Michael Saylor’s Bitcoin Gamble: $30 Billion Profit or Market Manipulation?

Bitcoin investment strategy, cryptocurrency market trends 2025, unrealized profit growth

—————–

Michael Saylor’s Bitcoin investment strategy has achieved an impressive milestone with an unrealized profit of $30 billion. This significant profit highlights the potential of Bitcoin as a long-term investment and reinforces Saylor’s influence in the cryptocurrency market. The financial community is closely monitoring Saylor’s moves, as they could shape future trends in digital assets. As Bitcoin continues to gain traction, investors are increasingly drawn to its volatility and potential for substantial returns. This development is a testament to the growing acceptance of Bitcoin in mainstream finance. Stay updated on Bitcoin and investment strategies for more insights.

JUST IN: Michael Saylor’s ‘Strategy’ now has $30,000,000,000 unrealized profit on its Bitcoin investment. pic.twitter.com/q3iC9WYZ1i

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Watcher.Guru (@WatcherGuru) July 14, 2025

JUST IN: Michael Saylor’s ‘Strategy’ now has $30,000,000,000 unrealized profit on its Bitcoin investment

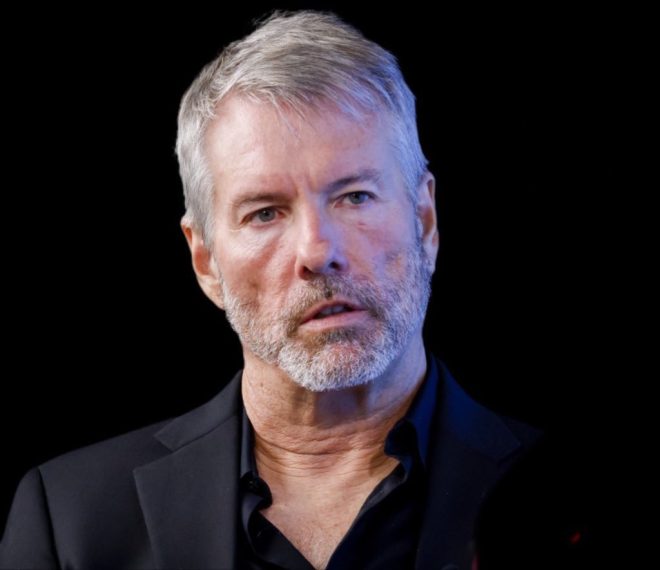

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has been a prominent figure in the cryptocurrency space, particularly known for his bullish stance on Bitcoin. Recently, news broke that his investment strategy has amassed a staggering $30 billion in unrealized profit on Bitcoin. This revelation has sparked interest and discussions among investors and crypto enthusiasts alike. But what does this really mean for the market and Saylor’s strategy?

Understanding Saylor’s Bitcoin Investment Strategy

Saylor’s approach to Bitcoin is not just about buying and holding; it’s a well-thought-out strategy rooted in the belief that Bitcoin is a superior store of value compared to traditional assets. He has often compared Bitcoin to gold, arguing that it offers a hedge against inflation and currency devaluation. By investing in Bitcoin, Saylor aims to secure long-term value for MicroStrategy and its shareholders. The company’s strategy has become a case study for institutional investors looking to diversify their portfolios.

The Impact of Bitcoin’s Price Surge

The unrealized profit of $30 billion indicates that Saylor’s investments have greatly benefited from the recent surge in Bitcoin prices. As Bitcoin continues to gain mainstream acceptance, it has experienced significant price increases, leading to impressive returns for early investors like Saylor. For those keeping an eye on the cryptocurrency market, this serves as a reminder of the potential financial rewards that come from investing in digital currencies.

What This Means for the Future of Bitcoin

This massive unrealized profit not only highlights Saylor’s successful investment strategy but also signals growing institutional interest in Bitcoin. As more companies and investors recognize Bitcoin’s potential as a digital asset, we may see increased demand and further price appreciation. Saylor’s success could encourage others to follow suit, creating a ripple effect throughout the industry.

Risks and Considerations

While the profits are impressive, it’s essential to remember that the cryptocurrency market is notoriously volatile. Bitcoin’s price can fluctuate dramatically, and what goes up can come down just as quickly. Investors should approach this space with caution and consider their risk tolerance. Saylor himself has acknowledged the risks involved, but his long-term vision for Bitcoin suggests he believes the potential rewards outweigh these risks.

The Broader Economic Context

As global economic uncertainties continue to rise, many are turning to Bitcoin as a safe haven. Saylor’s statement regarding the unrealized profit reflects not only his success but also a broader trend where investors are looking for alternative assets to protect their wealth. With inflation rates climbing and traditional markets experiencing fluctuations, Bitcoin may become an essential part of modern investment strategies.

In summary, Michael Saylor’s ‘Strategy’ has now yielded an impressive $30 billion in unrealized profit, which could signify a pivotal moment for both him and the cryptocurrency market. As Bitcoin continues to evolve, Saylor’s approach may serve as a blueprint for future investments. Stay tuned, as the world of Bitcoin unfolds!