Federal Reserve interest rates, September rate cut predictions, economic impact of lower rates

BREAKING

FED WILL CUT RATES IN SEPTEMBER

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

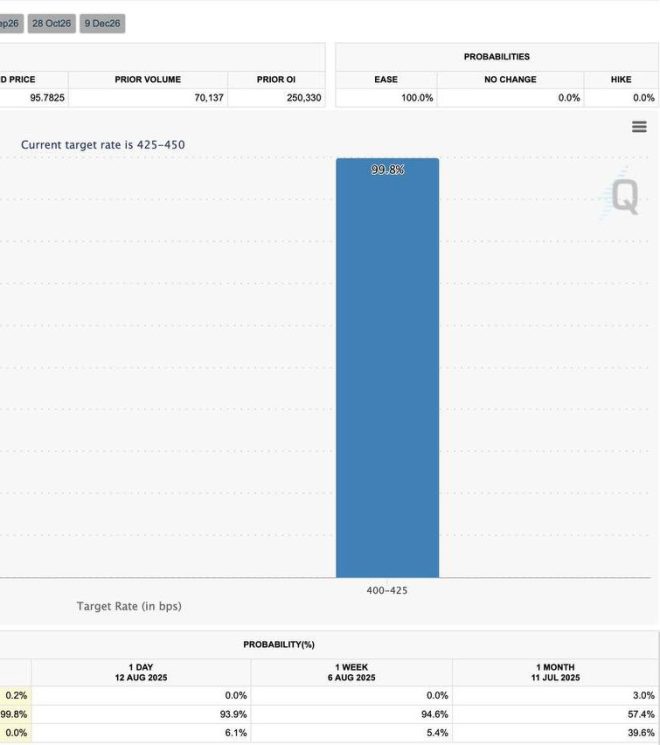

ODDS ARE NOW 99.8% pic.twitter.com/OT1CJ4FET8

— Ash Crypto (@Ashcryptoreal) August 13, 2025

BREAKING

The recent announcement that the FED WILL CUT RATES IN SEPTEMBER has sent ripples through the financial world. With odds now standing at a staggering 99.8%, it’s clear that many are anticipating a significant shift in monetary policy. This decision could potentially reshape the economic landscape, making it an important topic for investors, homeowners, and anyone interested in the financial markets.

The implications of a rate cut can be far-reaching. Lower interest rates typically encourage borrowing, which can stimulate economic growth. For individuals considering buying a home, this could mean lower mortgage rates, making it a more favorable time to invest in property. Businesses might also find it easier to secure loans, leading to expansion and job creation.

Additionally, the FED’s decision to lower rates often influences stock market performance. Investors typically respond positively to rate cuts, as they can lead to higher corporate profits. This could result in a bullish market, attracting more investment and increasing overall market activity.

It’s essential to stay informed about these developments, as they can affect various aspects of your financial life. If you’re interested in understanding how these changes may impact your investments or financial decisions, consider following reliable financial news sources for the latest updates. For instance, you can check out the original tweet from Ash Crypto for real-time insights.

In summary, the FED’s impending rate cut in September could have widespread effects on the economy, impacting everything from mortgage rates to stock market trends. Keeping an eye on these changes will help you navigate the financial landscape more effectively.