“Jerome Powell’s Reckless Policies: Are We Facing Economic Ruin?”

financial policy analysis, interest rate impact, economic instability forecast

—————–

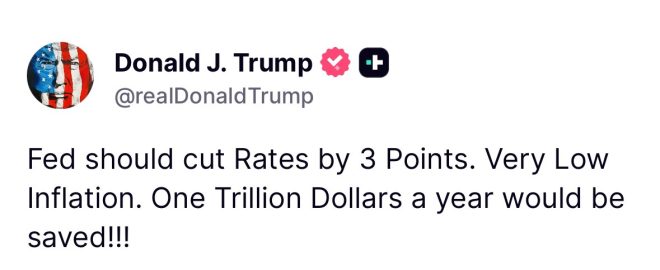

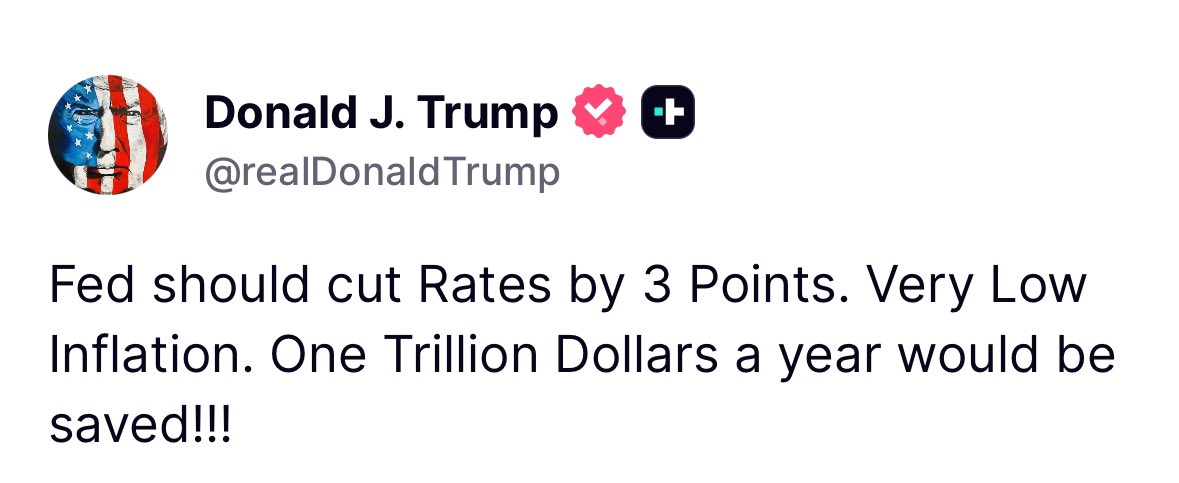

In a recent tweet, Catturd criticizes Jerome Powell, suggesting his decisions could lead to severe financial consequences for the United States. The tweet expresses concern over Powell’s management of the economy, implying that his actions are driven by “TDS” (Trump Derangement Syndrome). This sentiment resonates with many who believe that economic policies should prioritize stability and growth. The discussion highlights the broader debate on monetary policy and leadership in challenging times. As the economic landscape evolves, public sentiment toward key figures like Powell remains critical. Stay informed about the latest economic developments and their implications for the future.

At this point, It’s obvious that Jerome Powell will financially burn this country down to the ground over his TDS. pic.twitter.com/t5nPcyfYAW

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Catturd (@catturd2) July 15, 2025

At this point, It’s obvious that Jerome Powell will financially burn this country down to the ground over his TDS

In today’s tumultuous economic climate, many are pointing fingers at Jerome Powell, the Chair of the Federal Reserve. The sentiment expressed in a recent tweet by Catturd captures a growing frustration among citizens: “At this point, It’s obvious that Jerome Powell will financially burn this country down to the ground over his TDS.” This statement reflects a deep concern about the financial policies being implemented and their potential impact on the economy.

Understanding TDS in Economic Context

The term “TDS” in this context likely refers to a specific viewpoint that critics believe influences Powell’s decisions. It’s important to unpack this concept to understand the broader implications for the economy and why many believe Powell’s actions could lead to dire consequences. Are his decisions driven by a political agenda, or do they stem from a genuine belief in the economic theories he espouses? Analyzing Powell’s track record and the decisions he has made can provide insight into these questions.

The Current Economic Landscape

As inflation rises and market volatility becomes the norm, the actions taken by the Federal Reserve can either stabilize or destabilize the economy. Critics argue that Powell’s approach may be exacerbating financial instability. For instance, raising interest rates too quickly could lead to increased borrowing costs, impacting everything from mortgages to business loans. This could, in turn, slow down economic growth and lead to higher unemployment rates. The fear is that, as stated in the tweet, we may be heading toward a financial catastrophe.

The Ripple Effects of Monetary Policy

It’s not just about immediate financial implications. The decisions made by the Federal Reserve under Powell’s leadership can have long-lasting effects on everyday Americans. From the cost of living to job creation, the ramifications of these policies extend far beyond Wall Street. Many people worry that the current trajectory could lead to a recession, with families struggling to make ends meet as economic conditions deteriorate.

The Debate Around Leadership and Accountability

Catturd’s tweet highlights a broader narrative regarding accountability in leadership roles. Is it fair to place the blame solely on Powell, or are there systemic issues at play? Critics argue that the Federal Reserve’s independence means Powell can operate without direct oversight, allowing for decisions that may not align with the best interests of the general public. This raises critical questions about how monetary policy is formulated and who truly benefits from it.

Looking Ahead: What Can We Expect?

With the economy at a crossroads, many are left wondering what the future holds. Is there a way to recalibrate monetary policy to ensure it serves the public interest? The debate surrounding Jerome Powell’s leadership will continue as the economic landscape evolves. Citizens are urged to stay informed and engaged, as the consequences of these decisions will affect generations to come.

To stay updated on the latest developments regarding Jerome Powell and the Federal Reserve, consider following financial news outlets or visiting the official Federal Reserve website for insights and updates. Understanding these dynamics is crucial for navigating the complexities of the current economic climate.