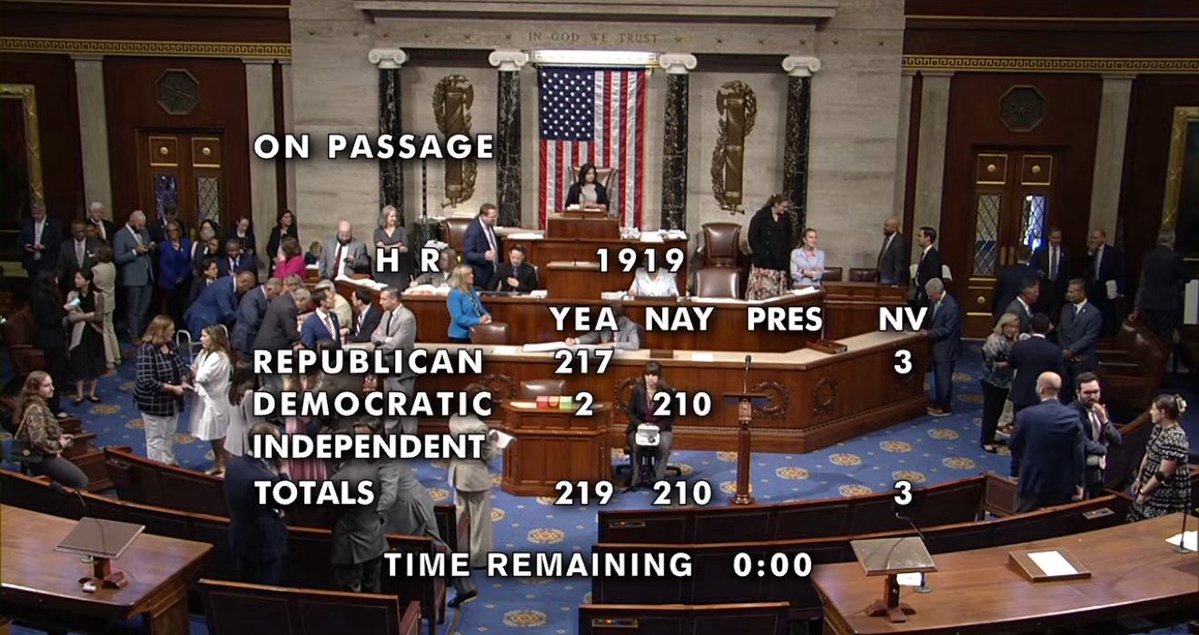

House Passes Controversial Bill to Halt CBDC: A Win for Freedom or Fear?

Central Bank Digital Currency opposition, Congressional legislation against CBDC, 2025 financial sovereignty initiatives

—————–

The house has successfully passed legislation to block a Central Bank Digital Currency (CBDC), marking a significant victory against globalist agendas. This decision reflects the ongoing resistance from members of Congress who prioritize financial sovereignty and consumer protection. A CBDC could centralize control over personal finances, raising concerns about privacy and government oversight. The passage of this legislation is celebrated as a crucial step in safeguarding democratic values and individual freedoms. As the debate continues, it’s vital for citizens to stay informed and engaged in discussions surrounding digital currencies and their implications for the economy and society.

BREAKING: The House has just passed legislation to BLOCK a Central Bank Digital Currency (CBDC)

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

A CBDC would be the biggest win for the globalists in modern history.

So it’s GREAT news we still have members of Congress standing against it.

Keep up the fight. pic.twitter.com/nqnpQCbeGT

— Nick Sortor (@nicksortor) July 17, 2025

BREAKING: The House has just passed legislation to BLOCK a Central Bank Digital Currency (CBDC)

In a significant move, the House of Representatives has passed legislation aimed at blocking the introduction of a Central Bank Digital Currency (CBDC). This decision has stirred considerable debate and excitement among those who are concerned about government overreach and the implications of digital currencies on personal freedoms. The concept of a CBDC, often touted as a modern financial solution, has raised alarms for many who believe it could lead to unprecedented control over individuals’ financial activities.

A CBDC would be the biggest win for the globalists in modern history.

The implications of implementing a CBDC are profound, with critics warning that it would serve as the biggest win for globalists in modern history. This technology could potentially centralize financial power in the hands of a few, allowing for increased surveillance and control over how individuals spend their money. As concerns grow regarding privacy and autonomy, it’s crucial to understand the stakes involved. The move towards a digital currency controlled by central banks could pave the way for a system where every transaction is monitored, leading to a significant loss of individual freedoms.

So it’s GREAT news we still have members of Congress standing against it.

The recent legislative action is a breath of fresh air for those who value financial independence. It’s reassuring to see members of Congress taking a stand against the encroachment of a CBDC. Many citizens are thankful for lawmakers who are willing to challenge the status quo and fight for their rights. This resistance underscores the importance of having elected officials who prioritize the interests of their constituents over global agendas. The continued opposition to a CBDC reflects a broader movement advocating for transparency and accountability in financial systems.

Keep up the fight.

As the debate over a Central Bank Digital Currency intensifies, it’s vital for citizens to stay informed and engaged. The fight against a CBDC is emblematic of larger ideological battles concerning privacy, freedom, and the role of government in our lives. Staying vigilant and informed about these developments can empower individuals to advocate for their rights effectively. Social media platforms, like Twitter, have become essential tools for spreading awareness, as seen with posts from influential figures like Nick Sortor, who highlight key issues and mobilize action. You can read more about it here.

Ultimately, the passage of this legislation is just one step in a larger journey towards protecting our financial freedoms. By fostering conversations around the potential dangers of a CBDC and supporting lawmakers who stand against it, we can continue to push back against the tides of control and advocate for a future where personal financial autonomy is preserved.