Cracker Barrel stockholders, BlackRock Vanguard influence, Wall Street DEI trends, ESG investing impact, American heritage erasure

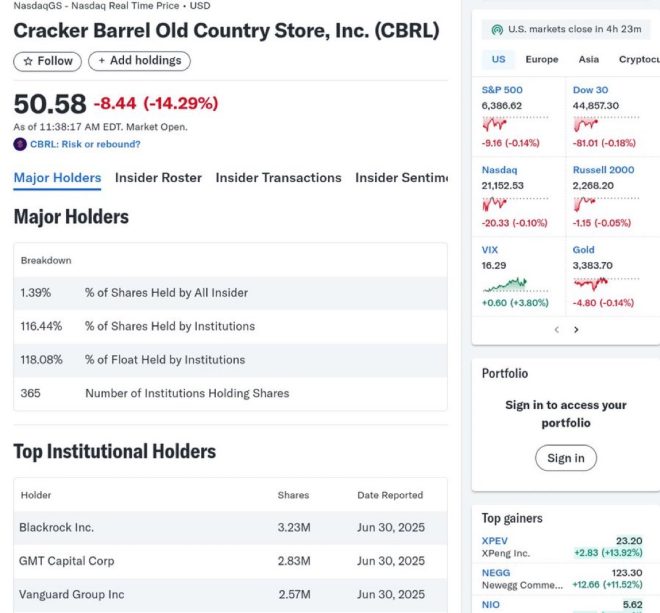

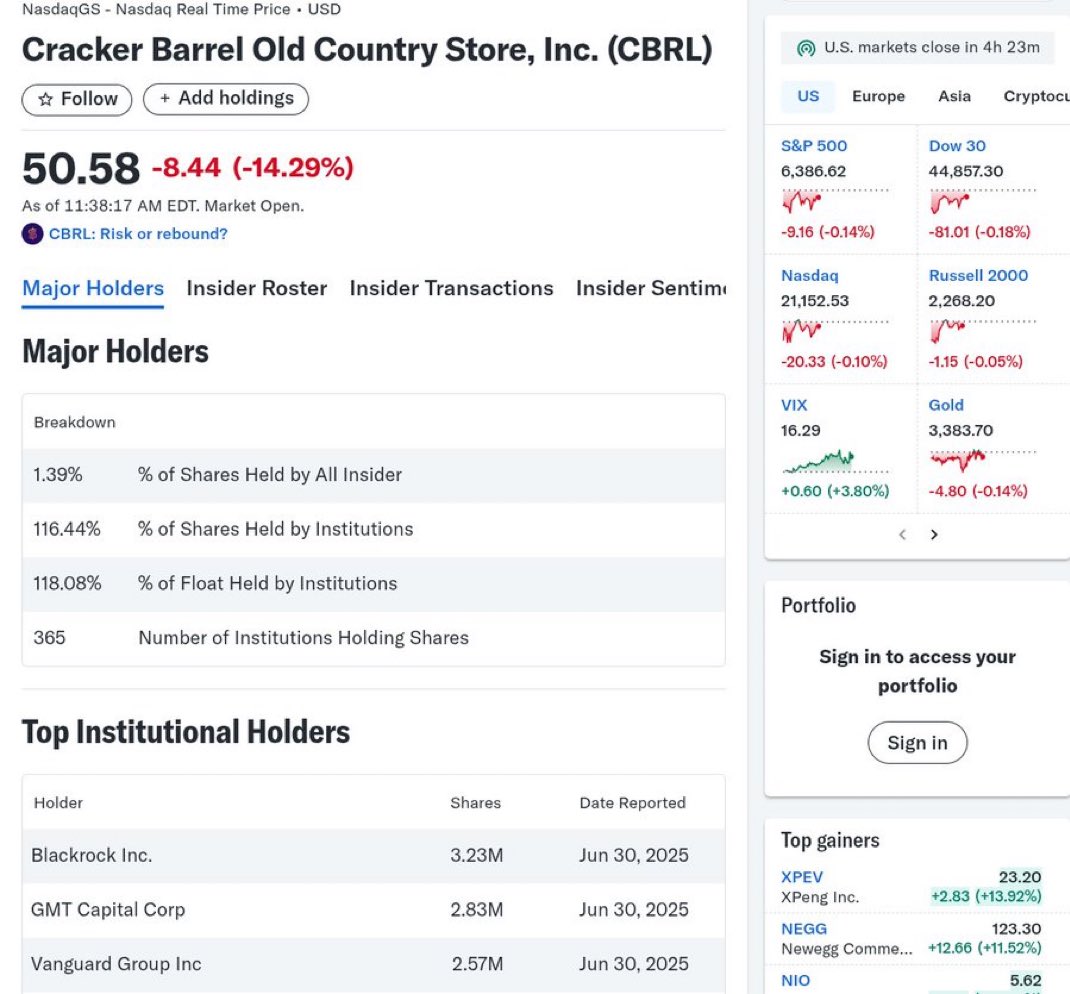

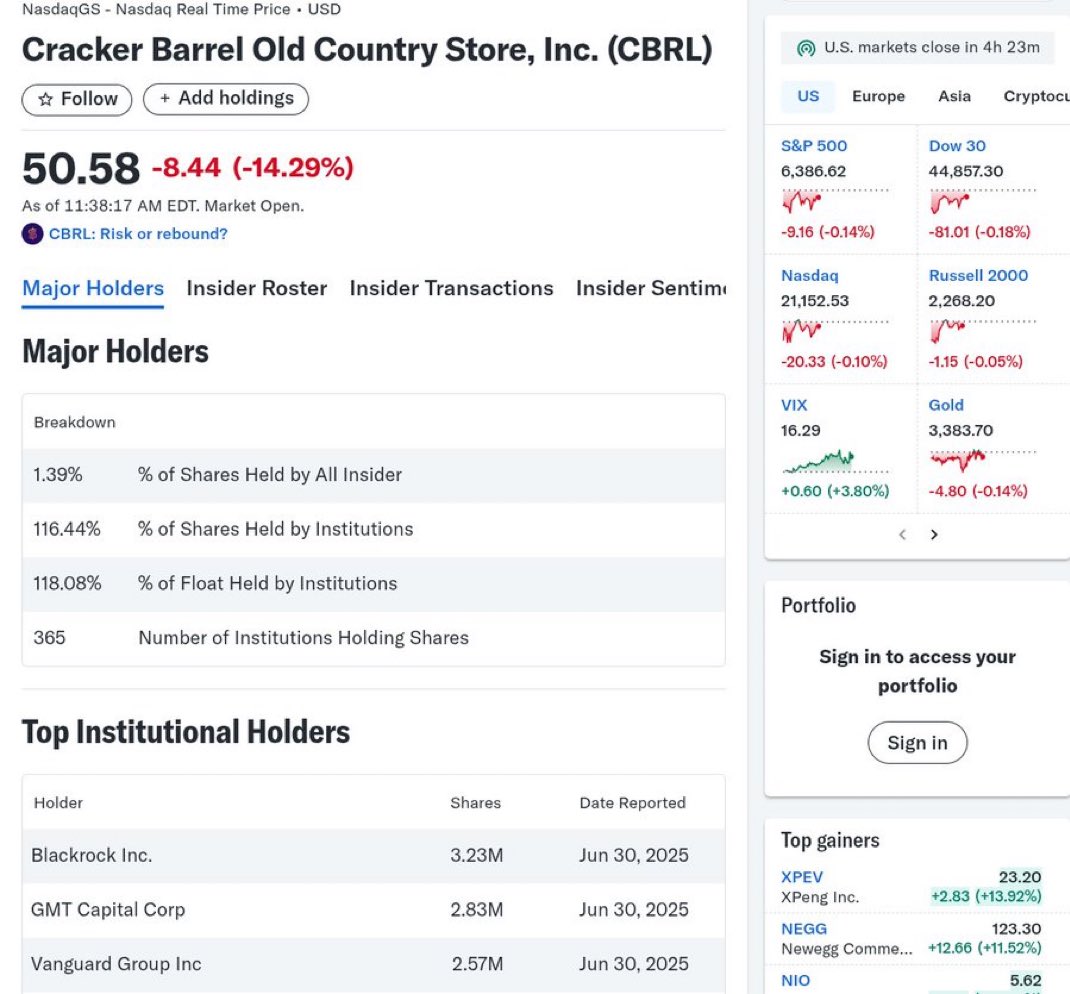

Oh look – 2 of the 3 largest stockholders in Cracker Barrel are BlackRock and Vanguard

The DEI & ESG kings of Wall Street

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Now do you see why their girl boss puppets did what they did?

This is an intentional erasure of American heritage pic.twitter.com/QKbq34Ze9a

— DC_Draino (@DC_Draino) August 22, 2025

Understanding the Influence of BlackRock and Vanguard on Cracker Barrel

In a recent tweet, the social media user DC_Draino highlighted a striking observation: two of the three largest stockholders in Cracker Barrel are financial giants BlackRock and Vanguard. This revelation has sparked discussions around the implications of their ownership, particularly in relation to Diversity, Equity, and Inclusion (DEI) initiatives and Environmental, Social, and Governance (ESG) standards that many corporations are adopting today.

The Role of BlackRock and Vanguard

BlackRock and Vanguard are known as leaders in asset management, overseeing trillions of dollars in investments. Their influence extends beyond mere financial metrics; they have become significant players in shaping corporate policies, particularly concerning social responsibility and governance. Their commitment to DEI and ESG principles has made them key figures in the modern corporate landscape, driving companies to adopt practices that align with these values.

The Impact of DEI and ESG Initiatives

The push for DEI and ESG initiatives is not merely a trend; it reflects a broader societal shift towards more responsible business practices. Companies are increasingly recognizing the importance of social accountability and environmental stewardship. In this context, BlackRock and Vanguard’s influence can lead to significant changes in corporate policy, often prioritizing these initiatives over traditional business practices.

Cracker Barrel’s Response

The tweet suggests that the actions taken by Cracker Barrel’s management may be influenced by the expectations of these major stakeholders. This raises questions about the extent to which corporate decisions are being guided by shareholder interests versus the heritage and values that the brand represents. Cracker Barrel, known for its American heritage and traditional values, may find itself at a crossroads as it navigates these pressures.

The Debate on American Heritage

The assertion of "intentional erasure of American heritage" made in the tweet underscores a growing concern among certain segments of the population regarding the dilution of traditional values in favor of more progressive policies. Critics argue that the push for inclusivity and environmental responsibility may sometimes overshadow the historical and cultural significance that brands like Cracker Barrel represent.

The Cultural Significance of Cracker Barrel

Cracker Barrel is not just a restaurant chain; it is a symbol of Americana, offering a nostalgic dining experience that evokes memories of simpler times. The brand’s decor and menu often reflect a deep appreciation for Southern culture and cuisine. As such, any perceived departure from these roots in favor of modern corporate initiatives can lead to backlash from loyal customers who cherish the brand’s heritage.

The Corporate Landscape: A Balancing Act

As corporations navigate the delicate balance between meeting stakeholder expectations and preserving their core identity, they face ongoing challenges. The influence of BlackRock and Vanguard illustrates how financial interests can drive significant corporate changes. However, it also raises questions about the sustainability of such changes in the long term, especially if they alienate existing customers.

Navigating Stakeholder Pressures

Corporate leaders must weigh the demands of major shareholders against the expectations of their consumer base. In Cracker Barrel’s case, the challenge lies in aligning its operational practices with the values that have historically attracted customers while also embracing the evolving landscape of corporate responsibility.

The Future of Corporate Governance

As discussions around DEI and ESG continue to evolve, companies like Cracker Barrel will need to adapt to meet new expectations while remaining true to their heritage. This balancing act will require thoughtful leadership and a strategic approach to corporate governance that acknowledges both financial imperatives and cultural significance.

The Role of Consumers

Consumers play a pivotal role in this dynamic. Their reactions to corporate policies can significantly influence a company’s direction. Businesses that fail to resonate with their customer base risk losing brand loyalty, which can have far-reaching implications for their financial performance. Therefore, understanding consumer sentiment and responding to it effectively is crucial for any business navigating these waters.

Conclusion

The impact of major stakeholders such as BlackRock and Vanguard on companies like Cracker Barrel showcases the intricate relationship between finance, corporate governance, and cultural identity. As the landscape of business continues to evolve, the challenge for corporations will be to find a harmonious balance between embracing modern values and honoring the traditions that define their brand. The ongoing discussions surrounding DEI and ESG initiatives will undoubtedly shape the future of corporate America, making it essential for companies to listen to their consumers while adapting to the pressures of influential shareholders.

This dialogue is crucial as we move forward in an era where corporate responsibility is not just an option but a necessity. Brands that successfully navigate these complexities will be better positioned to thrive in an increasingly competitive market, ensuring that they remain relevant and respected in the eyes of their customers. As we continue to observe the developments in this space, it will be interesting to see how Cracker Barrel and similar companies respond to the challenges and opportunities presented by their stakeholders and the broader societal context.

BlackRock & Vanguard: Cracker Barrel’s Hidden Agenda Unveiled!

” />

Oh look – 2 of the 3 largest stockholders in Cracker Barrel are BlackRock and Vanguard

The DEI & ESG kings of Wall Street

Now do you see why their girl boss puppets did what they did?

This is an intentional erasure of American heritage pic.twitter.com/QKbq34Ze9a

— DC_Draino (@DC_Draino) August 22, 2025

Oh look – 2 of the 3 largest stockholders in Cracker Barrel are BlackRock and Vanguard

Have you ever stopped to think about who really controls the businesses we love? Well, it turns out that two of the three largest stockholders in Cracker Barrel are none other than BlackRock and Vanguard. These financial giants are well-known in the investment world, and their influence stretches far beyond just a few companies. When we talk about brands that invoke a sense of American heritage, Cracker Barrel is definitely one of them. It’s a place where families gather for hearty meals, and where nostalgia flows as freely as their sweet tea. But what happens when the guardians of our beloved establishments are tied to larger trends in the corporate world?

The implications of having BlackRock and Vanguard as major stakeholders in Cracker Barrel raise questions that many of us are now asking. Are these investment firms simply looking for profit, or are they pushing a broader agenda? You might be surprised to learn that their involvement ties back to the growing focus on DEI (Diversity, Equity, and Inclusion) and ESG (Environmental, Social, and Governance) initiatives.

The DEI & ESG kings of Wall Street

When we mention BlackRock and Vanguard, it’s hard to ignore their reputation as the kings of DEI and ESG. These firms have made headlines for advocating for socially responsible investing, which sounds great on the surface. However, many critics argue that this push for inclusivity and sustainability can sometimes come at the expense of traditional values.

The question arises: what does this mean for Cracker Barrel and its identity? The company has long been viewed as a bastion of American culture, serving up Southern comfort food and values. Yet, with BlackRock and Vanguard pulling the strings, we might see a shift in how the brand represents itself. This isn’t just about food; it’s about the very essence of what Cracker Barrel stands for in the fabric of American society.

Now do you see why their girl boss puppets did what they did?

The tweet that sparked this discussion raises eyebrows with its choice of words. It suggests that the people in charge—often referred to as “girl boss puppets”—are merely following orders from their powerful stockholders. What does this imply for the future of Cracker Barrel? Are decisions made in the boardroom reflective of genuine corporate values, or are they simply responding to pressures from above?

Many have pointed out that companies are increasingly adopting policies that align with ESG and DEI standards, sometimes to the detriment of their core audiences. For instance, when changes are made to menus, branding, or corporate policies, it can feel like a disconnect from what loyal customers have come to cherish. This situation invites a larger conversation about the balance between progress and tradition.

This is an intentional erasure of American heritage

When you think about it, the idea of “intentional erasure of American heritage” is a powerful statement. It’s not just a buzzword—it’s a fear that many feel as they see beloved brands shift their focus. Is Cracker Barrel still committed to the values and traditions that made it a household name? Or are we witnessing the beginning of a transformation driven by external influences?

The term “erasure” suggests that something vital is being stripped away, and it’s crucial to consider what that means for future generations. If we allow our cherished institutions to become merely vessels for corporate agendas, what happens to the stories and traditions that have shaped our culture? Many folks are passionate about preserving these legacies, and they are likely to voice their concerns when they feel that something integral is at stake.

The Bigger Picture

This conversation isn’t just about Cracker Barrel; it’s a window into a larger trend affecting many industries. As BlackRock, Vanguard, and similar firms continue to wield their influence, we must ask ourselves how these dynamics will shape our culture moving forward. The rise of DEI and ESG initiatives has its merits, but it’s essential to consider the implications for businesses that have long represented the heart of America.

As consumers, we have a voice. Whether it’s through social media platforms or local community discussions, sharing our thoughts can lead to meaningful change. It’s worth staying informed and engaged with the companies that serve us. After all, the choices they make can have lasting impacts on our collective heritage. By expressing our opinions, we can encourage brands like Cracker Barrel to honor their roots while still embracing necessary progress.

In conclusion, the involvement of significant shareholders like BlackRock and Vanguard in Cracker Barrel brings a complex set of issues to the forefront. As we navigate this evolving landscape, let’s keep the conversation alive and advocate for the preservation of the values that matter to us. After all, our collective heritage is worth fighting for.

BlackRock investment strategy, Vanguard asset management, Cracker Barrel stock analysis, DEI initiatives in corporate America, ESG investing trends 2025, Wall Street investment powerhouses, corporate governance and heritage, American culture in business, shareholder influence on companies, Cracker Barrel ownership structure, financial giants in retail, ethical investing practices, diversity in corporate leadership, Wall Street’s impact on tradition, Vanguard and BlackRock influence, corporate responsibility in 2025, heritage preservation in business, stockholder activism in America, investment firms and social change, corporate America and cultural identity