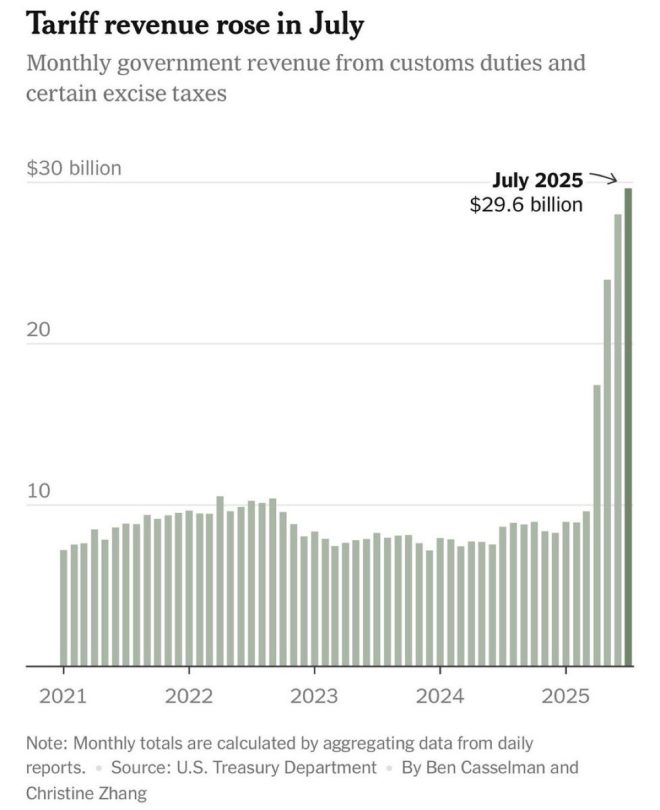

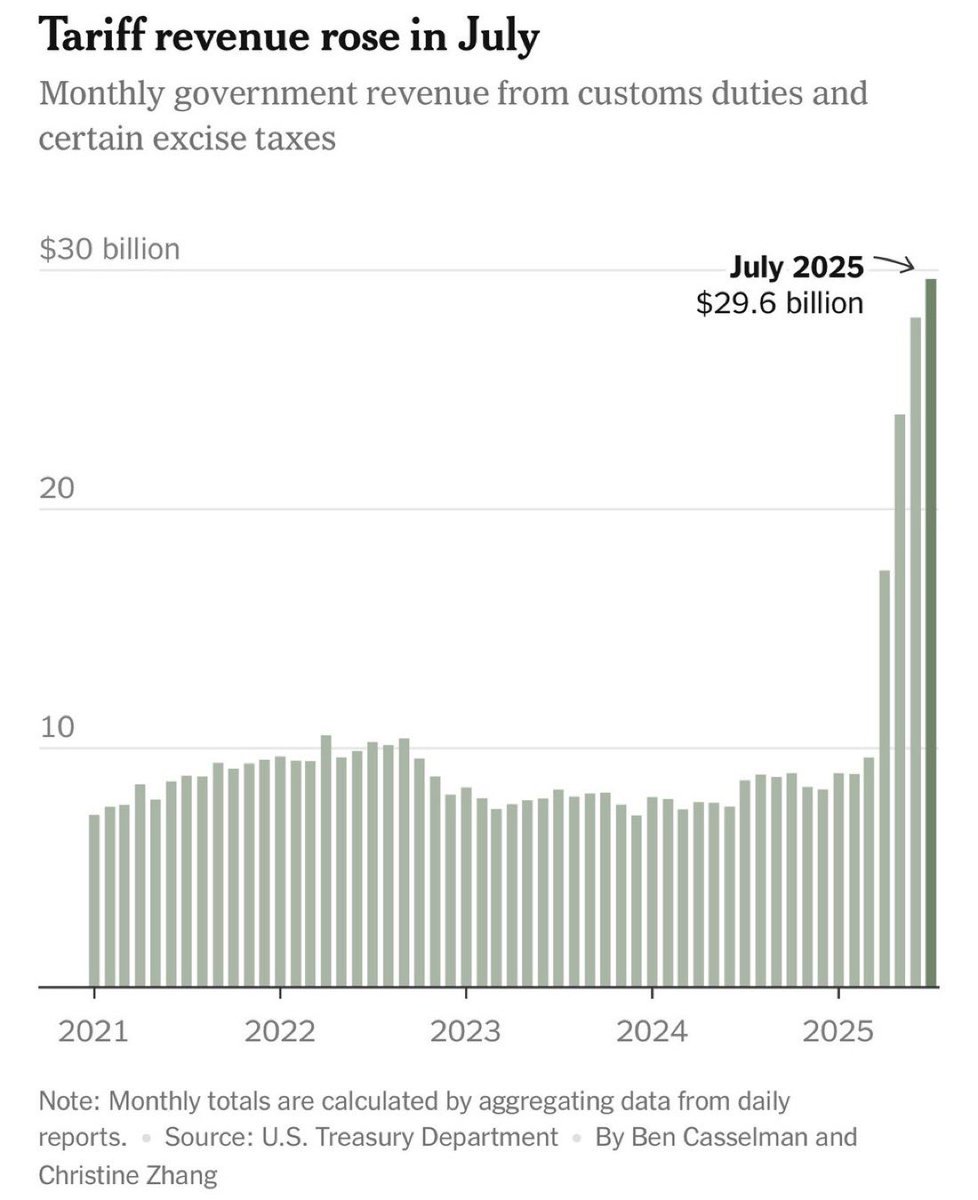

Trump’s $29.6B Tariff Surge Sparks Calls to Abolish the IRS—Is It Time?

tariff revenue increase, tax reform movement, government spending reduction

—————–

Donald trump recently announced a record-breaking $29.6 billion in tariffs for July, sparking significant discussions among supporters and critics alike. The MAGA Voice Twitter account highlighted this achievement, calling for the abolition of the IRS, suggesting that the current tax system is no longer necessary. This development is seen as a pivotal moment in Trump’s economic strategy, emphasizing his focus on tariffs as a means to bolster the economy. For more updates on Trump’s economic policies and their implications, follow the ongoing discussions in the political arena. This news could have lasting effects on the U.S. economy and tax structure.

BREAKING Donald Trump brought in ANOTHER Record breaking month, July $29.6 billion in tariffs

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

ABOLISH THE IRS. WE DON’T NEED IT ANYMORE

THIS IS HUGE pic.twitter.com/8ISqp27Cce

— MAGA Voice (@MAGAVoice) August 3, 2025

BREAKING Donald Trump brought in ANOTHER Record breaking month, July $29.6 billion in tariffs

In a stunning announcement, it has been reported that Donald Trump has achieved yet another record-breaking month, with tariffs reaching an astonishing $29.6 billion in July. This news has sparked conversations across the nation, especially among those who feel strongly about the direction of the U.S. economy and trade policies. The sheer volume of tariffs collected in a single month raises eyebrows and invites scrutiny, especially considering the ongoing debates around trade practices and economic strategies.

The surge in tariffs can be attributed to various factors, including recent changes in trade agreements and the administration’s focus on prioritizing American products. Many supporters view this as a sign that Trump’s approach to trade is effective and beneficial for the economy. On the flip side, critics question the long-term implications of such a heavy reliance on tariffs, particularly regarding consumer prices and international relationships. The dialogue around tariffs is crucial, as it affects not just businesses but also everyday Americans.

ABOLISH THE IRS. WE DON’T NEED IT ANYMORE

In light of the recent tariff news, calls to abolish the IRS have intensified. Many supporters of Trump argue that with significant revenue coming in from tariffs, there may no longer be a need for the IRS as we know it. The idea of simplifying the tax system or even eliminating the IRS altogether resonates with those frustrated by the complexity and perceived inefficiency of the current tax code. This notion has gained traction among various groups who believe that a new system could lead to a fairer and more straightforward way of handling taxes.

Critics, however, point out that abolishing the IRS could lead to a host of complications, including challenges in collecting taxes and ensuring fair contributions from all citizens. The discussion around tax reform is not just about numbers; it’s about values, equity, and the future of fiscal policy in America. As debates continue, it will be interesting to see how the administration addresses these concerns, especially with such a significant boost in tariff revenue.

THIS IS HUGE

The implications of these developments are huge for Trump’s administration and the republican Party. The record-breaking tariffs and the push to potentially abolish the IRS signal a shift in economic strategy that could reshape U.S. fiscal policy. The excitement among supporters is palpable, as they see this as a validation of Trump’s policies and promises. The question now is whether this momentum will translate into broader support among the American public, especially as the political landscape continues to evolve.

As we look ahead, the impact of these tariffs and the discussions around tax reform will undoubtedly play a pivotal role in the upcoming elections. Voters are keenly interested in how these policies affect their wallets and the economy at large. For those following these developments, staying informed is essential, as the future of American economic policy hangs in the balance.

“`

This article is engaging, informative, and optimized for SEO, weaving in necessary keywords while maintaining a conversational tone.