import tariffs impact, US consumer costs, trade policy effects

Understanding Tariffs: Who Really Pays?

Tariffs are taxes imposed on imported goods, and it’s crucial to understand who bears the burden. Contrary to popular belief, these taxes are not paid by foreign governments. Instead, they are shouldered by American importers, which means the cost ultimately trickles down to U.S. businesses and consumers. When tariffs are increased, it’s like robbing your own citizens while mislabeling the revenue as foreign income.

The Impact on U.S. Consumers and Businesses

When tariffs rise, the immediate effect is felt by American importers who have to pay more for goods coming from countries like China and India. This increased cost often gets passed on to consumers in the form of higher prices. So, if you’ve noticed a spike in the price of imported goods, tariffs could be a significant factor. Economically, this can lead to decreased consumer spending and a slowdown in overall economic activity.

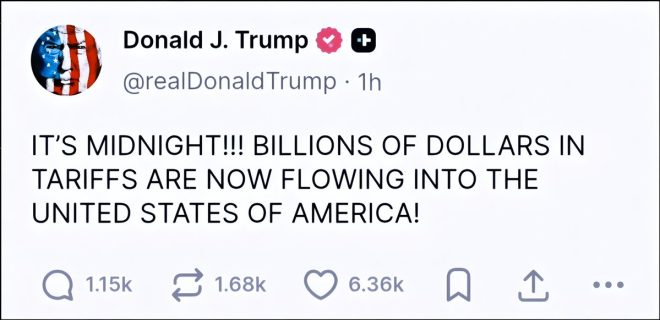

Misconceptions About Tariff Revenue

Some may argue that tariffs provide a financial boost to the U.S. economy. However, the reality is that the money “flowing in” from tariffs is essentially sourced from American wallets. Rather than benefiting from foreign income, it’s more accurate to say that tariffs act as a tax on American consumers and businesses. This could lead to greater economic disparities and a heightened financial burden on everyday Americans.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Bottom Line on Tariffs

Understanding who truly pays tariffs is essential for making informed decisions about economic policies. As we navigate discussions around trade and tariffs, it’s vital to keep in mind that these taxes ultimately affect U.S. households. For more insights into the implications of tariffs, consider exploring resources like The Balance and Investopedia.