Bitcoin Surpasses Amazon to Become 5th-Largest Asset: Is This the End for Traditional Wealth?

cryptocurrency market trends, digital asset growth, investment strategies 2025

—————–

Bitcoin Surpasses Major Assets

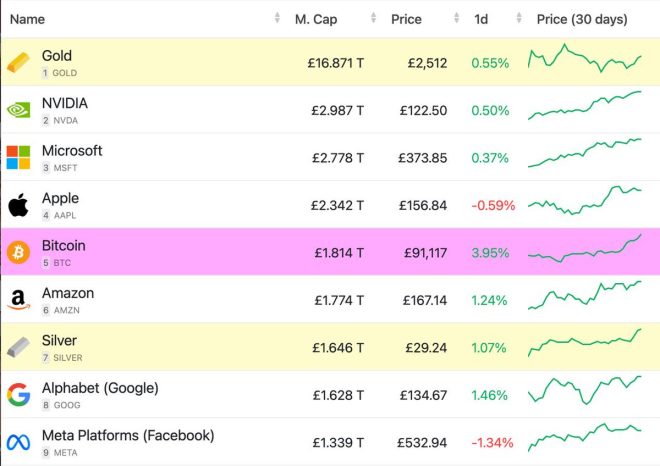

Bitcoin has made headlines by becoming the 5th-largest asset globally, surpassing notable giants like Amazon, Silver, and Google. This significant milestone highlights Bitcoin’s growing influence in the financial market and its increasing adoption among investors. As cryptocurrencies gain traction, Bitcoin’s rise reflects a shift in asset valuation and investment strategies. For those interested in cryptocurrency trends, this news underscores Bitcoin’s potential as a valuable asset class. Stay informed about the latest developments in the crypto space to understand how Bitcoin’s position could impact future market dynamics. Follow Cointelegraph for timely updates on cryptocurrency news.

BREAKING: Bitcoin is now the 5th-largest asset in the world, surpassing Amazon, Silver, and Google. pic.twitter.com/er1Bwu9ElJ

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Cointelegraph (@Cointelegraph) July 14, 2025

BREAKING: Bitcoin is now the 5th-largest asset in the world, surpassing Amazon, Silver, and Google.

Bitcoin has recently made headlines by becoming the 5th-largest asset globally, overtaking giants like Amazon, Silver, and even Google. This significant milestone signals a profound shift in the financial landscape, highlighting Bitcoin’s growing acceptance and value. As more investors and institutions recognize its potential, the cryptocurrency is carving out an essential place in the portfolio of modern investments.

Understanding Bitcoin’s Rise

So, what’s driving Bitcoin’s meteoric rise? It’s a combination of factors, really. First off, the adoption of cryptocurrency has surged. More people are buying, trading, and holding Bitcoin than ever before. This increased demand naturally bolsters its value. The mainstream media coverage, like the recent news from [Cointelegraph](https://twitter.com/Cointelegraph/status/1944675735953711300?ref_src=twsrc%5Etfw), is also giving Bitcoin a spotlight it hasn’t experienced in the past.

Another crucial aspect is the scarcity of Bitcoin. With a capped supply of 21 million coins, it’s becoming more valuable as demand continues to rise. Investors see it as a hedge against inflation, particularly in uncertain economic times. Unlike traditional currencies, Bitcoin isn’t subject to the same inflationary pressures, making it an appealing option for those looking to preserve their wealth.

Surpassing Major Assets

Surpassing established assets like Amazon, Silver, and Google is no small feat. For years, these companies and commodities have been seen as cornerstones of the global economy. Bitcoin’s ascent above them signifies growing confidence in its viability as a legitimate asset class. Investors are starting to view Bitcoin not just as a speculative investment but as a serious competitor to traditional assets.

This shift is further evidenced by the increasing number of institutional investors diving into Bitcoin. Companies are adding Bitcoin to their balance sheets, and investment funds are creating products tailored specifically for cryptocurrency investments. This institutional interest is crucial, as it adds a layer of legitimacy and stability to the market.

What This Means for the Future

Now that Bitcoin has claimed its spot as the 5th-largest asset, what’s next? Many experts believe that this is just the beginning. As more people become aware of Bitcoin and its potential benefits, we could see even more significant growth in the coming years. The future of Bitcoin looks promising, especially with advancements in blockchain technology and the increasing acceptance of cryptocurrencies in everyday transactions.

However, it’s essential to approach Bitcoin with caution. The cryptocurrency market is notoriously volatile, and while Bitcoin has proven its resilience, it can still experience significant price swings. If you’re thinking about investing, it’s vital to do your research and understand the risks involved.

In conclusion, Bitcoin’s rise to become the 5th-largest asset globally is a clear indicator of its growing importance in the financial world. By surpassing well-established giants like Amazon, Silver, and Google, Bitcoin is not just a trend; it’s a revolution. Whether you’re an experienced investor or just crypto-curious, now is an exciting time to pay attention to the developments in the world of Bitcoin.