liquid staking regulation, SEC cryptocurrency news, blockchain investment opportunities

SEC Declares Liquid Staking Activities Not Securities

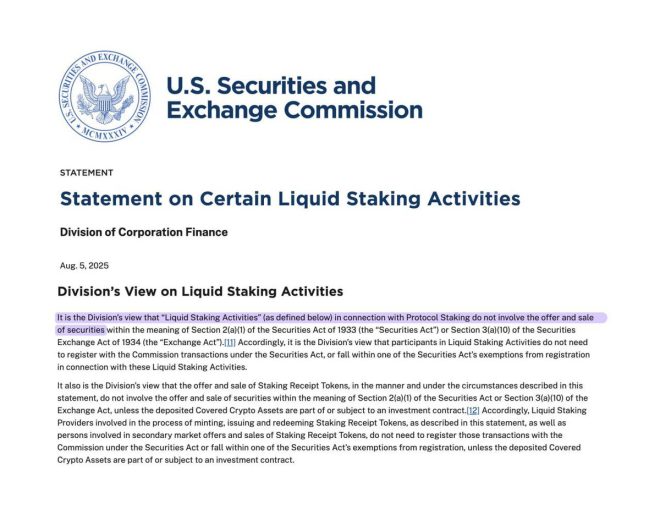

In a significant update for the cryptocurrency community, the U.S. Securities and Exchange Commission (SEC) has officially declared that liquid staking activities are not classified as securities. This news broke on August 5, 2025, through a tweet by Ash Crypto, and it’s creating quite a buzz in the crypto world.

Understanding Liquid Staking

Liquid staking is an innovative solution that allows crypto enthusiasts to stake their tokens while still retaining liquidity. Essentially, it enables users to earn staking rewards without locking up their assets. This flexibility can be a game-changer, especially for those who want to maintain the ability to trade their tokens while still earning passive income.

By clarifying that liquid staking activities are not considered securities, the SEC is paving the way for broader adoption and use of this staking model. For many investors, this means less regulatory uncertainty and more opportunities to engage with their cryptocurrencies in a meaningful way.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

What This Means for Investors

The SEC’s announcement is undoubtedly bullish for the crypto market. With less regulatory scrutiny, investors may feel more confident participating in liquid staking activities. This could lead to an influx of new participants in the market, driving demand for liquid staking solutions. As a result, we can expect to see various platforms and protocols enhancing their liquid staking offerings to attract more users.

Additionally, this decision has implications for the broader DeFi (Decentralized Finance) landscape. By removing the securities classification from liquid staking, the SEC has reduced the barriers for developers and projects looking to innovate in this space. This could lead to new protocols and applications that further enhance the utility and attractiveness of staking.

The Bullish Sentiment in the Crypto Community

The market’s reaction to this news has been overwhelmingly positive. Investors and analysts alike are expressing bullish sentiment regarding the future of liquid staking. As more people enter the market to take advantage of the benefits of staking, we may witness a surge in demand for cryptocurrencies that support these activities.

The bullish sentiment also reflects a growing acceptance of blockchain technology and its applications. As regulatory bodies like the SEC continue to clarify their positions on various aspects of cryptocurrency, it fosters a more stable environment for innovation and investment.

Keeping an Eye on Future Developments

While this declaration is a significant win for the crypto community, it’s essential to stay informed about future developments. Regulatory landscapes can change, and the SEC may issue new guidance or regulations that could affect liquid staking and other aspects of the crypto market.

Investors should remain vigilant and continue to educate themselves about the potential risks and opportunities within the cryptocurrency ecosystem. Following credible sources and updates from the SEC will help keep you informed about any changes that could impact your investment strategy.

In summary, the SEC’s ruling on liquid staking is a pivotal moment for the cryptocurrency industry. With this clarity, the stage is set for a more robust and dynamic market, encouraging innovation and participation. As we move forward, it’s exciting to think about what the future holds for liquid staking and the broader crypto landscape.