“XRP ETFs Launch on DTCC: Is Wall Street’s Bold Move a Game-Changer?”

XRP investment opportunities, cryptocurrency exchange-traded funds, digital asset market trends

—————–

XRP ETF Launch: A Game Changer for Cryptocurrency Investors

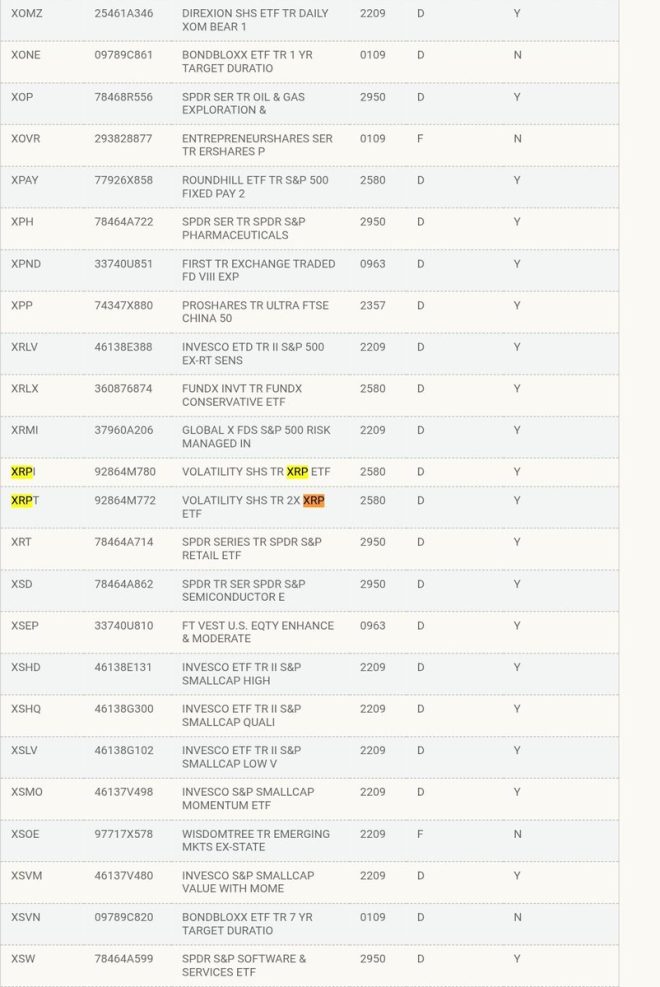

In a significant development for the cryptocurrency market, the XRP ETF (Exchange-Traded Fund) and its leveraged counterpart, the 2x XRP ETF, have recently been officially listed on the Depository Trust & Clearing Corporation (DTCC) under the tickers $XRPI and $XRPT, respectively. This announcement has sent ripples through the financial community, indicating that Wall Street is gearing up for enhanced exposure to XRP, a leading digital asset known for its innovative use case in cross-border payments.

The announcement was made via a tweet from prominent crypto influencer @Xaif_Crypto, who emphasized the urgency of the situation, stating, “They’re not waiting… THEY’RE LOADING UP.” This phrase highlights a growing anticipation among investors who understand the potential of XRP and the leverage that ETFs can provide in accessing the asset class. With institutional interest ramping up, the listing of these ETFs is likely to attract a broader audience to the cryptocurrency space.

Understanding XRP and Its Significance

XRP, created by Ripple Labs, has distinguished itself in the crowded cryptocurrency market due to its unique protocol designed for fast and cost-effective cross-border transactions. Unlike many cryptocurrencies that rely on mining, XRP transactions are validated through a consensus mechanism, allowing for quick processing times. With a growing number of financial institutions considering XRP for their payment systems, the asset has garnered significant attention in recent years.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The introduction of ETFs is particularly noteworthy as it provides a regulated and accessible means for investors to gain exposure to XRP without directly purchasing the cryptocurrency. ETFs can help reduce the barriers to entry for traditional investors who may be hesitant to navigate the complexities of cryptocurrency exchanges. With the new XRP ETFs, investors can now easily buy and sell shares that reflect the price movements of XRP, making it a more appealing option for those looking to diversify their portfolios.

The Impact of ETFs on XRP’s Market

The launch of the XRP ETF and 2x XRP ETF is expected to have a profound impact on the market dynamics of XRP. Historically, the introduction of ETFs for other cryptocurrencies has led to increased liquidity, higher trading volumes, and often a surge in the asset’s price. As institutional investors begin to allocate funds into these ETFs, it could lead to a significant uptick in demand for XRP, further validating its position in the financial ecosystem.

Moreover, as traditional finance continues to embrace cryptocurrency assets, the launch of these ETFs signifies an important milestone for XRP and the broader cryptocurrency market. It reflects a growing acceptance of digital assets within mainstream finance, paving the way for future developments and innovations.

Conclusion

The listing of the XRP ETF and 2x XRP ETF on the DTCC marks a critical juncture for both XRP and the cryptocurrency landscape at large. As Wall Street looks to capitalize on this burgeoning asset class, investors should keep a close eye on the developments surrounding these ETFs. With the momentum building, it’s clear that XRP is poised for a significant role in the future of finance, and this recent announcement is just the beginning of what could be an exciting journey for cryptocurrency investors.

BREAKING: XRP ETF & 2x XRP ETF listed on DTCC under tickers $XRPI and $XRPT

Wall Street’s next play $XRP exposure!

They’re not waiting… THEY’RE LOADING UP pic.twitter.com/YeY6HB7kCt

— 𝕏aif| (@Xaif_Crypto) July 13, 2025

BREAKING: XRP ETF & 2x XRP ETF listed on DTCC under tickers $XRPI and $XRPT

The cryptocurrency landscape is buzzing with excitement as the news breaks about the listing of the XRP ETF and its 2x counterpart on the Depository Trust & Clearing Corporation (DTCC). This recent move has energized traders and investors alike, marking a significant moment for XRP enthusiasts. If you’ve been following the cryptocurrency scene, you know how vital these developments can be for market dynamics and investment strategies.

For those new to this space, an ETF (Exchange-Traded Fund) provides a way for investors to gain exposure to an underlying asset—in this case, XRP—without the need to directly buy and hold the cryptocurrency itself. This makes it easier for traditional investors to jump into the crypto market, and the listing of the ETFs under the tickers $XRPI and $XRPT opens new doors for Wall Street’s engagement with digital assets.

Wall Street’s next play $XRP exposure!

The excitement around XRP is palpable, especially with Wall Street now setting its sights on this digital asset. Traditionally, institutional investors have been hesitant to dive into cryptocurrencies due to regulatory uncertainties and market volatility. However, with the introduction of the XRP ETF, that hesitance seems to be fading.

Institutional investors love ETFs because they simplify the investment process and offer a regulated avenue to gain exposure to an asset. With the XRP ETF, investors can now tap into the potential of XRP without the complexities of wallets and exchanges. This surge in institutional interest could lead to increased liquidity, greater price stability, and a more robust market for XRP.

But why is Wall Street particularly interested in XRP? The answer lies in its unique positioning within the cryptocurrency ecosystem. XRP facilitates fast and low-cost cross-border transactions, making it an attractive option for financial institutions looking to streamline their operations. As traditional finance continues to explore blockchain technology, XRP stands out as a solution that bridges the gap between traditional banking and digital assets.

They’re not waiting… THEY’RE LOADING UP

The recent developments have triggered a rush among traders and investors, eager to capitalize on the potential growth of XRP now that it has gained legitimacy through the ETF listings. The excitement is not just from retail investors; institutional players are also gearing up to invest heavily in XRP.

Many are flocking to platforms to buy up substantial amounts of XRP before prices potentially surge. The notion of “loading up” reflects a common sentiment in the trading community: the fear of missing out (FOMO). With the ETF making XRP more accessible, many anticipate that a wave of new investors will enter the market, driving demand and, subsequently, prices higher.

It’s important to understand that while the crypto market is known for its volatility, the backing of institutional investors often leads to a more stable investment environment. As more players enter the space, we could see a shift in XRP’s market dynamics, making it a more favorable option for both short-term traders and long-term holders.

The implications of the XRP ETF for investors

So, what does this mean for you as an investor? With the XRP ETF now available, you have a chance to diversify your portfolio with a digital asset that has strong potential for growth. The ETF structure allows for a more straightforward investment process, and it can often come with lower fees compared to other investment methods.

Moreover, having an ETF listed on a reputable platform like DTCC adds a layer of credibility to XRP, making it a more attractive option for those who might have been skeptical about investing in cryptocurrencies before. As the market matures, products like the XRP ETF will likely play a crucial role in bringing more investors into the fold.

However, it’s essential to conduct thorough research and stay updated on market trends. The cryptocurrency market is notorious for its rapid changes, and while the XRP ETF is a significant step forward, it’s crucial to approach investments with caution and informed strategies.

What the future holds for XRP

Looking ahead, it’s hard not to feel optimistic about the future of XRP. The listing of the ETF is just the beginning. As more financial institutions recognize the benefits of blockchain technology and digital currencies, the demand for XRP could rise significantly.

Additionally, regulatory clarity around cryptocurrencies is gradually improving, which could further bolster investor confidence. The more mainstream acceptance of cryptocurrencies and blockchain technology will likely lead to broader adoption and innovative use cases.

Furthermore, the partnership between Ripple, the company behind XRP, and various financial institutions around the globe cannot be understated. These collaborations aim to revolutionize cross-border payments and improve financial transactions, making XRP a key player in the evolution of the financial landscape.

How to get involved with XRP and the new ETFs

If you’re interested in getting involved with XRP or the newly listed ETFs, the first step is to choose a reputable trading platform that offers access to these products. Look for platforms that provide easy access to both cryptocurrencies and ETFs, ensuring that you can manage your investments seamlessly.

Once you’re set up, consider your investment strategy. Are you looking for short-term gains, or are you in it for the long haul? This decision will guide how you approach investing in XRP. Remember to keep an eye on market trends, news, and regulatory updates, as these factors can significantly influence your investment decisions.

Also, consider engaging with the community around XRP. There are numerous forums, social media groups, and platforms dedicated to discussing XRP and its potential. Engaging with other investors can provide valuable insights and help you navigate the complexities of the cryptocurrency market.

In summary

The recent news about the XRP ETF and its 2x counterpart being listed on the DTCC under the tickers $XRPI and $XRPT is a game-changer for the cryptocurrency market. With Wall Street now showing interest in $XRP exposure, the stage is set for increased investment and participation from both retail and institutional players.

As they say, timing is everything. If you’ve been considering dipping your toes into the crypto waters, now might be the perfect moment to explore the opportunities that XRP offers. With the ETF providing a regulated and accessible way to invest, the possibilities are exciting.

As always, approach your investments with a critical eye, do your research, and stay informed about the latest developments. The world of cryptocurrency is always evolving, and being well-informed will help you make the best decisions for your financial future.