Egypt and China Ditch SWIFT: Is a New Financial Era on the Horizon?

local currency trade, Egyptian-Chinese economic partnership, Cross-border payment systems 2025

—————–

Egypt and China’s central banks have made a significant move by abandoning the SWIFT system for international trade. Instead, they will now conduct transactions in their local currencies and utilize the Chinese Cross-border Interbank Payment System (CIPS). This strategic decision underscores a growing trend among nations to reduce reliance on traditional banking systems and enhance financial sovereignty. By adopting local currencies for trade, Egypt and China aim to boost economic cooperation and streamline financial transactions. This shift could redefine global trade dynamics and encourage other countries to follow suit, marking a pivotal shift in international finance.

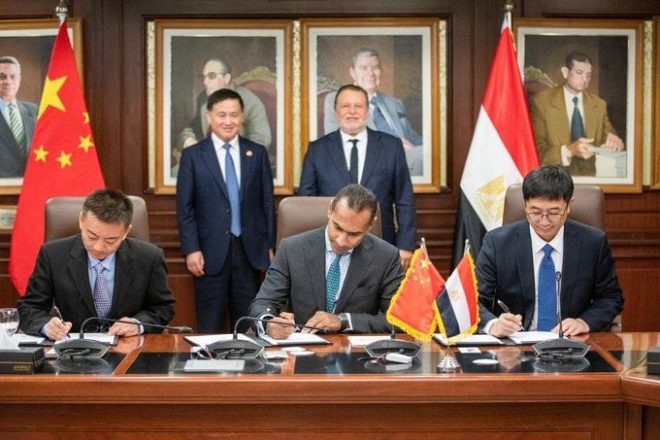

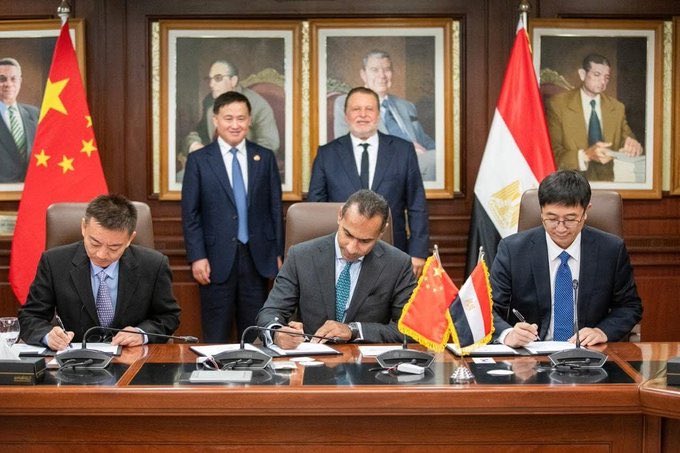

BREAKING: Egypt and China central banks decided to abandon the SWIFT system and move to trade in local currencies and the use of the Chinese Cross-border Interbank Payment System (CIPS) pic.twitter.com/hCbgmcjDGf

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— The Daily CPEC (@TheDailyCPEC) July 15, 2025

BREAKING: Egypt and China central banks decided to abandon the SWIFT system and move to trade in local currencies and the use of the Chinese Cross-border Interbank Payment System (CIPS)

In a significant shift in international banking practices, the central banks of Egypt and China have announced their decision to abandon the SWIFT system. Instead, they will now trade in their local currencies and utilize the Chinese Cross-border Interbank Payment System (CIPS). This landmark decision, reported by [The Daily CPEC](https://twitter.com/TheDailyCPEC/status/1945202785428947308?ref_src=twsrc%5Etfw), marks a substantial change in how countries conduct cross-border transactions.

Understanding the Implications of This Move

So, what does this really mean? The SWIFT system has long been the backbone of international financial transactions, facilitating communication between banks around the globe. By moving away from SWIFT, Egypt and China are signaling a desire for greater financial autonomy and a shift towards a more localized trading system. This change is likely a strategic move to reduce dependence on Western financial systems and to bolster economic ties between the two nations.

The [CIPS](http://www.chinacips.com/en/) is designed to facilitate cross-border RMB transactions, making it a convenient alternative for countries looking to engage in trade without relying on traditional Western banking systems. This system not only enhances the efficiency of transactions but also aims to promote the use of the Chinese Yuan in international trade.

Why Local Currencies Matter

Trading in local currencies can significantly reduce transaction costs and currency risk. For Egyptian traders, this means they can avoid the volatility associated with relying on foreign currencies, particularly the US dollar. For China, it’s an opportunity to internationalize the Yuan further, promoting it as a global trading currency. This could pave the way for more countries to consider similar moves in the future.

Furthermore, this decision is a part of a broader trend where nations are increasingly exploring alternatives to the US dollar for international trade. Countries like Russia and Iran have already taken steps to trade in their local currencies, and Egypt and China’s collaboration is a clear indication that this trend is gaining momentum.

The Future of International Trade

As we look ahead, the abandonment of the SWIFT system by Egypt and China could usher in a new era of international trade. This move not only reflects changing geopolitical dynamics but also sets the stage for potential collaborations among other nations looking to adopt similar strategies. It raises questions about the future of global financial systems and how they will adapt to these shifts.

Moreover, with the rise of digital currencies and alternative payment systems, the landscape of international finance is evolving rapidly. Countries are becoming more innovative in finding ways to conduct trade that align with their national interests. This is certainly an exciting time for global finance and trade!

In summary, the decision by Egypt and China to abandon the SWIFT system and adopt local currencies and CIPS is a pivotal moment in the evolution of international banking. It represents a significant shift towards localized trading practices, with the potential to reshape global financial dynamics in the years to come. Keep an eye on how this develops, as it could have far-reaching implications for economies around the world.