Federal Reserve’s Shocking Crypto Directive: Banks Can Now Treat Digital Assets Like Cash!

cryptocurrency banking regulations, digital asset compliance framework, financial institution crypto integration

—————–

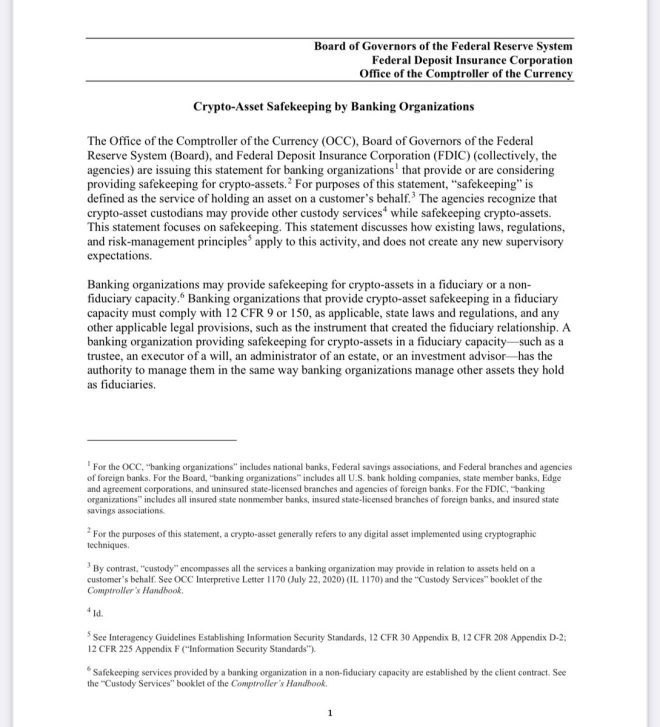

The Federal Reserve has announced new regulations allowing banks to treat cryptocurrencies as standard assets, marking a significant shift in the financial landscape. This development enables banks to integrate crypto into their operations seamlessly, potentially boosting the adoption and legitimacy of digital currencies. The announcement, shared by JackTheRippler on Twitter, highlights the growing recognition of cryptocurrencies like XRP in traditional banking environments. As financial institutions adapt to these changes, the implications for investors, consumers, and the crypto market are profound. Stay informed about these regulatory changes and their impact on the future of cryptocurrency and banking.

BREAKING: The Federal Reserve just released a document outlining the regulations for banks to operate with crypto, allowing them to treat them as any other asset! #XRP pic.twitter.com/vS4Ar6dPJC

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— JackTheRippler © (@RippleXrpie) July 14, 2025

BREAKING: The Federal Reserve Just Released a Document Outlining the Regulations for Banks to Operate with Crypto, Allowing Them to Treat Them as Any Other Asset!

Exciting news is buzzing in the financial world! The Federal Reserve has just dropped a significant document that lays down the regulations for banks to engage with cryptocurrencies. This is a game-changer, as it allows banks to treat cryptocurrencies, like XRP, just like any other asset. If you’ve been following the crypto space, you know how pivotal this is for the future of digital currencies.

What Does This Mean for Banks and Cryptocurrencies?

With these new regulations, banks can finally dive into the crypto pool without hesitation. This means they can hold, trade, and manage cryptocurrencies with the same rules that apply to traditional assets. It opens the door for more mainstream adoption of digital currencies. Imagine walking into your bank and being able to buy or sell crypto just like you would stocks or bonds. Sounds pretty cool, right?

Understanding the Impact on XRP and Other Cryptos

The timing of this announcement couldn’t be better, especially for XRP enthusiasts. As a leading digital asset aimed at facilitating cross-border payments, XRP stands to benefit immensely from increased institutional adoption. With banks now able to operate freely with cryptocurrencies, the demand for XRP could skyrocket. This could lead to more liquidity in the market and potentially increase its value.

What Should Crypto Investors Know?

If you’re an investor or just someone curious about cryptocurrencies, this regulation is worth paying attention to. The Federal Reserve’s move indicates a shift towards embracing digital currencies rather than shunning them. As banks become more involved, we might see a rise in crypto-friendly services like crypto savings accounts or even crypto credit cards! This can make investing in crypto more accessible for everyday people.

The Long-Term Vision for Crypto and Banking

What does the future hold? While it’s hard to predict, this regulatory acceptance suggests a growing partnership between traditional finance and the crypto world. As banks begin to integrate crypto services, we may witness a new era of financial innovation. Think about it: decentralized finance (DeFi) applications could start collaborating with traditional banks, creating a hybrid financial ecosystem that benefits everyone.

Stay Informed and Engaged

With all this happening, it’s essential to stay informed. Following updates from the Federal Reserve and other regulatory bodies will give you insight into how these changes might affect your investments. Engaging with the community, whether through forums or social media, can also provide valuable perspectives and tips. So, keep your ears to the ground and your investments diversified!

In summary, the Federal Reserve’s recent document is a landmark moment for both banks and cryptocurrencies. It paves the way for a more integrated financial landscape where digital assets can thrive alongside traditional ones. If you’ve ever had an interest in crypto, now is a great time to dive deeper into how these regulations might affect your financial future!