central bank liquidity, economic stimulus strategies, monetary policy impacts

BREAKING CHINA’S CENTRAL BANK PUMPED ¥2 TRILLION IN LIQUIDITY INTO THEIR ECONOMY THIS WEEK.

POWELL HAS TO MATCH THAG ENERGY pic.twitter.com/H44R00CXR8

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— That Martini Guy ₿ (@MartiniGuyYT) August 23, 2025

BREAKING CHINA’S CENTRAL BANK PUMPED ¥2 TRILLION IN LIQUIDITY INTO THEIR ECONOMY THIS WEEK

China’s central bank has taken a significant step this week by injecting ¥2 trillion into the economy. This move is intended to bolster economic growth and liquidity in a time when many analysts are observing a slowdown. The infusion of such a large amount of cash signals a proactive approach to stimulate financial markets and ensure the smooth functioning of economic activities. The central bank’s actions reflect an understanding of the challenges posed by both domestic and global economic pressures.

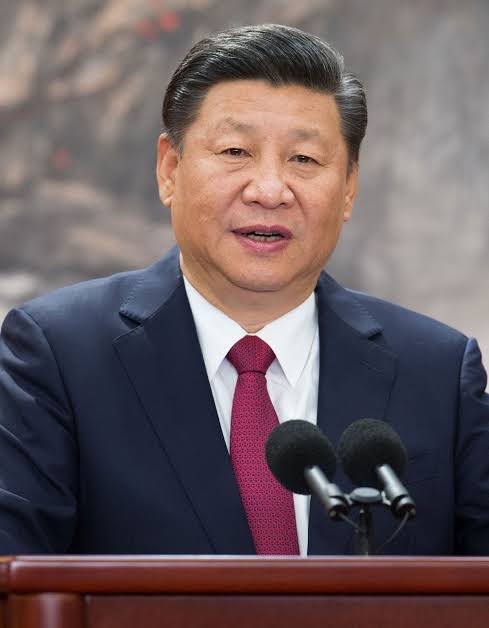

POWELL HAS TO MATCH THAT ENERGY

In response to China’s aggressive monetary policy, many economists speculate that Federal Reserve Chair Jerome Powell may need to consider similar actions to maintain balance in the global economy. As markets react to China’s liquidity boost, Powell’s decisions will be closely scrutinized, particularly in light of ongoing inflationary pressures in the United States. The call for Powell to "match that energy" suggests that investors are looking for a robust response to ensure the U.S. economy remains competitive.

The dynamics between the Chinese and U.S. economies are more crucial than ever. With the interconnectedness of global markets, decisions made by central banks in one major economy can have ripple effects worldwide. As we watch these developments unfold, it’s clear that monetary policy will play a pivotal role in shaping the economic landscape for both nations.

For more insights into this ongoing economic situation, you can check out the original tweet from That Martini Guy on Twitter here. It’s an exciting time for economists, investors, and anyone interested in the global financial system!