Federal Reserve interest rates, economic forecasts September, monetary policy predictions

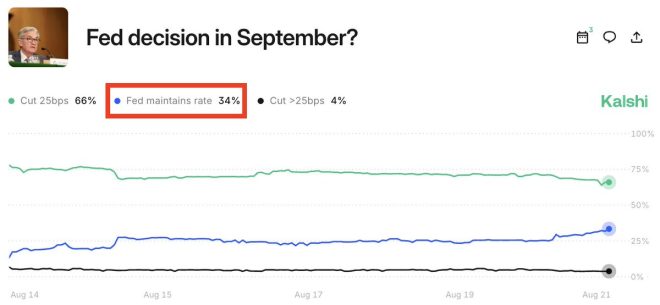

BREAKING: The odds of the Fed NOT cutting rates in September 2025 rise to 34%, the highest since August 1st, per Kalshi. pic.twitter.com/LF4bGtCoQD

— The Kobeissi Letter (@KobeissiLetter) August 21, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: The odds of the Fed NOT cutting rates in September 2025 rise to 34%

Recent developments in the financial landscape have stirred considerable interest among economists and investors alike. According to a tweet from The Kobeissi Letter, the odds of the Federal Reserve not cutting interest rates in September 2025 have surged to a notable 34%. This figure marks the highest probability since August 1st, indicating a potential shift in monetary policy expectations.

As we navigate the complexities of economic indicators, understanding the implications of this data is crucial. A 34% chance of maintaining rates suggests that the Fed might be more cautious about further rate cuts in the near future. This could be a response to various factors, such as inflation trends, employment rates, and overall economic growth. Keeping rates steady could signal confidence in the economy’s resilience, while any adjustments would depend on forthcoming economic data.

Insights from Kalshi

Kalshi, a platform that tracks event contracts, provides valuable insights into market expectations. The rising odds reflect traders’ sentiments and their predictions about future Fed actions. For those invested in the financial markets, this information is invaluable for making informed decisions.

With economic uncertainty always looming, it’s essential to stay updated on developments like these. Changes in Fed policy can significantly impact everything from mortgage rates to stock market performance. As we look ahead, monitoring these trends will be crucial for anyone involved in investing or financial planning.

For more detailed analysis, you can check the original report from The Kobeissi Letter here. Staying informed will help you navigate the ever-evolving financial landscape effectively.