US Treasury Bitcoin policy, cryptocurrency government holdings, Bitcoin investment strategy

BREAKING:

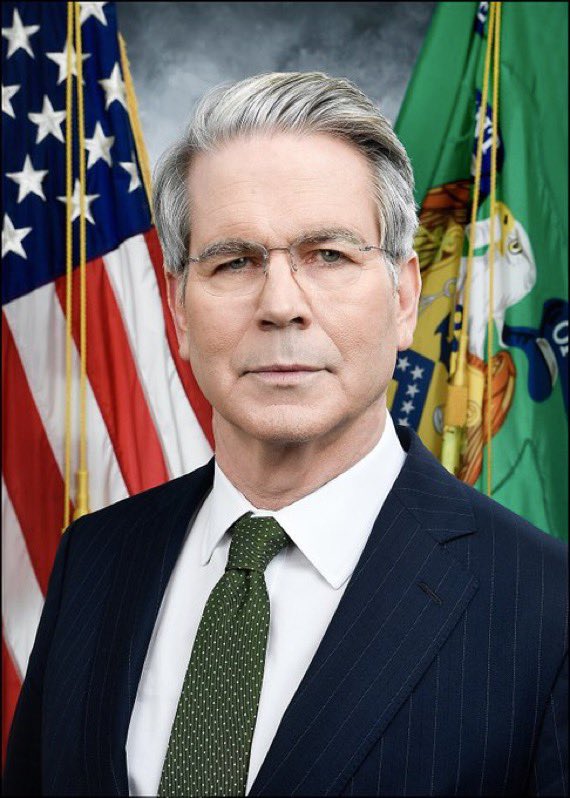

US Treasury Secretary Bessent says the government will stop selling Bitcoin holdings, and their current BTC reserves are worth approximately $15-$20 billion. pic.twitter.com/QiafW5WH6M

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Ash Crypto (@Ashcryptoreal) August 14, 2025

BREAKING: US Treasury Secretary Bessent announces Bitcoin holdings strategy

In a significant development for the cryptocurrency market, US Treasury Secretary Bessent has stated that the government will stop selling its Bitcoin holdings. This announcement has sent ripples through the crypto community, as it indicates a shift in the government’s approach to digital assets. Currently, the US government’s Bitcoin reserves are estimated to be worth approximately $15-$20 billion. This news comes at a time when Bitcoin continues to capture the interest of investors and regulators alike.

The decision to halt Bitcoin sales could have various implications for the market. For one, it may signal increased confidence from the government in the long-term viability of Bitcoin as a legitimate asset. Many investors view this as a positive sign, potentially leading to increased demand and price stability. The halt in sales could also allow the government to retain its holdings for future strategic use, especially as Bitcoin’s role in the global financial landscape continues to evolve.

For those keeping an eye on Bitcoin’s price movements, the government’s stance could be a game-changer. If you want to stay updated on the latest developments in cryptocurrency and how they may affect your investments, follow reputable sources like Ash Crypto for timely news and analysis.

As more institutions begin to recognize Bitcoin’s potential, the landscape of digital currency is likely to change. The US Treasury’s decision to stop selling Bitcoin holdings could pave the way for more institutional investment and a broader acceptance of cryptocurrencies in mainstream finance.

Stay tuned for more updates, as developments in this space are happening rapidly!