rate cut predictions, economic trends September, central bank decisions

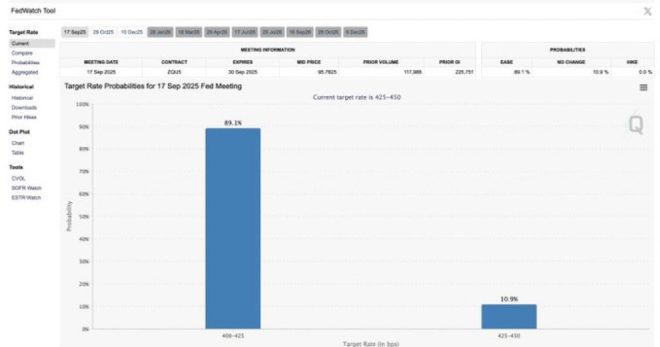

BREAKING: THERE’S NOW 89.1% CHANCE OF A RATE CUT IN SEPTEMBER

The financial landscape is buzzing with excitement following a recent announcement indicating that there’s now an impressive 89.1% chance of a rate cut in September. This significant shift in expectations could have profound implications for various sectors, from real estate to consumer spending, and even the cryptocurrency market.

As the economy continues to navigate through uncertainties, interest rate changes are closely monitored by investors and analysts alike. A potential rate cut often signals a move to stimulate economic growth, making borrowing cheaper for consumers and businesses. This could lead to increased spending, which might positively impact economic recovery.

Understanding the Implications of a Rate Cut

When we talk about a rate cut, we’re referring to the reduction of interest rates set by the central bank. Lower interest rates typically encourage more borrowing and spending. For instance, if you’re considering buying a home or a car, a lower interest rate could mean lower monthly payments, making these purchases more accessible.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Additionally, businesses often take advantage of lower rates to invest in expansion and hiring, fostering job creation. This increased economic activity can help boost overall economic health, which is why many are eagerly watching the developments surrounding this potential rate cut.

How Does This Affect the Cryptocurrency Market?

The cryptocurrency market is particularly sensitive to changes in monetary policy. With the possibility of a rate cut, many investors might see cryptocurrencies as an attractive alternative to traditional assets. The perception of reduced returns on savings accounts and bonds can lead investors to seek higher returns in the volatile world of cryptocurrencies.

Moreover, a rate cut could lead to a depreciation of the dollar, which historically has prompted a surge in cryptocurrency prices as investors look for hedges against inflation. The dynamics between traditional finance and the crypto market will be fascinating to watch as these financial shifts unfold.

What Experts Are Saying

Financial experts and analysts are weighing in on this development. Many believe that a rate cut could provide much-needed relief to struggling sectors and help sustain the economic recovery. According to a recent analysis by reputable financial news outlets, the anticipated cut could also influence stock prices, leading to a bullish market sentiment.

In the wake of this announcement, social media platforms are abuzz with discussions and predictions. Influencers in the finance and crypto sectors are sharing insights and analysis, making it crucial for investors to stay informed. Following credible sources like Crypto Rover can provide timely updates and detailed analysis on how these changes may impact your investments.

Preparing for the Future

As we approach September, it’s essential to stay abreast of any developments regarding the rate cut. Whether you’re a homeowner, a potential car buyer, or an investor in cryptocurrencies, understanding how interest rates affect your financial decisions can help you navigate the changing landscape.

In conclusion, the announcement of an 89.1% chance of a rate cut in September is a pivotal moment for the economy and markets. By keeping informed and considering the implications of this potential change, you can make better financial decisions and potentially capitalize on new opportunities. Stay tuned for more updates, as the situation is likely to evolve rapidly in the coming weeks.