business bankruptcy trends, corporate financial collapse, economic downturn impact

BREAKING: 71 large US companies went bankrupt in July, the highest monthly total since the 2020 pandemic.

This follows 66 and 64 fillings in June and May, respectively.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

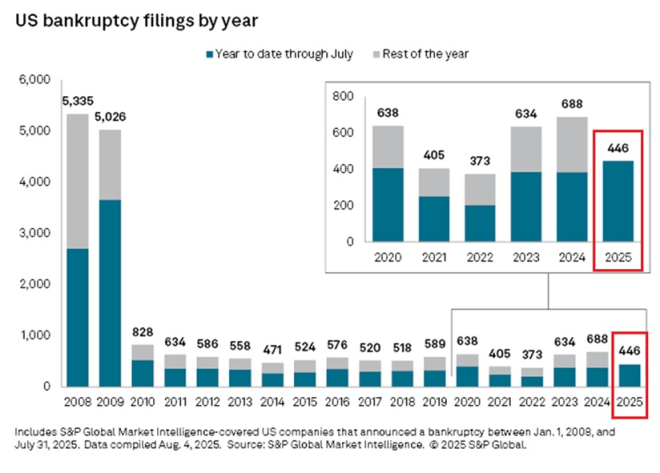

Year-to-date, there have been 446 large bankruptcies, the most in 15 years.

This is already higher than the… pic.twitter.com/8HUB5ORuKS

— The Kobeissi Letter (@KobeissiLetter) August 12, 2025

71 Large US Companies Went Bankrupt in July

Recent reports reveal that 71 large US companies went bankrupt in July, marking the highest monthly total since the 2020 pandemic. This surge in bankruptcies follows 66 and 64 filings in June and May, respectively. The alarming trend raises questions about the state of the economy and the factors contributing to such a significant number of corporate failures.

Year-to-Date Bankruptcy Statistics

As of now, there have been 446 large bankruptcies year-to-date, the most in 15 years. This statistic highlights a worrying pattern in the business landscape, where economic conditions may be forcing once-thriving companies to close their doors. The growing number of bankruptcies suggests that many companies are struggling to adapt to changing market conditions, rising costs, and other economic pressures.

Understanding the Causes

Several factors may be driving this wave of bankruptcies. The aftermath of the pandemic has left many businesses reeling, particularly in sectors like retail and hospitality. Additionally, inflation rates and supply chain disruptions continue to pose significant challenges. Companies that thrived pre-pandemic may find it increasingly difficult to sustain operations in this new economic reality.

What This Means for the Future

The implications of these bankruptcies extend beyond just the companies involved. Increased unemployment, loss of investor confidence, and a potential downturn in consumer spending could follow. It’s crucial for stakeholders, including policymakers, to monitor these trends and implement strategies to support struggling businesses.

For more insights and updates on this pressing economic issue, follow the latest reports from trusted sources like The Kobeissi Letter.