“Federal Reserve Shocks Nation: Banks Can Now Hold Bitcoin and Crypto!”

Bitcoin custody services, crypto regulation updates, US bank involvement in cryptocurrency

—————–

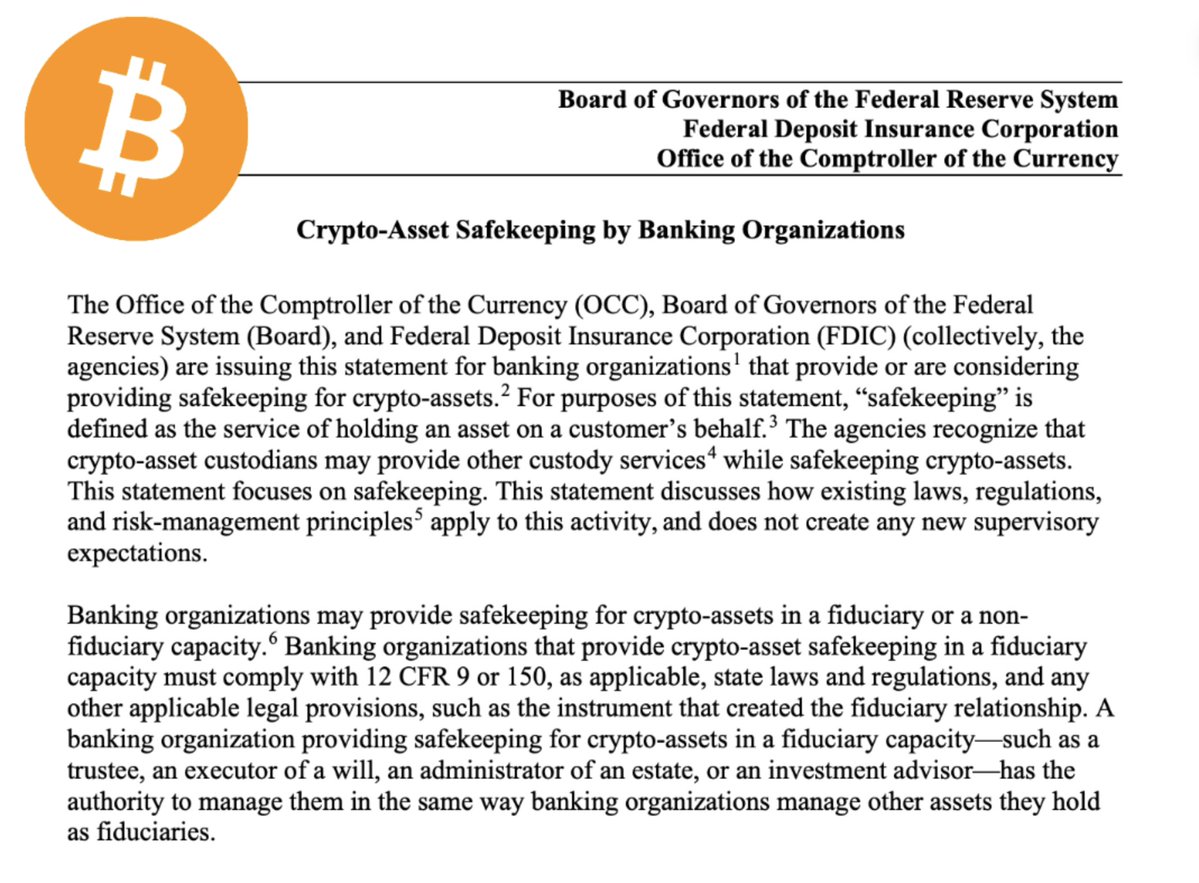

The Federal Reserve and US regulators have announced that banks are now permitted to custody Bitcoin and other cryptocurrencies. This significant development, reported by Bitcoin Magazine, marks a turning point for the financial industry, opening doors for increased institutional adoption of digital assets. As regulatory clarity improves, banks can offer secure storage solutions for cryptocurrencies, further integrating them into mainstream finance. This decision is expected to enhance consumer confidence and promote the growth of the cryptocurrency market. Stay informed on how these changes impact the future of banking and digital currencies. For more updates, follow Bitcoin Magazine.

JUST IN: Federal Reserve and US regulators issue statement saying banks are allowed to custody Bitcoin & crypto. pic.twitter.com/2PZOtHhZCH

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Bitcoin Magazine (@BitcoinMagazine) July 14, 2025

JUST IN: Federal Reserve and US regulators issue statement saying banks are allowed to custody Bitcoin & crypto

The landscape of cryptocurrency just got a significant makeover, thanks to a recent statement from the Federal Reserve and US regulators. They’ve officially announced that banks are permitted to custody Bitcoin and other cryptocurrencies. This is a game changer for the crypto world, as it brings a sense of legitimacy and security to digital assets that many have been craving.

The Importance of Custody in Crypto

So, why is this announcement such a big deal? Custody refers to how assets are held, managed, and protected. For cryptocurrencies, having established banks take on the responsibility of custody means enhanced security for investors. Banks are traditionally seen as safe havens for assets, and this move could encourage more people to invest in cryptocurrencies. You can dive deeper into this topic on [Bitcoin Magazine](https://bitcoinmagazine.com).

What This Means for Banks and Investors

With banks now able to custody Bitcoin and crypto, we can expect to see a wave of new services tailored to both institutional and retail investors. Banks may start offering crypto investment products, which can help demystify digital currencies for the average consumer. Imagine walking into your local bank and discussing your Bitcoin investments with a financial advisor! This could make digital currencies more accessible and appealing to those who have been hesitant to enter the crypto space.

Potential Impact on the Market

This regulatory shift could also have a significant impact on the cryptocurrency market. The announcement may lead to increased institutional investment, which historically has been a major driver of price growth in the crypto world. As banks begin to provide custody services, we could see more traditional investors entering the market, adding to the overall demand for Bitcoin and other cryptocurrencies.

Regulatory Confidence and the Future of Crypto

The Federal Reserve and US regulators stepping in to endorse the custody of digital assets is a clear sign of growing confidence in the cryptocurrency ecosystem. This could pave the way for further regulatory clarity, which is essential for the long-term growth and stability of the market. A more regulated environment could protect investors from fraud and other risks, fostering a more robust and sustainable crypto economy.

What Should Investors Do Now?

For those already involved in the crypto space or thinking about diving in, it’s an exciting time. This announcement could be a catalyst for further investments and innovations in the cryptocurrency landscape. If you’re considering investing in Bitcoin or other digital currencies, it’s a good idea to stay informed about these regulatory changes and how they might affect your investment choices.

You can keep an eye on updates from trusted sources like [Bitcoin Magazine](https://bitcoinmagazine.com) to stay ahead of the curve. As the situation continues to evolve, being informed will help you make the best decisions for your financial future.

In summary, the ability for banks to custody Bitcoin and crypto signifies a new chapter in the relationship between traditional finance and the burgeoning world of digital currencies. Whether you’re a seasoned investor or a curious newcomer, this development opens up a wealth of opportunities and discussions worth exploring.