Saylor’s Bold Move: Is His $472M Bitcoin Bet a Genius Investment or a Gamble?

Bitcoin investment strategy, cryptocurrency market trends, Saylor’s financial moves

—————–

Breaking news: Saylor’s Bitcoin Acquisition

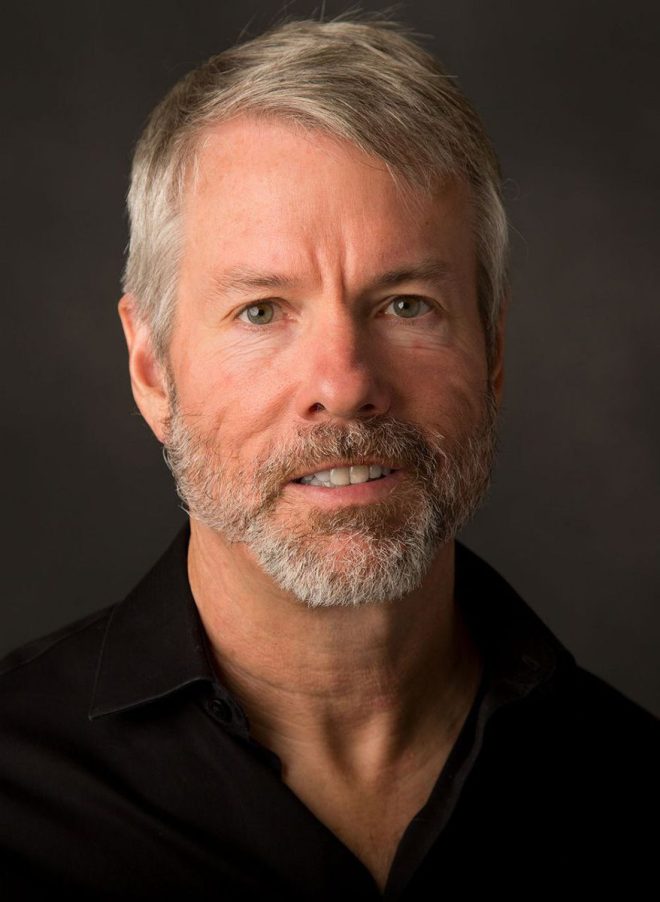

In a significant move for the cryptocurrency market, Michael Saylor has purchased 4,225 Bitcoin for an impressive $472.5 million. This strategic acquisition highlights Saylor’s unwavering belief in Bitcoin as a long-term asset. As the founder of MicroStrategy, Saylor continues to load up on Bitcoin, reinforcing his status as a major player in the digital currency landscape. His latest investment further emphasizes the growing institutional interest in cryptocurrency and its potential for substantial returns. Stay updated on market trends and Saylor’s future moves as he navigates the evolving landscape of Bitcoin investment.

BREAKING:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

SAYLOR’S STRATEGY HAS BOUGHT

4,225 BITCOIN FOR $472.50 MILLION.HE IS LOADING UP !! pic.twitter.com/1fJhehMoNs

— Ash Crypto (@Ashcryptoreal) July 14, 2025

BREAKING:

In a significant move that has sent ripples through the cryptocurrency community, Michael Saylor, the co-founder of MicroStrategy, has made headlines by purchasing a staggering 4,225 Bitcoin for a total of $472.50 million. This bold investment has sparked conversations about Saylor’s strategy and what it means for the future of Bitcoin. It’s worth diving deeper into the implications of this massive acquisition and what it signifies for both Saylor and the broader market.

SAYLOR’S STRATEGY HAS BOUGHT

Michael Saylor is no stranger to making waves in the crypto world. His company, MicroStrategy, has been accumulating Bitcoin for quite some time, and this latest purchase is a testament to his unwavering belief in the digital currency. With a total investment of $472.50 million, Saylor is clearly doubling down on his strategy. But why is he so confident? The answer lies in Bitcoin’s potential as a hedge against inflation and its growing acceptance as a legitimate asset class. These factors make it an attractive option for investors looking to diversify their portfolios.

4,225 BITCOIN FOR $472.50 MILLION.

So, what does buying 4,225 Bitcoin for such a hefty sum mean for Saylor and his company? For one, it reinforces MicroStrategy’s position as a leader in the corporate adoption of Bitcoin. Saylor’s aggressive strategy demonstrates a long-term vision, contrasting sharply with the short-term fluctuations often seen in the crypto market. By acquiring this amount of Bitcoin, Saylor is not just playing the market; he’s making a statement that he believes in the future of this cryptocurrency. It’s a bold move that many are watching closely, as it could influence other companies to consider similar investments.

HE IS LOADING UP !!

Saylor’s latest acquisition has certainly raised eyebrows, and it has many wondering if this is a signal to other investors. His confidence in Bitcoin suggests that he sees potential for further growth, despite recent market volatility. This move could also encourage others to follow suit, potentially leading to increased institutional investment in Bitcoin. As more corporations recognize Bitcoin as a viable asset, the demand could increase, driving prices up further. It’s a fascinating time in the crypto space, and Saylor’s actions are a key part of this evolving narrative.

Moreover, Saylor’s strategy is not just about numbers; it’s about belief in the underlying technology of blockchain and the transformative potential of cryptocurrencies. With every Bitcoin purchase, he is making a case for the future of finance where digital currencies play a central role. His recent acquisition is a clear indication that he is not phased by market downturns and is committed to holding Bitcoin long-term.

As we continue to watch this space, it’s essential to stay informed about these developments. Saylor’s moves not only affect MicroStrategy but could also have a domino effect on the entire cryptocurrency market. For those interested in the financial landscape, keeping an eye on figures like Michael Saylor will be crucial in understanding where Bitcoin and the broader market may head next.

For more details on this breaking news, check out the original tweet from [Ash Crypto](https://twitter.com/Ashcryptoreal/status/1944728978360578055?ref_src=twsrc%5Etfw).