inflation impact on tariffs, economic forecasts 2025, short-term inflation trends

BREAKING:

The reasonable base case is that inflation effects of tariffs will be short-lived.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

THIS IS DOVISH LANGUAGE! pic.twitter.com/jQAPyNllNA

— Crypto Rover (@rovercrc) August 22, 2025

BREAKING: Inflation Effects of Tariffs Will Be Short-Lived

The recent statement from Crypto Rover has sparked conversations in the financial community, especially regarding the inflation effects of tariffs. According to the tweet, "The reasonable base case is that inflation effects of tariffs will be short-lived." This assertion provides a sense of relief to investors and consumers alike, as prolonged inflation can have detrimental effects on the economy.

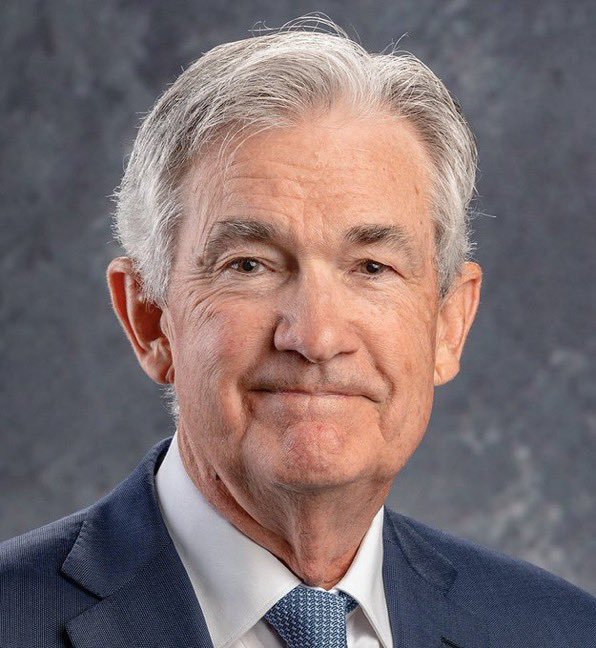

Dovish Language

The phrase "THIS IS DOVISH LANGUAGE!" highlights a shift in monetary policy perspectives. Dovish language typically suggests a focus on growth and economic stability, indicating that the Federal Reserve may not be inclined to raise interest rates aggressively in response to inflationary pressures from tariffs. This could mean a more favorable environment for borrowing and spending, which is essential for economic recovery.

Implications for Investors

For investors, understanding the implications of this statement is crucial. Short-lived inflation effects could mean that sectors reliant on consumer spending might see a boost. If inflationary pressures ease, it could lead to more stable market conditions, allowing for better investment decisions. You can read more about how inflation impacts various sectors here.

Consumer Confidence

Consumers should also take note of these developments. If inflation remains manageable, purchasing power could be preserved, and spending might increase. This is particularly important in a recovering economy. Keeping an eye on inflation trends can help you make informed decisions about your finances.

In summary, the insights from Crypto Rover provide a glimmer of hope in a complex economic landscape. Understanding the short-lived nature of tariff-induced inflation can empower both investors and consumers to navigate the market more effectively.