Trump stock purchases, July equity investments, financial market strategies

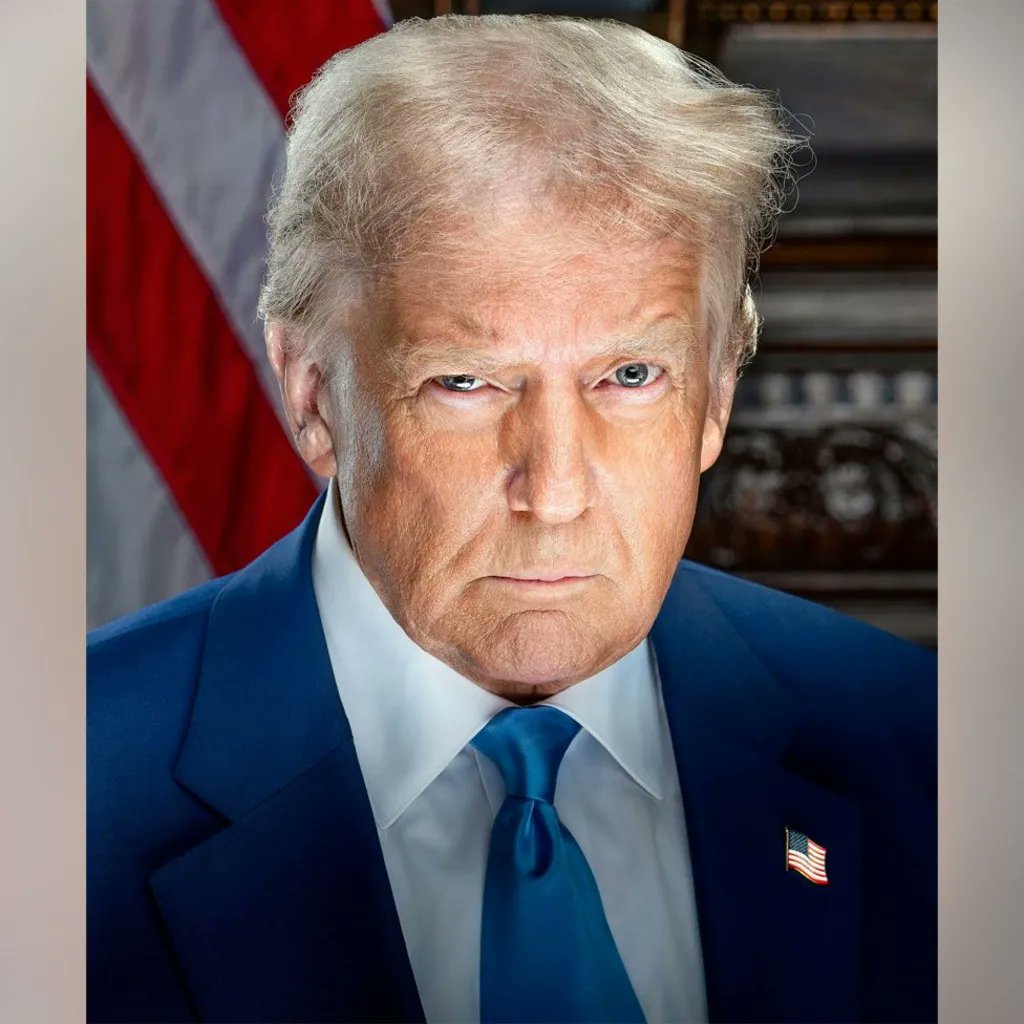

BREAKING: President Donald trump has just released millions of purchases in July in equities and other assets. pic.twitter.com/broHT55D8n

— unusual_whales (@unusual_whales) August 19, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: President Donald Trump has just released millions of purchases in July in equities and other assets.

In an unexpected move, President Donald Trump has disclosed a significant investment in equities and various assets, amounting to millions of dollars. This announcement has generated considerable buzz in financial circles, as many analysts speculate on the implications for the market. Trump’s strategic purchases may indicate a bullish outlook on certain sectors, potentially influencing investor sentiment.

Investors are keen to understand which specific equities and assets Trump has targeted. Given his history of making bold financial moves, this could be an opportunity for savvy investors to reassess their portfolios. Trump’s investment strategy often reflects broader economic trends, and this could be a sign of confidence in recovery or growth in specific industries.

The timing of these purchases is particularly noteworthy. Released in July, they come at a time when many investors are navigating a volatile market landscape. With economic indicators fluctuating, Trump’s choices might offer insights into which areas he believes are primed for growth.

Moreover, the transparency in Trump’s investments could set a precedent for political figures, encouraging them to disclose their financial activities to foster trust with the public and investors alike. If other leaders follow suit, we could see a shift towards greater accountability in financial dealings among those in power.

For those interested in the details of Trump’s investment decisions, you can find more information in the original tweet by unusual_whales. Keeping an eye on these developments will be crucial for investors looking to capitalize on potential market shifts that may arise from such high-profile investments.