Ethereum investment trends, cryptocurrency market analysis, large-scale digital asset purchases

BREAKING:

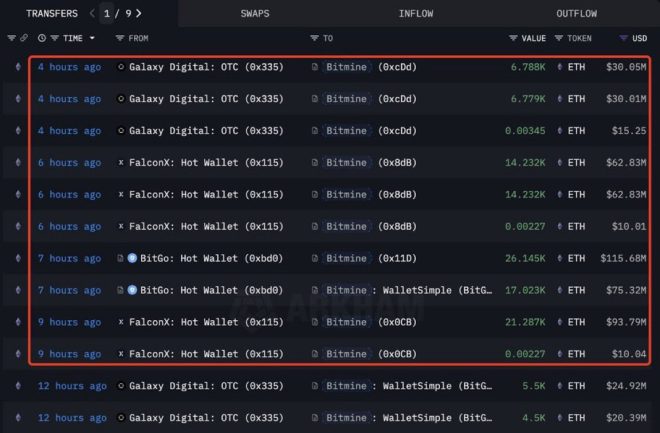

While most are panic-selling $ETH, Bitmine keep buying.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bitmine just bought another 106,485 $ETH ($470.51M).

Bringing its holdings to 1,297,093 $ETH worth 5.75B! pic.twitter.com/uqhQ8NC4JL

— Crypto Rover (@rovercrc) August 16, 2025

BREAKING: Bitmine’s Bold Move Amid $ETH Panic

In the ever-fluctuating world of cryptocurrency, it’s not uncommon to see panic-selling during market downturns. However, while many investors are offloading their assets, Bitmine is taking a different approach. According to recent updates from Crypto Rover, Bitmine has made a significant purchase of 106,485 $ETH, amounting to a staggering $470.51 million. This move has propelled their total holdings to an impressive 1,297,093 $ETH, valued at around $5.75 billion.

Bitmine’s strategy appears to defy the prevailing sentiment in the market. As many traders rush to sell their $ETH, fearing further declines, Bitmine is strategically increasing its position. This reflects a strong belief in the future potential of Ethereum, even as others panic.

The current scenario is a classic example of the adage, “buy low, sell high.” By accumulating more $ETH during a downturn, Bitmine is positioning itself for potential gains when the market rebounds. This confidence in Ethereum could suggest that Bitmine anticipates a recovery in $ETH prices, making this a calculated risk rather than a hasty decision.

Investors watching this situation unfold may want to consider Bitmine’s actions as a potential indicator of where the market could be headed. With its substantial holdings, Bitmine is not just a player in the crypto space; they are making bold moves that could influence market dynamics.

If you’re keen to stay updated on similar developments, following trusted sources like Crypto Rover on Twitter can provide valuable insights. Investing in cryptocurrency requires careful analysis, and observing how companies like Bitmine navigate these fluctuations may offer lessons for individual investors.