“Subpoenas Rock Wall Street: Anson Funds & GTS Securities Under Fire!”

SEC legal proceedings, securities fraud defense strategies, investment fund subpoenas

—————–

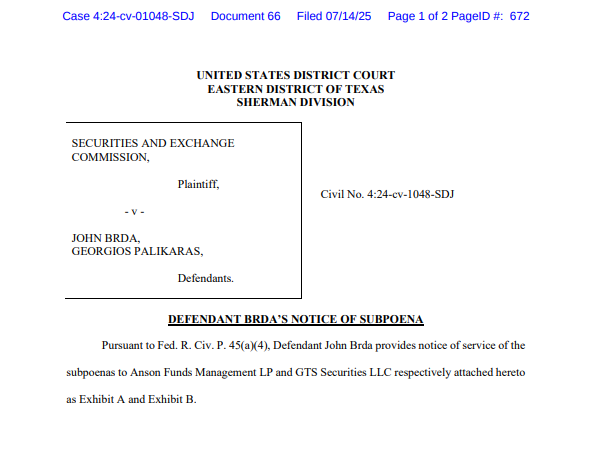

In a significant development in the SEC v. John Brda & Georgios Palikaras case, subpoenas have been served to Anson Funds and GTS Securities by the defendants. As of now, no decision has been made regarding the defendants’ motions to dismiss or their motion to exclude evidence. This case continues to attract attention, especially among stakeholders of $MMTLP, $MMAT, and $TRCH. Investors and analysts are closely monitoring updates from the SEC and the involved parties. Stay informed on the latest legal proceedings that could impact market dynamics and investment strategies related to these stocks.

BREAKING news

SUBPOENAS SERVED TO ANSON FUNDS AND GTS SECURITIES BY DEFENDANT IN SEC V. JOHN BRDA & GEORGIOS PALIKARAS. NO DECISION REGARDING DEFENDANTS’ MOTIONS TO DISMISS OR MOTION TO EXCLUDE EVIDENCE. $MMTLP $MMAT $TRCH@johnbrda @palikaras @SECgov #AnsonFunds… pic.twitter.com/kvviU8PdeO

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— JunkSavvy (@JunkSavvy) July 14, 2025

BREAKING NEWS

In a significant development in the ongoing case of SEC v. John Brda & Georgios Palikaras, subpoenas have been served to Anson Funds and GTS Securities by the defendants. This latest twist in the legal saga has put the spotlight back on the case, raising questions about the implications for all parties involved.

SUBPOENAS SERVED TO ANSON FUNDS AND GTS SECURITIES BY DEFENDANT IN SEC V. JOHN BRDA & GEORGIOS PALIKARAS

The serving of subpoenas is a big deal in any legal context, particularly when they are directed at investment entities like Anson Funds and GTS Securities. It indicates that the defendants, including prominent figures such as @johnbrda and @palikaras, are looking to gather more evidence or challenge the existing evidence presented by the SEC. It’s a strategic move that could have far-reaching effects on the case.

NO DECISION REGARDING DEFENDANTS’ MOTIONS TO DISMISS OR MOTION TO EXCLUDE EVIDENCE

As of now, there hasn’t been any ruling on the defendants’ motions to dismiss the case or their motion to exclude certain pieces of evidence. This lack of a decision leaves both sides in a bit of a limbo, as they await the court’s guidance on these pivotal issues. The uncertainty can be unsettling, especially for investors and stakeholders who are closely following the case, particularly those with interests in stocks like $MMTLP, $MMAT, and $TRCH.

Implications for Investors

This development could impact investor sentiment significantly. If you’re holding shares in companies tied to this case, it’s essential to stay updated on how these legal proceedings unfold. The outcome could affect stock prices and market confidence. Investors often react to legal news, so keeping a close eye on developments can help you make informed decisions.

What’s Next?

The next steps in the SEC v. John Brda & Georgios Palikaras case are crucial. With subpoenas now in play, the defendants have a chance to bolster their argument or potentially uncover evidence that could shift the case’s dynamics. The SEC, on the other hand, must prepare to defend its position vigorously. This legal battle is far from over, and all eyes are on the court for the next round of rulings.

Stay Informed

For those invested in the future of this case and its implications, following updates from reliable sources like the Securities and Exchange Commission and financial news outlets is vital. You’ll want to keep track of any new developments regarding subpoenas, motions, and overall case progression. It’s a rapidly evolving situation, and being in the know can help you stay ahead.

Overall, this breaking news about subpoenas served to Anson Funds and GTS Securities is a reminder of the complexities inherent in securities law and the ongoing battles that can unfold in the finance world. Keep your ears to the ground; there may be more to come in this intriguing case.