTX deposits from six years ago.

Via @SaniExp pic.twitter.com/4xrZiiVpJ6

— Bitcoin news (@BitcoinNewsCom) August 24, 2025

A Single Whale Caused Today’s $310M Bitcoin Flash Crash

In a dramatic turn of events, a single whale has been identified as the catalyst behind today’s staggering $310 million Bitcoin flash crash. Reports indicate that this entity dumped over 24,000 BTC, triggering a significant decline in Bitcoin prices. Such large-scale sell-offs can cause panic in the market, leading to further price drops as traders react to the sudden influx of Bitcoin on exchanges.

The Entity Still Holds 152,874 BTC Across Linked Wallets

What’s fascinating is that this whale still holds a substantial amount of Bitcoin—152,874 BTC, to be exact—across several linked wallets. This raises questions about the intentions behind the sell-off. Was it a strategic move to maximize profits, or an attempt to manipulate the market? Understanding the behavior of such large holders is crucial for investors who want to navigate the often volatile cryptocurrency landscape.

The Funds Trace Back to HTX Deposits from Six Years Ago

Interestingly, the funds involved in this massive transaction trace back to HTX deposits made six years ago. This long-term holding pattern suggests that the whale was sitting on these assets for quite some time before deciding to liquidate a portion. It highlights the unpredictable nature of cryptocurrency investments, where even seasoned investors can make sudden moves that impact the market dramatically.

For those following Bitcoin closely, it’s imperative to stay informed about these developments. The cryptocurrency market is incredibly sensitive, and understanding the actions of major players can provide valuable insights. Keep an eye on market trends and be prepared for potential fluctuations in response to similar events in the future.