BREAKING: BlackRock’s Massive $394.7 Million Bitcoin Acquisition Sends Crypto Market Soaring!

BlackRock cryptocurrency investment, Bitcoin market update, institutional investors in digital assets

—————–

BlackRock, a major investment management company, has made headlines by purchasing $394.7 million worth of Bitcoin. This move has sparked excitement in the cryptocurrency market, with many seeing it as a vote of confidence in the digital currency. The news was shared by Crypto Rover on Twitter, causing a stir among investors and enthusiasts alike. This bold move by BlackRock could have a significant impact on the future of Bitcoin and the broader cryptocurrency market. Stay tuned for updates on how this purchase will shape the industry moving forward. #Bitcoin #BlackRock #Cryptocurrency #Investing

BREAKING:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BLACKROCK JUST BOUGHT $394.7 MILLION WORTH OF #BITCOIN. pic.twitter.com/VrfYdDC4up

— Crypto Rover (@rovercrc) July 15, 2025

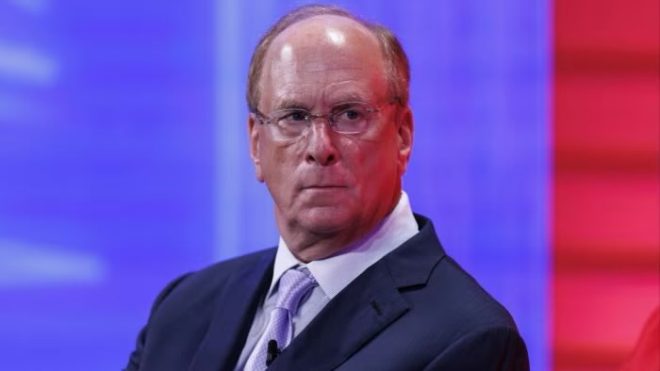

In a recent development that has sent shockwaves through the financial world, BlackRock, the world’s largest asset manager, has just purchased a staggering $394.7 million worth of Bitcoin. This move has further solidified the mainstream adoption of cryptocurrency and has sparked conversations about the future of digital assets in traditional financial markets.

The news of BlackRock’s massive investment in Bitcoin was first reported by Crypto Rover on Twitter. The tweet, which went viral within minutes, announced the groundbreaking purchase and included a link to the details of the transaction. This move by BlackRock is a clear indication that institutional investors are increasingly recognizing the value and potential of cryptocurrencies like Bitcoin.

BREAKING: BLACKROCK JUST BOUGHT $394.7 MILLION WORTH OF #BITCOIN.

This significant investment by BlackRock comes at a time when the cryptocurrency market is experiencing a resurgence in interest and value. Bitcoin, in particular, has seen a significant increase in price over the past year, reaching new all-time highs. This surge in value has attracted the attention of both retail and institutional investors, leading to a greater acceptance of digital assets as a legitimate investment option.

The decision by BlackRock to invest nearly $400 million in Bitcoin is a bold move that reflects the changing attitudes towards cryptocurrencies in the financial industry. As one of the most influential players in the asset management sector, BlackRock’s endorsement of Bitcoin is likely to have a ripple effect across the market, encouraging other institutional investors to consider adding digital assets to their portfolios.

While some traditional investors may still be skeptical about the long-term viability of cryptocurrencies, the growing acceptance of Bitcoin by major financial institutions like BlackRock is a clear indication that the tide is turning. With the backing of institutional giants, cryptocurrencies are poised to become an integral part of the global financial landscape in the years to come.

As the cryptocurrency market continues to evolve and mature, the involvement of institutional investors like BlackRock will play a crucial role in shaping its future. The decision to invest in Bitcoin is not only a strategic move by BlackRock to diversify its portfolio but also a vote of confidence in the potential of digital assets to revolutionize the way we think about money and investments.

In conclusion, BlackRock’s purchase of $394.7 million worth of Bitcoin is a game-changing development that underscores the growing mainstream acceptance of cryptocurrencies. This move is a clear sign that digital assets are here to stay and are poised to play a significant role in the future of finance. With institutional giants like BlackRock leading the way, the future of cryptocurrencies looks brighter than ever.