Trump’s Shocking Call to Slash Fed Rates Amid Surging 2.7% Inflation Crisis!

inflation trends analysis, Federal Reserve interest rate cuts, consumer price index changes

—————–

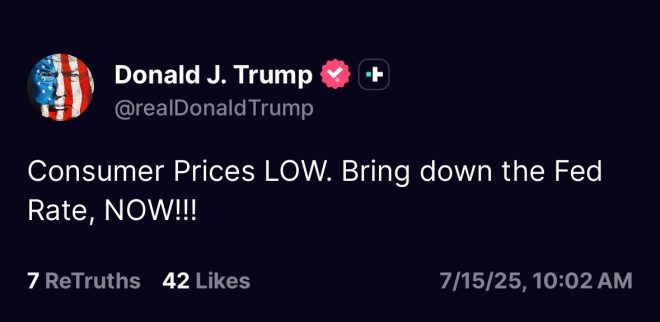

President trump has responded to the recent rise in Consumer Price Index (CPI) inflation, which climbed to 2.7%. In a statement shared on social media, he emphasized that consumer prices remain low and urged for an immediate reduction in the Federal Reserve’s interest rate. This call comes amid ongoing discussions about economic policies and their impact on inflation rates. As the financial landscape evolves, Trump’s remarks highlight the significance of monetary policy in managing inflation and economic growth. Stay updated on economic trends and political responses that shape the market. For more insights, follow the latest economic news.

BREAKING: President Trump posts a statement after CPI inflation rose to 2.7% this morning:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

“Consumer Prices LOW. Bring down the Fed Rate, NOW!!!” pic.twitter.com/16UuZklqP2

— The Kobeissi Letter (@KobeissiLetter) July 15, 2025

BREAKING: President Trump posts a statement after CPI inflation rose to 2.7% this morning:

In a surprising turn of events, former President Donald Trump has made headlines once again. The latest buzz centers around his recent statement regarding consumer price index (CPI) inflation, which ticked up to 2.7% this morning. This figure has sparked significant conversation across economic circles, and Trump’s response is particularly interesting.

“Consumer Prices LOW. Bring down the Fed Rate, NOW!!!”

Trump’s enthusiastic declaration that “Consumer Prices LOW” has caught the attention of many. He’s calling for an immediate reduction in the Federal Reserve interest rates, urging policymakers to act swiftly. But what does this mean for the average American? Lower rates can lead to cheaper loans, making it easier for individuals to buy homes, cars, and even fund education. It’s a move that could stimulate economic growth, but it also raises questions about inflation management and long-term economic health.

The Implications of Rising CPI Inflation

When we hear that CPI inflation has risen to 2.7%, it’s essential to understand what this means. Inflation is a measure of how much prices for goods and services are increasing. A CPI increase can affect various sectors, including housing, food, and transportation. For many consumers, this means that their dollars don’t stretch as far as they used to, leading to tighter budgets and increased financial strain. Trump’s tweet suggests he believes that the current economic climate warrants a reevaluation of the Fed’s approach to interest rates.

The Fed’s Role in the Economy

The Federal Reserve plays a critical role in managing the economy, particularly through its control of interest rates. By adjusting these rates, the Fed can influence inflation and employment levels. When rates are low, borrowing becomes cheaper, which can stimulate spending and investment. However, too much inflation can lead to a loss of purchasing power for consumers, which is a risk that Trump seems keen to address with his call to action.

Public Reaction and Economic Outlook

Reactions to Trump’s statement have been mixed. Supporters may view it as a necessary push for economic relief, while critics argue that lowering interest rates too quickly could exacerbate inflation rather than control it. It raises an important debate about balancing growth with stability in an economy that has shown signs of recovery but still faces uncertainties. For more insights on this topic, you can check out the detailed analysis from The Kobeissi Letter.

Final Thoughts

As we navigate through these economic waters, Trump’s statement serves as a reminder of the complexities involved in managing inflation and interest rates. While the call for lower rates may resonate with many who are feeling the pinch of rising prices, it’s crucial to consider the broader implications for the economy as a whole. The ongoing dialogue about inflation, consumer prices, and federal policy remains vital as we look ahead. Will the Fed respond to this call? Only time will tell.