Ethereum investment trends, cryptocurrency supply shock, digital asset acquisition strategies

JUST IN:

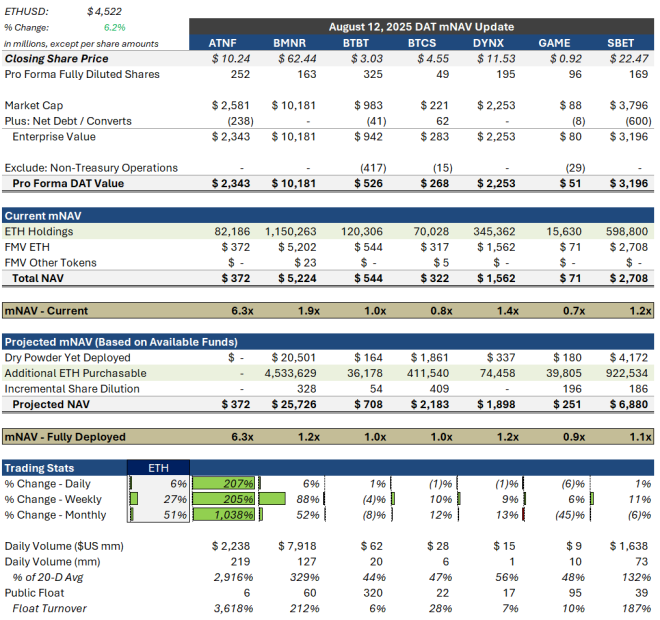

ETH TREASURY COMPANIES ARE GETTING READY TO BUY $27B ETH

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

THIS IS 40% OF ALL ETH ON EXCHANGES

A massive supply shock is coming pic.twitter.com/Q1USchLpg3

— Rekt Fencer (@rektfencer) August 13, 2025

ETH TREASURY COMPANIES ARE GETTING READY TO BUY $27B ETH

In a groundbreaking announcement, ETH treasury companies are reportedly preparing to purchase a staggering $27 billion worth of Ethereum (ETH). This massive investment represents approximately 40% of all ETH currently available on exchanges. As cryptocurrency enthusiasts, this news signals a potential turning point in the market, leading to a significant supply shock.

A SUPPLY SHOCK IS COMING

When we talk about a supply shock, we mean that a sudden decrease in available ETH can lead to increased prices, as demand may outstrip supply. With treasury companies poised to make such a large purchase, the dynamics of the Ethereum market could shift dramatically. Investors are eager to understand how this influx of capital will affect the price and availability of ETH in the near future.

WHAT DOES THIS MEAN FOR INVESTORS?

For investors, this could be a crucial moment. The anticipated buying spree might drive prices higher, making it a potentially lucrative time to invest in Ethereum. However, it also raises questions about market stability and the long-term implications for ETH’s value. Are we on the brink of a bull market, or will this surge lead to a correction?

As the situation unfolds, staying informed will be key. Following reliable sources and market analysis will help you navigate these changes effectively.

In summary, the impending purchase of $27 billion in ETH by treasury companies presents a unique opportunity for investors and highlights the ongoing evolution of the cryptocurrency market. Keep an eye on this development, as it may just be the catalyst for significant shifts in Ethereum’s landscape.

For more updates, check out the original tweet from Rekt Fencer here.