producer price inflation trends, core PPI analysis, wholesale price impacts

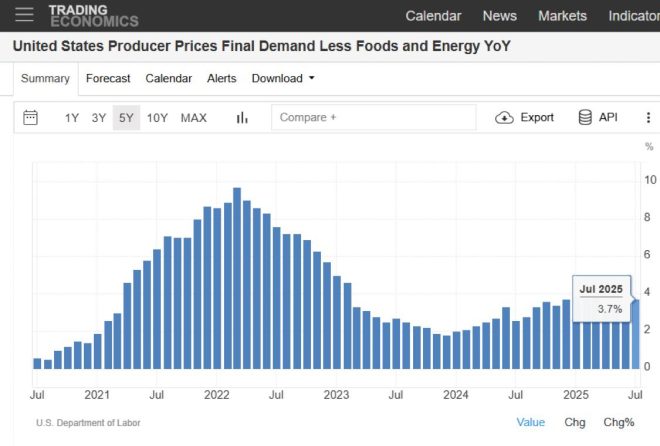

BREAKING: Producer Price Inflation just spiked to 3.7% YoY (vs. 2.9% expected, 2.6% prior) — the hottest monthly jump since March 2022.

Core PPI surged the most since April 2021, with wholesale prices up 0.9% in July alone, driven largely by service-sector costs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Trump once… pic.twitter.com/Rn4LzCmXQL

— Ed Krassenstein (@EdKrassen) August 14, 2025

BREAKING: Producer Price Inflation just spiked to 3.7% YoY (vs. 2.9% expected, 2.6% prior) — the hottest monthly jump since March 2022.

The recent surge in Producer Price Inflation (PPI) is a significant economic indicator that has caught the attention of many. With the PPI jumping to 3.7% year-over-year, it’s clear that inflationary pressures are intensifying. This spike marks the highest monthly increase since March 2022, raising eyebrows among economists and policymakers alike.

Core PPI surged the most since April 2021, with wholesale prices up 0.9% in July alone, driven largely by service-sector costs. This increase reflects the ongoing challenges in supply chains and rising costs associated with services that consumers rely on daily. Service-sector inflation often impacts households more directly than goods inflation, making this trend particularly concerning for consumers.

If you’re curious about what this means for the economy, it’s crucial to consider the broader implications. Rising wholesale prices can lead to increased costs for businesses, which may pass those costs on to consumers. This cycle can create a ripple effect throughout the economy, impacting everything from grocery prices to housing costs.

Understanding the dynamics of Producer Price Inflation can help you stay informed about potential changes in the market. It’s essential to keep an eye on these developments, as they can significantly affect your financial decisions and overall economic health. As the situation evolves, staying informed will empower you to navigate these changes more effectively.

For more insights on inflation and its impact, you can read more from reputable sources like CNBC and Bloomberg.