“Inflation Surges to 2.7% in June: Are Tariffs Fueling a Cost Crisis?”

inflation trends 2025, rising food prices impact, energy cost increases 2025

—————–

Breaking news: Inflation Rises in June

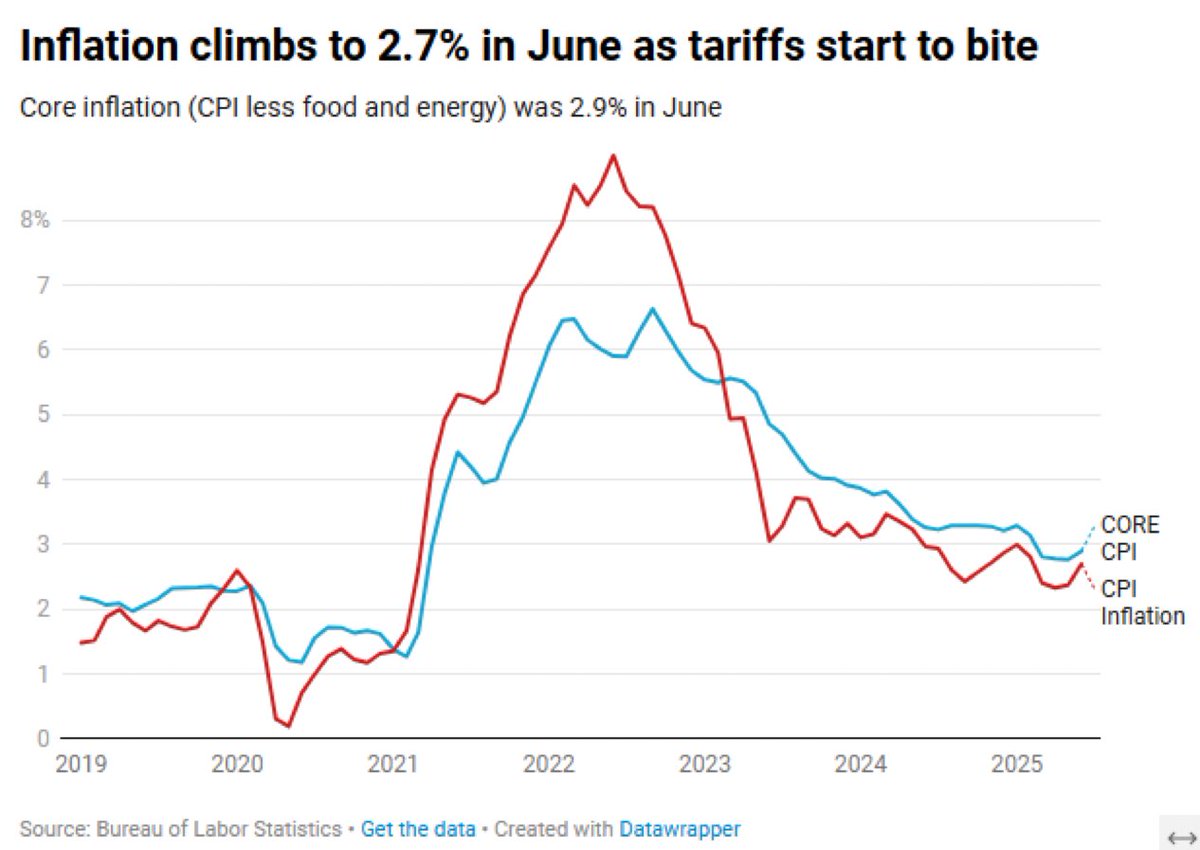

In June, inflation rose to 2.7%, up from 2.3% in April and 2.4% in May, as predicted. Key factors contributing to this increase include rising tariffs and prices for essential goods such as food, energy, and rent. The core inflation rate, which excludes food and energy costs, also saw a significant rise, reaching 2.9%. This inflation spike highlights ongoing economic challenges and may influence monetary policy decisions moving forward. Stay informed about economic trends and their impact on your financial decisions by following reliable news sources.

BREAKING: INFLATION RISES IN JUNE.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

As expected: It’s here.

-Tariffs are starting to raise prices.

-Annual rate climbed to 2.7%. That’s up from 2.3 % in April and 2.4% in May.

-Food, energy & rent contributors.

-Core inflation (which excludes food and energy) rose 2.9% pic.twitter.com/xxLSVl0F94

— Maine (@TheMaineWonk) July 15, 2025

BREAKING: INFLATION RISES IN JUNE

So, it looks like inflation is back in the spotlight this June. If you’ve been keeping an eye on the economy (or even if you haven’t), you might have felt a bit of a pinch lately. The news is that inflation has climbed to an annual rate of 2.7%. This number is a noticeable increase from 2.3% in April and 2.4% in May, and it’s raising eyebrows everywhere.

As expected: It’s here.

You may be wondering what’s driving this surge in inflation. Well, tariffs are starting to rear their heads and raise prices across various sectors. When tariffs go up, businesses often pass those costs down to consumers, which can hit your wallet pretty hard. This is something many of us have been anticipating, but it’s still a bit unsettling to see it manifest in our everyday costs.

-Tariffs are starting to raise prices.

The implications of rising tariffs are far-reaching. They affect everything from the price of imported goods to the cost of everyday essentials. If you’ve noticed that your grocery bill has gone up or your utility costs have spiked, you’re not alone. These changes can make budgeting a real challenge, especially for families trying to make ends meet.

-Annual rate climbed to 2.7%. That’s up from 2.3 % in April and 2.4% in May.

When we talk about the annual rate climbing, it’s important to look at what that means. An increase to 2.7% signifies a growing concern about the stability of prices. For many people, even small changes can have a big impact on how they manage their finances. If you’re feeling the weight of these increases, it’s time to reassess your budget and spending habits.

-Food, energy & rent contributors.

One of the largest contributors to this inflation spike has been food, energy, and rent. These are the essentials that everyone needs, and when their prices rise, it can feel like a double whammy. You might find yourself paying more at the grocery store or noticing that your energy bills are climbing higher than before. Even rent prices are on the rise, making it even more difficult for many to find affordable housing.

-Core inflation (which excludes food and energy) rose 2.9%

Interestingly, core inflation, which strips out food and energy prices, has also risen to 2.9%. This indicates that inflation isn’t just a temporary spike in specific areas; there’s a broader trend at play. It’s something to keep an eye on as it can signal longer-term economic changes. For more insights, check out this [source](https://www.investopedia.com/terms/c/core-inflation.asp) for a deeper understanding.

In short, the rise in inflation isn’t just a headline; it’s a reality that many are experiencing firsthand. From rising prices due to tariffs to increases in essential costs, it’s crucial to stay informed and proactive about your financial situation. As always, staying aware of these trends can help you navigate the economic landscape a bit more smoothly.