Ethereum investment trends, cryptocurrency whale activity, OTC trading strategies

WHALES KEEP BUYING ETHEREUM!

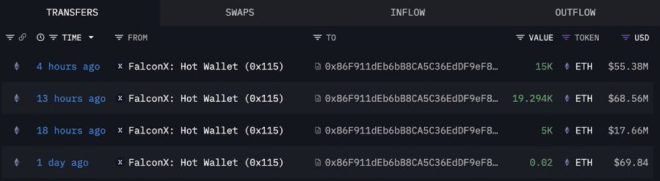

The cryptocurrency market is buzzing with excitement as Ethereum whales are making significant moves. In a recent update, it was reported that three wallets purchased a staggering 63,837 ETH, amounting to about $236 million. This transaction was facilitated through Galaxy Digital’s Over-the-Counter (OTC) service, highlighting growing confidence in Ethereum’s potential.

Understanding Whale Activity

In the crypto world, "whales" refer to individuals or entities that hold large amounts of cryptocurrency. Their buying and selling behaviors can significantly influence market trends. When whales buy large quantities of ETH, it often signals a bullish sentiment, which can attract other investors looking to capitalize on potential price increases.

The Implications of Large Purchases

The recent purchase of 63,837 ETH indicates a strong belief in Ethereum’s future. This kind of investment can lead to increased demand, potentially driving the price higher. Such whale activity often serves as a bellwether for the market, prompting smaller investors to take action. If you’re considering entering the Ethereum market, it’s essential to monitor these whale movements to gauge market sentiment effectively.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why Ethereum?

Ethereum has carved out a significant niche in the blockchain space, primarily due to its smart contract functionality. Unlike Bitcoin, which is primarily a digital currency, Ethereum allows developers to create decentralized applications (dApps) on its platform. This versatility has led to a growing ecosystem of projects, particularly in the realms of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Investors are increasingly recognizing the value of Ethereum’s underlying technology, and this latest whale activity reinforces that narrative. As Ethereum continues to evolve and adapt, many believe it could play a pivotal role in the future of finance and digital assets.

What Does This Mean for the Average Investor?

For everyday investors, the actions of whales can be both a warning and an opportunity. Following whale movements can help you make informed decisions about when to buy or sell your own ETH holdings. However, it’s crucial to remember that investing in cryptocurrencies carries risks, and market conditions can change rapidly. Always conduct thorough research and consider your financial situation before diving in.

Keeping an Eye on Market Trends

As the crypto landscape evolves, staying informed about significant transactions and market trends is vital. Social media platforms like Twitter can be excellent resources for real-time updates on whale activity and other market developments. Following reputable accounts, such as Crypto Rover, can provide insights into larger market movements and trends.

In summary, the recent whale activity surrounding Ethereum is a strong indicator of investor confidence in the cryptocurrency. With significant purchases like the recent 63,837 ETH acquisition, it’s clear that whales are betting on Ethereum’s growth. If you’re considering investing in ETH, keep an eye on these trends and remember to do your homework before making any financial decisions.