“Michael Saylor’s Shocking $30B Bitcoin Windfall: Will He Go All In Again?”

Michael Saylor Bitcoin strategy, cryptocurrency investment leverage, Bitcoin market trends 2025

—————–

Michael Saylor’s Bitcoin Holdings Surge

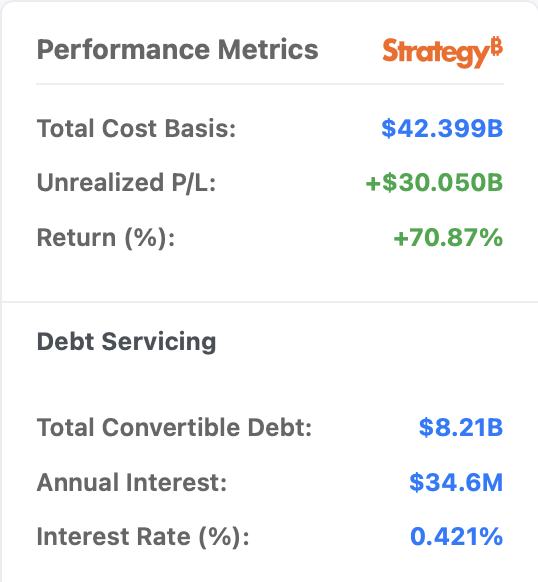

Michael Saylor’s Bitcoin strategy has resulted in unrealized profits exceeding $30 billion, according to a recent tweet by Crypto Rover. This substantial profit allows Saylor to leverage his holdings, potentially borrowing more funds to acquire additional Bitcoin. With market anticipation building, a significant purchase may be on the horizon today. Saylor’s bold moves in the cryptocurrency space continue to attract attention, highlighting the volatility and potential of Bitcoin investments. As a prominent figure in the crypto community, his strategies could influence market trends and investor sentiment. Stay tuned for updates on Saylor’s next steps in the Bitcoin market.

BREAKING:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

MICHAEL SAYLOR’S STRATEGY UNREALISED PROFITS ON BITCOIN HOLDINGS NOW EXCEED $30B.

THIS MEANS HE CAN BORROW MORE AND BUY EVEN MORE BITCOIN.

BIG BUY INCOMING TODAY? pic.twitter.com/iGhvUacEjz

— Crypto Rover (@rovercrc) July 14, 2025

BREAKING:

In the ever-evolving world of cryptocurrency, big players often make headlines, and none more so than Michael Saylor. His recent achievements with Bitcoin have sent ripples through the market. According to reports, Saylor’s unrealized profits on his Bitcoin holdings have now exceeded a staggering $30 billion. This is a monumental figure that not only showcases the potential of Bitcoin but also highlights Saylor’s strategic prowess in navigating the volatile crypto landscape.

MICHAEL SAYLOR’S STRATEGY UNREALISED PROFITS ON BITCOIN HOLDINGS NOW EXCEED $30B.

Saylor, the co-founder of MicroStrategy, has been a vocal advocate for Bitcoin, and his investment strategy reflects a strong belief in its long-term value. Holding a significant amount of Bitcoin, he has leveraged these assets to bolster his company’s financial standing. The unrealized profits indicate that if he chose to liquidate some of his holdings, he could secure an immense financial windfall. However, Saylor’s approach has been far from conventional; instead of cashing out, he’s been doubling down on his investments. This leads us to the exciting prospect of what he might do next.

THIS MEANS HE CAN BORROW MORE AND BUY EVEN MORE BITCOIN.

With these unrealized profits, Saylor has the unique opportunity to borrow against his Bitcoin holdings. This strategic move allows him to finance even larger Bitcoin purchases without needing to sell his existing assets. It’s a classic example of using leverage to amplify potential gains. By borrowing more, he can not only increase his Bitcoin stash but also further solidify his position in the market. This is particularly interesting because, as the market fluctuates, having the ability to buy more Bitcoin at lower prices could lead to even greater profits in the future.

BIG BUY INCOMING TODAY?

The buzz around Saylor’s next move has sparked speculation across social media platforms and crypto forums. Will he make a big buy today? Many enthusiasts are watching closely, eager to see if he will seize this opportunity to expand his Bitcoin holdings even further. Given his track record, it wouldn’t be surprising if he decided to make a significant purchase. Such a move could potentially influence Bitcoin’s price, drawing in more investors and solidifying his reputation as a savvy crypto leader.

In the world of Bitcoin investments, Saylor stands out not just for his wealth but for his visionary approach. The implications of his strategy extend beyond personal gain; they also reflect broader trends in the cryptocurrency market. As more institutional investors enter the space, the dynamics of supply and demand are shifting, and Saylor’s actions are a bellwether for what’s to come.

As we watch this story unfold, one thing is clear: Michael Saylor is a key player in the Bitcoin narrative, and his next steps could shape the future of cryptocurrency investment. Whether you’re a seasoned investor or a curious newcomer, staying updated on his moves could provide valuable insights into the ever-fluctuating crypto landscape.