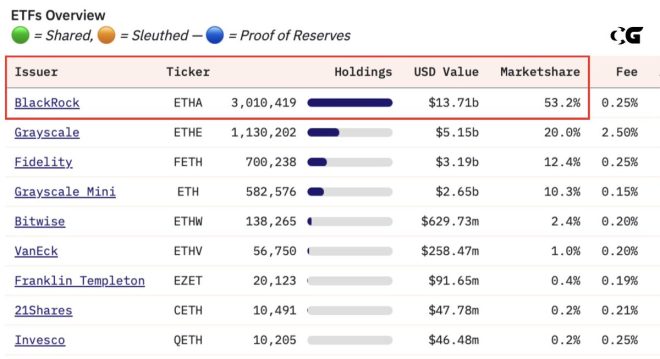

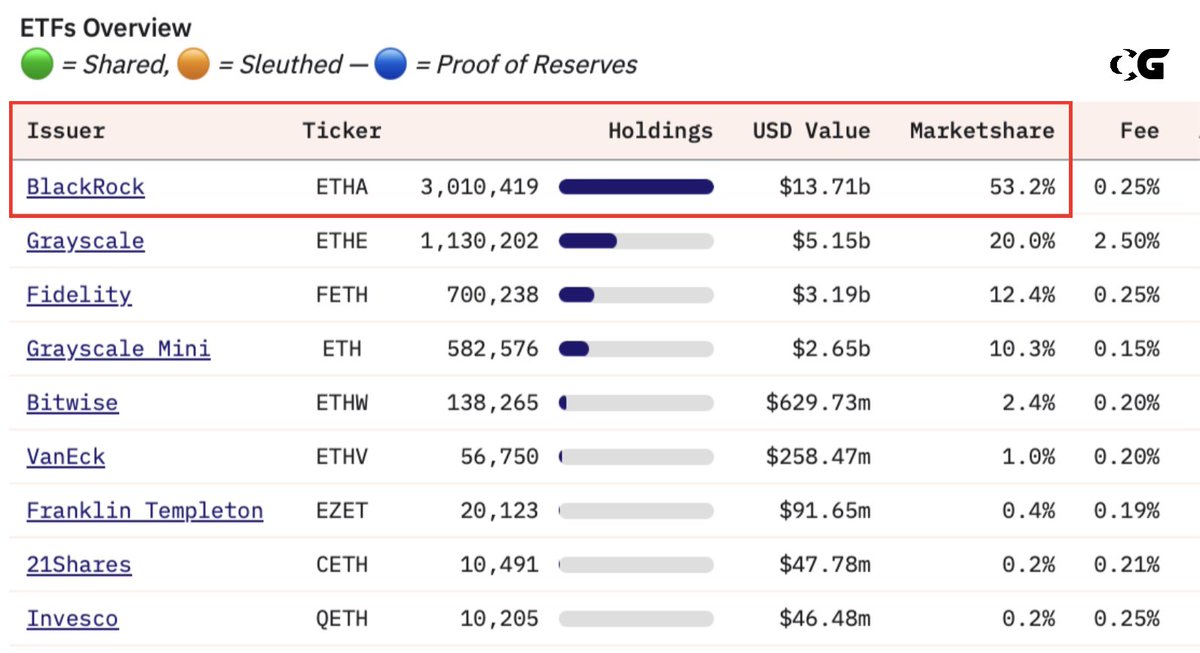

BlackRock Ethereum ETF, cryptocurrency market trends, investment strategies 2025

BREAKING:

BlackRock’s $ETH ETF market share climbs to 53.2%.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Total domination. pic.twitter.com/dlXwxQbAKL

— CryptoGoos (@crypto_goos) August 18, 2025

BlackRock’s $ETH ETF Market Share Climbs to 53.2%

In an exciting development for the cryptocurrency world, BlackRock’s $ETH ETF market share has surged to an impressive 53.2%. This significant increase positions BlackRock as a dominant player in the Ethereum exchange-traded fund (ETF) market. The news, shared by CryptoGoos on Twitter, highlights the growing interest and investment in Ethereum, one of the most popular cryptocurrencies today.

Total Domination in the ETF Market

This leap to over half of the market share signals a strong trend towards institutional adoption of cryptocurrencies, particularly Ethereum. As large firms like BlackRock invest heavily in this digital asset, it reflects the increasing acceptance of cryptocurrencies within traditional financial markets. Such moves can lead to greater liquidity and stability in the crypto space, making it more attractive for both retail and institutional investors.

What This Means for Investors

For investors, BlackRock’s dominance in the Ethereum ETF market could mean more opportunities. With greater institutional backing, the perception of Ethereum as a viable investment is likely to grow. This could drive up demand and potentially increase prices, benefiting those who invest early. Additionally, with more ETFs available, investors can gain exposure to Ethereum without directly holding the asset, which can be appealing for those wary of the complexities of cryptocurrency wallets and exchanges.

Stay Informed

As the cryptocurrency market continues to evolve, staying updated on developments like this is crucial. Following sources such as CryptoGoos on Twitter can provide timely information on market trends and investment opportunities. Keep an eye on how BlackRock’s actions influence the broader crypto landscape, as this could be just the beginning of a significant shift in how digital assets are viewed and traded.