Adam Schiff mortgage fraud, low interest home loans, real estate investigation news

Adam Schiff paying just 3% mortgage on homes at center of mortgage fraud probe https://t.co/pFNpv46dTl pic.twitter.com/Bo9MCBl68r

— New York Post (@nypost) August 16, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

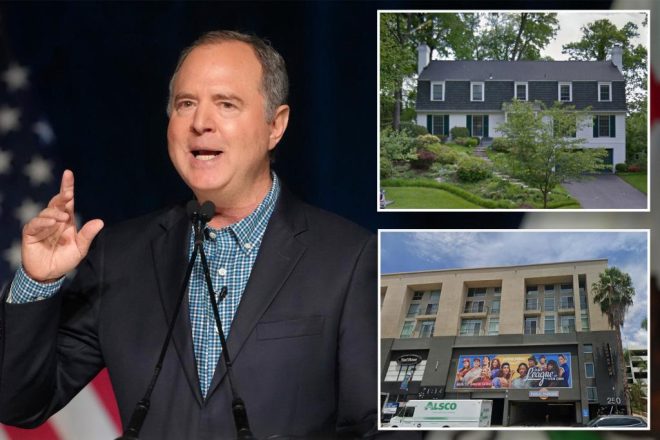

Adam Schiff Paying Just 3% Mortgage on Homes at Center of Mortgage Fraud Probe

In a recent revelation, Adam Schiff is making headlines for paying just a 3% mortgage on properties that are currently under scrutiny in a mortgage fraud investigation. This news, highlighted by the New York Post, raises eyebrows and questions regarding the implications of such low mortgage rates, especially in the context of a fraud probe.

The properties in question are not just any homes; they are linked to significant financial dealings that are now being examined closely. The 3% mortgage rate is notably lower than the current market rates, leading to speculation about how Schiff secured such favorable terms. It’s essential to understand the broader context of mortgage fraud, which often involves misrepresentation or deceit to secure loans under false pretenses.

Schiff’s situation highlights the complexities of real estate transactions, especially for public figures. As scrutiny increases, many are left wondering how this could affect his political career and public perception. Transparency in financial dealings is crucial for maintaining trust, particularly for someone in a prominent political position.

For those unfamiliar with mortgage fraud, it often entails falsifying information to obtain loans or manipulate property values. As Schiff navigates these allegations, the public awaits further developments.

The implications of this investigation extend beyond Schiff himself, touching on the broader issues of accountability and ethics in politics. With the mortgage probe still unfolding, it remains to be seen how this will impact Schiff’s future and the political landscape.

For more detailed insights, you can read the full article from the New York Post here.