Federal Reserve rate cut, September interest rate prediction, economic impact of rate changes

BREAKING

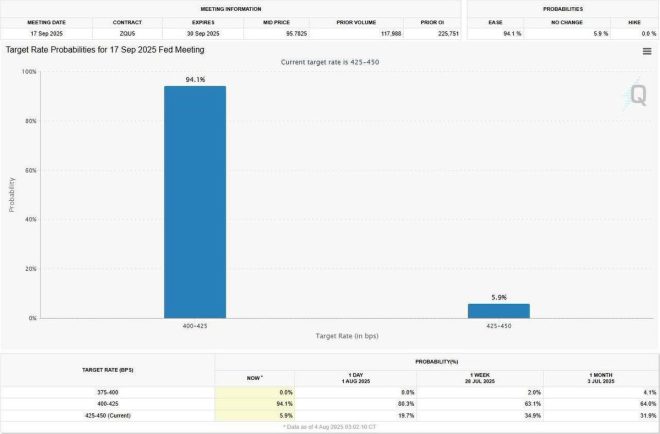

The recent announcement from the Federal Reserve (FED) has sent ripples through the financial community. The FED will cut rates in September, and the odds of this happening are now an astonishing 94.1%. This news comes as a surprise to many, but it also opens up a discussion on what this means for the economy and everyday individuals.

The decision to cut rates is often seen as a move to stimulate economic growth. When interest rates are lower, borrowing becomes cheaper. This can encourage consumers to take out loans for big purchases, like homes or cars, and businesses are more likely to invest in expansion. With the FED signaling a rate cut, it’s essential to understand how this could impact various sectors, including housing, consumer spending, and investment strategies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

When the FED cuts rates, you might notice a decrease in mortgage rates, which can be great news for those looking to buy a home. Lower rates can make homeownership more accessible, especially for first-time buyers. If you’ve been considering purchasing property, now might be the right time to explore your options.

Furthermore, consumer spending can see a boost as individuals feel more confident in their financial situation. Lower interest rates mean lower monthly payments on existing debt, freeing up disposable income for other expenses. This could lead to increased spending in sectors like retail and services, driving economic growth.

Investors will also be closely monitoring this situation. A rate cut typically leads to increased stock market activity as investors look for higher returns in a low-interest-rate environment. If you’re invested in stocks or considering entering the market, this could be a pivotal moment. It’s essential to stay informed and adjust your investment strategies accordingly.

However, it’s crucial to approach this news with a balanced perspective. While a rate cut can provide immediate benefits, it can also have long-term implications. For instance, sustained low rates may lead to inflationary pressures if the economy overheats. It’s vital to keep an eye on economic indicators and adjust your financial plans as needed.

As we move closer to September, the anticipation surrounding the FED’s decision will likely continue to grow. Analysts and financial experts will be weighing in on the potential impacts on various sectors and advising clients on the best course of action.

Make sure to stay updated on this developing story by following trusted financial news sources. Social media platforms, like Twitter, are also a great way to get real-time updates from financial analysts and market experts.

In summary, the FED’s announcement to cut rates in September with a staggering 94.1% probability is a significant development that could have wide-reaching effects on the economy. Whether you’re a homeowner, a prospective buyer, or an investor, understanding the implications of this decision is key to making informed financial choices. Keep an eye on the evolving situation, and don’t hesitate to seek advice tailored to your individual circumstances.