Ethereum investment trends, cryptocurrency market analysis, institutional buying strategies

BREAKING:

BLACKROCK JUST BOUGHT $338.1 MILLION WORTH OF ETHEREUM.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

WHALES ARE BUYING THE DIP pic.twitter.com/GHSyq84pqg

— Ash Crypto (@Ashcryptoreal) August 16, 2025

BREAKING: BLACKROCK JUST BOUGHT $338.1 MILLION WORTH OF ETHEREUM

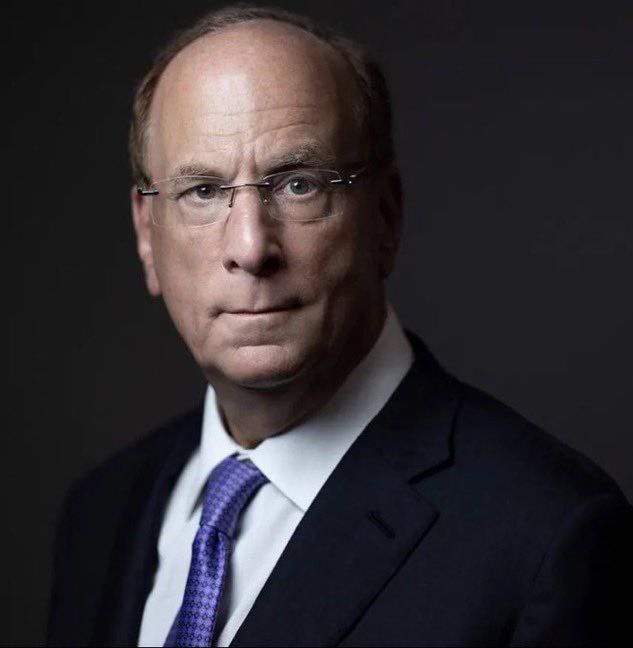

In a significant move for the cryptocurrency market, BlackRock has just acquired a staggering $338.1 million worth of Ethereum. This development has sent ripples through the crypto community, showcasing the increasing interest from institutional investors in digital assets. As one of the largest asset managers in the world, BlackRock’s decision to invest heavily in Ethereum signals a growing acceptance of cryptocurrency in mainstream finance.

WHALES ARE BUYING THE DIP

The timing of this purchase is particularly noteworthy, as it comes during a period when many investors are looking to “buy the dip.” This strategy involves purchasing assets when their prices are low, anticipating a rebound. With BlackRock entering the Ethereum market, it appears that these “whales,” or large investors, are confident in the future of this cryptocurrency. Their actions could influence market trends and encourage retail investors to follow suit.

The enthusiasm surrounding Ethereum is fueled by its robust technology and potential use cases, ranging from smart contracts to decentralized finance (DeFi). As more institutional players like BlackRock engage with Ethereum, the narrative around this digital asset becomes stronger, attracting more attention from both individual and professional investors alike.

In light of this news, those interested in cryptocurrency should keep an eye on BlackRock’s movements and the broader implications for the market. If you’re considering investing in Ethereum or other cryptocurrencies, now might be a pivotal moment to do your research and weigh your options carefully. The landscape is shifting, and opportunities may arise as more players enter the field.

Stay informed and ready to adapt as the cryptocurrency market evolves!