“unconventional mortgage approval strategies, creative financing solutions for homes, bizarre legal loopholes in marriage, unique ways to secure a loan, 2025 mortgage application hacks”

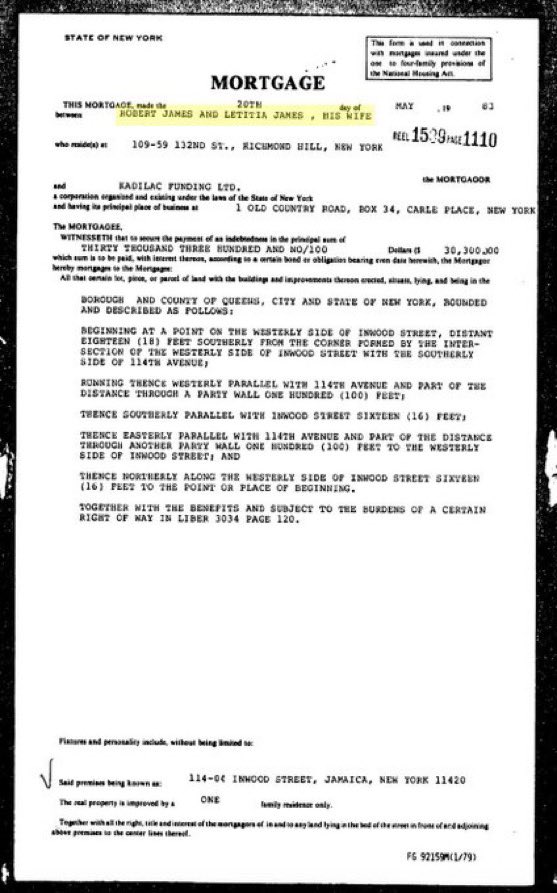

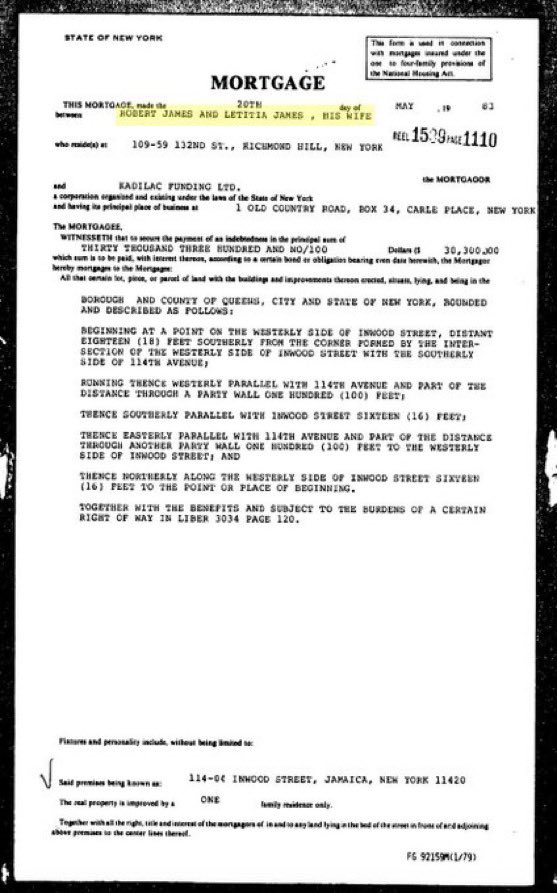

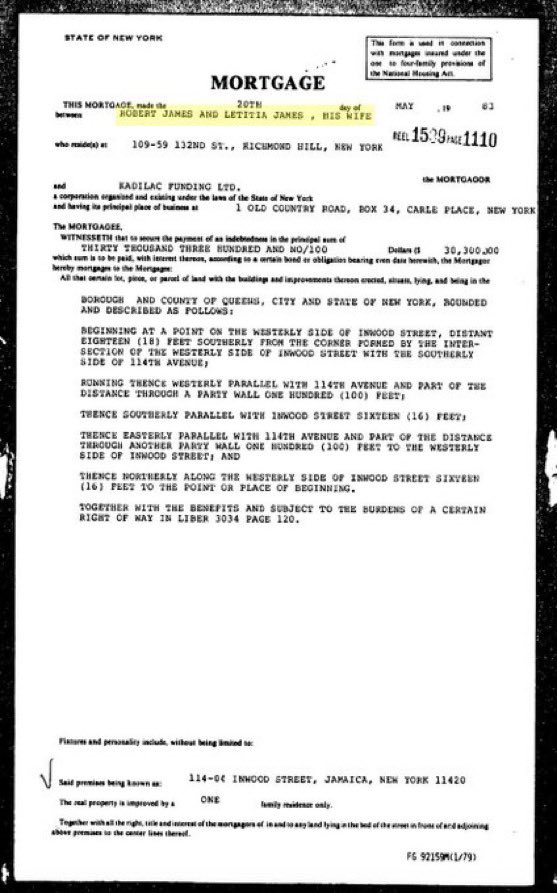

Can you Imagine? Letitia married her father on paper to get approved for a mortgage loan! pic.twitter.com/d1X6EX8Stj

— Johnny Midnight (@its_The_Dr) August 23, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Understanding the Unconventional Mortgage Strategy: Letitia’s Unique Approach

In an era where securing a mortgage can be a daunting task, innovative strategies are emerging to navigate the complexities of home financing. One such intriguing case is highlighted in a recent tweet by Johnny Midnight, where a woman named Letitia allegedly married her father on paper to secure a mortgage loan. This unconventional method raises questions about societal norms, legal implications, and the lengths to which individuals will go to achieve homeownership.

The Context of the Tweet

The tweet, which has garnered significant attention, presents a shocking scenario: Letitia’s marriage to her father was a strategic move aimed at obtaining mortgage approval. While many might dismiss this as a sensationalized story, it reflects a real struggle faced by many in today’s housing market. The image accompanying the tweet has sparked curiosity and debate, drawing attention to the extreme measures some people are willing to take when confronted with the challenges of securing a home loan.

The Challenges of Obtaining a Mortgage

For many potential homeowners, the path to mortgage approval is fraught with obstacles. Lenders often require extensive documentation, a solid credit score, and a stable income, making it increasingly difficult for first-time buyers or those with non-traditional financial backgrounds to qualify. As housing prices continue to soar, the pressure intensifies, leading some individuals to explore unconventional solutions to secure financing.

Legal and Ethical Implications

Letitia’s decision to marry her father raises significant legal and ethical questions. From a legal standpoint, such marriages, often referred to as "paper marriages," can be fraught with complications. While it may help in obtaining a mortgage, it can also lead to scrutiny from lenders and potential legal repercussions if discovered. Ethically, this situation challenges our understanding of familial relationships and the boundaries of acceptable behavior in financial transactions.

The Role of Family in Financial Decisions

The concept of family supporting each other in financial endeavors is not new. However, Letitia’s case takes this support to an extreme level. It highlights the lengths to which individuals may go to assist family members in achieving their goals, even if it involves bending societal norms. Families often collaborate to tackle financial challenges, but this example raises important discussions about the implications of such decisions on family dynamics and societal perceptions.

The Broader Impact on Homeownership

Letitia’s situation reflects a broader trend in the housing market, where individuals are increasingly seeking alternative methods to secure homeownership. As traditional paths become less accessible, more people may consider unconventional strategies to obtain financing. This could lead to a shift in how we view home loans and the lengths to which individuals will go to achieve their dream of homeownership.

The Importance of Financial Literacy

This case underscores the need for increased financial literacy among potential homebuyers. Many individuals may not be aware of the various options available to them in securing a mortgage. Understanding the nuances of mortgage approval processes, state laws regarding marriage and financial transactions, and alternative lending options can empower individuals to make informed decisions without resorting to extreme measures.

Conclusion: A Cautionary Tale

While Letitia’s story might seem extraordinary, it serves as a cautionary tale about the lengths individuals will go to in the pursuit of homeownership. As housing markets continue to evolve, it is crucial for individuals to remain informed about their financial options and the potential consequences of unconventional strategies. Letitia’s case invites a broader conversation about the nature of family, financial responsibility, and the societal pressures surrounding homeownership.

In summary, the story of Letitia marrying her father to secure a mortgage highlights the challenges many face in today’s housing market and raises important questions about legality, ethics, and the lengths people will go to achieve their dreams of homeownership. By fostering a culture of financial literacy and open dialogue, we can help ensure that individuals have the tools and knowledge necessary to navigate the complex world of mortgages responsibly.

Shocking Twist: Woman Marries Father for Mortgage Approval!

” />

Can you Imagine? Letitia married her father on paper to get approved for a mortgage loan! pic.twitter.com/d1X6EX8Stj

— Johnny Midnight (@its_The_Dr) August 23, 2025

Can you Imagine? Letitia married her father on paper to get approved for a mortgage loan!

Imagine this scenario: Letitia, in a rather unconventional move, marries her father on paper to secure a mortgage loan. It’s a jaw-dropping story that raises eyebrows and questions about the lengths people will go to in order to achieve their dreams. This situation highlights the complexities of mortgage approvals and the sometimes desperate measures individuals take to get that coveted loan.

Understanding the Mortgage Process

Before diving into the details of Letitia’s unique arrangement, let’s explore how mortgage approvals typically work. When applying for a mortgage, lenders assess a variety of factors, including credit scores, income, debt-to-income ratios, and employment history. These elements help lenders gauge whether a borrower can reliably repay the loan. However, sometimes, these criteria can seem insurmountable, leading people to seek alternative routes.

Why Would Someone Marry Their Parent?

At first glance, Letitia’s decision to marry her father for mortgage purposes seems baffling. However, it’s important to consider the financial landscape many individuals face today. With rising housing costs and stringent lending requirements, some people feel cornered into making unorthodox choices. Marrying a parent can theoretically improve a borrower’s financial profile, particularly if the parent has strong credit and financial stability. But this raises ethical concerns, blurring the lines between familial bonds and financial strategies.

The Ethical Dilemma

Letitia’s situation brings to light the ethical implications of using familial relationships to manipulate financial systems. Is it morally acceptable to enter into such an arrangement purely for financial gain? While some might argue that it’s just a clever workaround, others may see it as a betrayal of the trust and integrity that should exist in family relationships. This dilemma forces us to reflect on what lengths we might go to in the name of financial security.

Potential Consequences of Unconventional Loans

While Letitia’s story is certainly eye-catching, it also serves as a cautionary tale about the potential pitfalls of unconventional loan arrangements. If such a marriage is discovered, it could lead to severe repercussions, including legal issues, financial penalties, or even criminal charges. Lenders have strict regulations in place to prevent fraud, and any attempt to circumvent these can lead to significant consequences.

Alternatives to Unconventional Solutions

Instead of resorting to extreme measures, there are several legitimate alternatives to consider when facing mortgage challenges. For instance, first-time homebuyer programs often provide assistance in the form of grants or lower interest rates. Additionally, working to improve one’s credit score through responsible financial practices can open up more lending opportunities. Seeking advice from financial advisors can also help in navigating the complex world of mortgages without resorting to drastic actions.

Lessons Learned from Letitia’s Story

Letitia’s unconventional decision to marry her father for a mortgage loan offers valuable lessons about the importance of ethics in financial decision-making. While the story is certainly sensational, it serves as a reminder that there are always alternative paths to achieving financial goals. Utilizing family relationships for financial gain can lead to complications that may not be worth the risk.

Conclusion: Reflecting on Financial Choices

As we reflect on Letitia’s story, it’s essential to consider the broader implications of our financial choices. While the mortgage industry can be intimidating and complex, there are countless resources available to help navigate these challenges. Letitia’s experience reminds us to seek out ethical solutions and support when pursuing our financial dreams.

In wrapping up, it’s clear that while Letitia’s approach may have been extreme, it shines a light on the ongoing struggles many face in securing a home. The next time you hear a story like Letitia’s, take a moment to ponder the motivations behind such decisions and the broader context of financial pressures in today’s world.

“unconventional marriage for loans”, “legal loopholes for mortgages”, “surprising mortgage approval stories”, “creative financing solutions”, “strange marriage agreements”, “unusual ways to secure a loan”, “financial tricks for homebuyers”, “bizarre mortgage strategies”, “family ties and finance”, “marriage and mortgage eligibility”, “unique loan approval methods”, “absurd legal contracts”, “navigating mortgage regulations”, “uncommon paths to homeownership”, “quirky financial arrangements”, “unexpected loan approval scenarios”, “marriage to obtain financing”, “family relationships and loans”, “creative home loan strategies”, “unorthodox mortgage applications”