BJP GST announcement, new tax rates for essentials, luxury goods taxation

BREAKING news BJP announces New GST slabs

Essentials : 5%

Electronics & Appliances : 18%

Luxury & Sin Goods : 40%

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

GST rates on education, bicycles and groceries will be reduced from 12% to just 5%

40% GST for Cigarettes and Beer

Ultimate beneficiary of the next… pic.twitter.com/QQynGnhk17

— Times Algebra (@TimesAlgebraIND) August 16, 2025

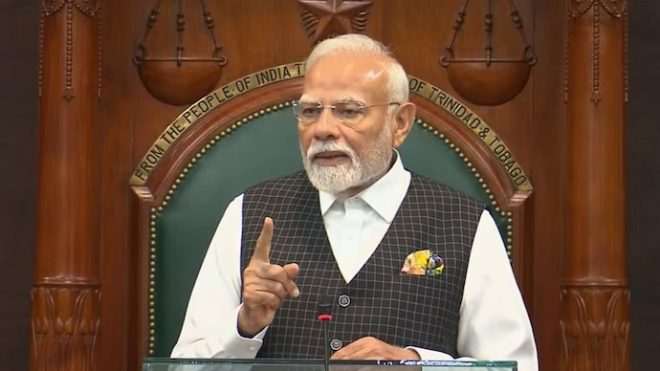

BREAKING NEWS BJP Announces New GST Slabs

In a significant update, the Bharatiya Janata Party (BJP) has announced new Goods and Services Tax (GST) slabs that are set to impact consumers across India. The changes aim to simplify the tax structure while making essential goods more affordable.

Essentials: 5%

One of the most notable changes is the GST rate for essentials, which has been reduced to just 5%. This move is expected to provide relief to households, making everyday items more accessible. By lowering the tax on essentials, the government hopes to alleviate the financial burden on families.

Electronics & Appliances: 18%

For those looking to upgrade their gadgets, the GST on electronics and appliances will remain at 18%. This rate ensures that while consumers can still enjoy the latest technology, they also contribute to the government’s revenue, which can be utilized for public services.

Luxury & Sin Goods: 40%

In a bold move, luxury and sin goods will face a steep GST rate of 40%. This includes items like high-end fashion, alcoholic beverages, and tobacco products. The government aims to discourage excessive consumption of these items, while also generating significant revenue from the luxury market.

GST Rates on Education, Bicycles, and Groceries Reduced from 12% to Just 5%

A significant reduction has been made in GST rates on education, bicycles, and groceries, dropping from 12% to just 5%. This change is likely to benefit students and families, making education and transportation more affordable.

40% GST for Cigarettes and Beer

Lastly, a hefty 40% GST has been imposed on cigarettes and beer, aligning with the government’s health initiatives to reduce consumption of harmful products. It’s a clear signal that the government is prioritizing public health while also increasing tax revenues.

For more details on these changes, check out the original announcement by Times Algebra here.