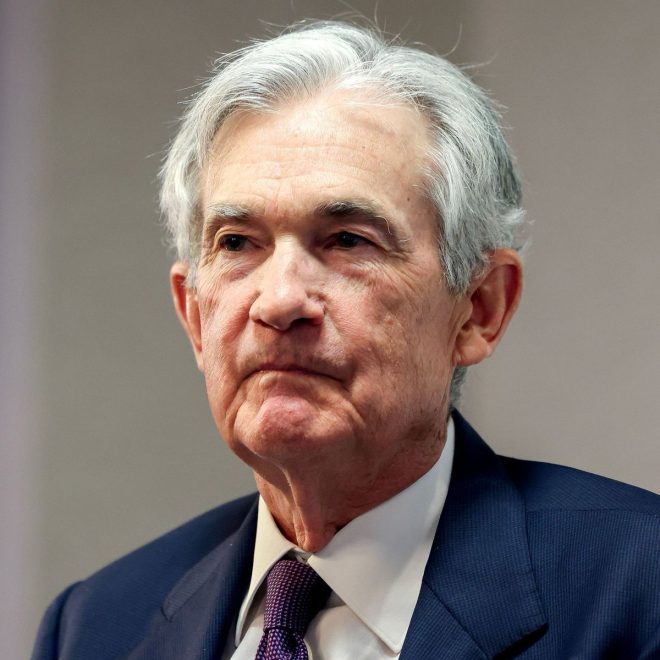

Core Inflation Falls to 0.2%: Is It Time for Jerome to Cut Rates or Step Down?

core inflation analysis, interest rate decisions, economic policy implications

—————–

Core inflation has come in below expectations at 0.2%, sparking significant reactions in the financial community. Eric Daugherty’s tweet suggests that this lower-than-anticipated figure could prompt Federal Reserve Chair Jerome Powell to consider cutting interest rates. The call to action—”CUT THE RATES JEROME, or RESIGN!!”—highlights the urgency felt by some economists and investors regarding monetary policy adjustments in response to changing economic indicators. This development is crucial for market analysts, as it may influence future investment strategies and economic forecasts. Stay informed on inflation trends and their potential impact on the economy.

BREAKING: Core inflation comes in below expectations at 0.2%.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

CUT THE RATES JEROME, or RESIGN!! pic.twitter.com/DwAOCj39VP

— Eric Daugherty (@EricLDaugh) July 15, 2025

BREAKING: Core inflation comes in below expectations at 0.2%

In a surprising twist, core inflation has come in below expectations at just 0.2%. This news sent ripples through the financial markets and sparked a flurry of reactions from economic analysts and the public alike. Many are now calling for decisive action from the Federal Reserve, specifically urging Jerome Powell to consider cutting interest rates. The sentiment is clear: the current economic climate demands a rapid response to stimulate growth and combat potential stagnation.

CUT THE RATES JEROME, or RESIGN!!

The urgency behind the call to “CUT THE RATES, JEROME, or RESIGN!!” reflects the growing frustration among economists and everyday Americans. With inflation rates falling below expectations, many believe this is a prime opportunity for the Fed to lower interest rates, making borrowing cheaper and encouraging spending. This kind of monetary policy could be a game-changer for businesses and consumers alike, potentially invigorating a sluggish economy.

Inflation has long been a hot topic, especially in the wake of the pandemic. With prices rising sharply in previous months, a drop to 0.2% signals a possible easing of economic pressures. However, the question remains: will the Federal Reserve act swiftly enough to prevent a downturn? The landscape is complex, and while falling inflation is good news, it’s crucial to remember that it’s just one piece of the puzzle.

The Economic Implications of Lower Inflation

Lower inflation can lead to increased purchasing power for consumers, which is exactly what many people are banking on. When prices stabilize, families can stretch their budgets further, which is a huge relief given recent trends. This could mean more spending on essentials and even discretionary items, giving a much-needed boost to local businesses. If the Fed responds appropriately, we might see a rebound in consumer confidence, which has been shaky since the pandemic began.

Market Reactions and Predictions

Following the announcement of the lower inflation rate, stock markets reacted positively, with many investors hopeful that the Fed would take action to support the economy. Analysts are closely monitoring the situation, as any sign of rate cuts could lead to a significant uptick in market activity. The relationship between interest rates and stock prices is well-documented; lower rates usually mean higher stock prices as companies can borrow at cheaper rates and invest in growth.

What’s Next for Jerome Powell and the Federal Reserve?

As the pressure mounts, all eyes are on Jerome Powell and the Federal Reserve. Will they heed the call and cut rates? Or will they adopt a more cautious approach, opting to wait and see how the economy reacts to the current inflation figures? The stakes are high, and the decisions made in the coming weeks could have far-reaching implications for the U.S. economy.

For those watching closely, this is a pivotal moment. Whether you’re an investor, a small business owner, or just someone trying to make sense of your finances, the outcome of this situation will likely affect you. Keep an eye on the developments as they unfold, and stay informed about how these economic changes might impact your day-to-day life.