Tax reform proposals, IRS fraud prevention strategies, government workforce reduction

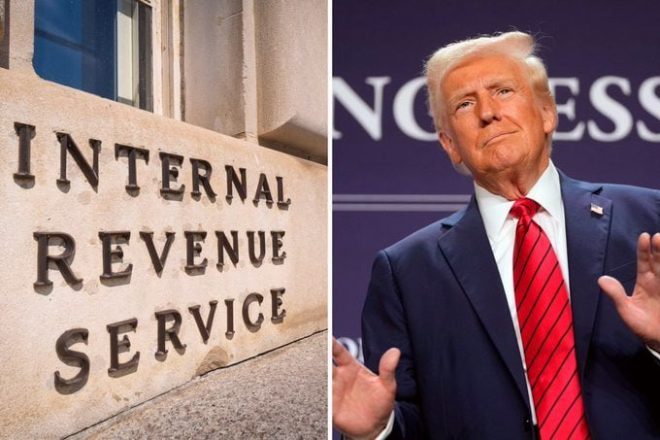

BREAKING: President trump plan to FREEZE the IRS for 90 days to find fraud in addition to FIRING 45,000 IRS Agents.

In an unprecedented move, former President Donald Trump has announced a plan to temporarily freeze the IRS for 90 days. The goal? To uncover potential fraud within the agency. This bold initiative includes the controversial decision to fire 45,000 IRS agents, a step that has sparked widespread discussion among taxpayers and political analysts alike.

The decision to freeze the IRS is aimed at addressing long-standing concerns about inefficiencies and the potential for fraudulent activities within the agency. Many supporters believe that by suspending operations, a thorough investigation can be conducted to root out any corrupt practices. This plan resonates with those who feel overwhelmed by the current tax system and believe comprehensive reforms are necessary.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

If you support this plan, you’re not alone. Many Americans are expressing their approval online. The proposal has garnered considerable attention, with people eager to engage in discussions about the future of tax reform and IRS accountability. The potential firing of 45,000 IRS agents raises questions about the agency’s capacity to operate effectively in the future and what that means for taxpayer services.

Critics, however, warn that such drastic measures could lead to delays in tax processing and reduced oversight, potentially harming honest taxpayers. The implications of this plan are vast, affecting millions of Americans who rely on the IRS for efficient tax services.

Engage in the conversation! Share your thoughts on this bold initiative and its impact on the IRS and tax reform. Your voice matters in shaping the future of our tax system.