Trump lawsuit against Federal Reserve, Powell interest rate controversy, economic impact of Federal Reserve policies

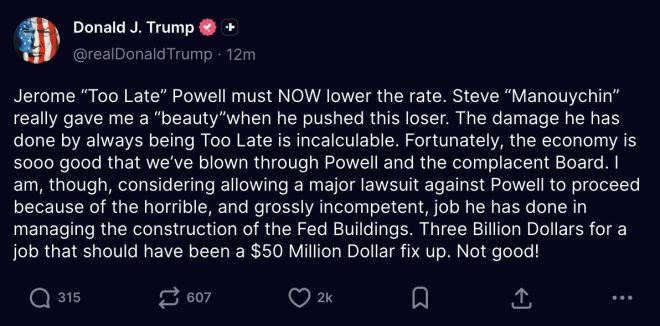

BREAKING: President trump says he is considering allowing “a major lawsuit” against Fed Chair Powell because of the “horrible and grossly incompetent job he has done.”

He also says Powell “must now lower rates” and the “damage he has done is incalculable.” pic.twitter.com/fYhf5rDz0K

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— The Kobeissi Letter (@KobeissiLetter) August 12, 2025

BREAKING: President Trump Considers Lawsuit Against Fed Chair Powell

In a bold statement, President Trump has announced he is contemplating “a major lawsuit” against Federal Reserve Chair Jerome Powell. He expressed serious concerns over what he perceives as “the horrible and grossly incompetent job he has done.” This unexpected move has sparked conversations across financial and political circles, as many wonder about the implications of such a lawsuit on the economy and the Federal Reserve’s operations.

Trump emphasized that Powell “must now lower rates,” pointing to the economic challenges that have arisen during Powell’s tenure. The President’s criticism highlights his frustration with the current monetary policy and its impact on inflation and employment rates. Many analysts are trying to decipher the potential fallout from Trump’s statements, especially regarding market stability.

The “damage he has done is incalculable,” Trump asserted, raising questions about the Fed’s role in economic recovery. As the nation grapples with rising inflation and fluctuating interest rates, the focus is now on how Powell will respond to this criticism and whether any legal actions could take shape.

Investors and economists alike are closely monitoring these developments. A lawsuit could set a precedent for future interactions between the executive branch and the Federal Reserve, potentially altering the landscape of U.S. monetary policy. As more information unfolds, it’s crucial to stay informed about how this situation could impact both domestic and global markets.

For ongoing updates, check out The Kobeissi Letter for more insights on this developing story.