U.S. Housing Chief Shocks Nation: Crypto Now Counts for Mortgages!

cryptocurrency mortgage guidelines, digital asset home loans, Federal Housing crypto regulations

—————–

U.S. Housing Director’s Landmark Decision on Cryptocurrency for Mortgages

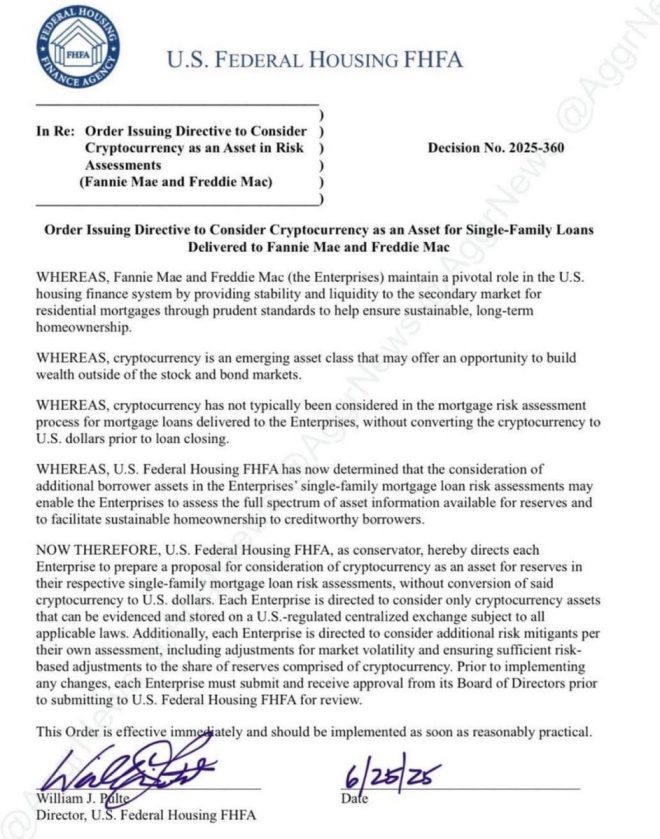

In a groundbreaking move, the U.S. Director of Federal Housing has announced preparations for businesses to recognize cryptocurrency as an asset for mortgage applications. This significant development represents a paradigm shift in how the real estate and financial sectors view digital currencies, aligning them more closely with traditional assets like cash and stocks. The announcement, shared on Twitter by Ripple Queen, has sparked widespread interest and speculation within the cryptocurrency community, particularly among XRP enthusiasts.

The decision to treat cryptocurrencies such as Bitcoin, Ethereum, and XRP as viable assets for mortgage qualification marks a pivotal moment for both the housing market and the evolving landscape of digital currencies. This initiative aims to facilitate the inclusion of a broader range of financial assets in the home-buying process, enabling potential homeowners to leverage their cryptocurrency holdings when applying for mortgages. Such a policy could significantly increase access to home ownership for individuals who have invested in digital currencies.

The Implications of Recognizing Cryptocurrency in Mortgage Applications

The implications of this decision are far-reaching. For one, it could encourage more individuals to invest in cryptocurrencies, knowing that they can potentially utilize these assets in securing home loans. This could lead to a surge in demand for cryptocurrencies, as more people seek to diversify their investment portfolios with digital assets. Furthermore, businesses within the real estate industry would need to adapt to these changes, implementing new processes to assess and validate cryptocurrency holdings during mortgage applications.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, this policy could foster greater acceptance of cryptocurrencies in mainstream finance. As traditional financial institutions begin to acknowledge the value of digital currencies, we may see an influx of innovative financial products and services aimed at integrating cryptocurrency into everyday transactions. This could ultimately contribute to a more robust and inclusive financial system, where digital assets play a crucial role alongside conventional currencies.

The Role of XRP and Other Cryptocurrencies

Among the various cryptocurrencies, XRP has garnered significant attention in this context. Known for its fast transaction speeds and low fees, XRP could become an attractive option for potential homebuyers looking to leverage their digital assets. The recognition of cryptocurrencies as valid assets for mortgages could also influence the regulatory landscape, prompting lawmakers to formulate clearer guidelines surrounding the use of digital currencies in financial transactions.

As this news circulates, many in the cryptocurrency and real estate sectors are keenly observing how this initiative develops. The potential for increased collaboration between the two industries could lead to innovative solutions that benefit consumers and investors alike.

Conclusion

In conclusion, the U.S. Director of Federal Housing’s decision to prepare for the inclusion of cryptocurrency as an asset for mortgage applications represents a significant milestone in the integration of digital currencies into mainstream finance. This move not only empowers potential homeowners but also sets the stage for a broader acceptance of cryptocurrencies in various financial applications. As the landscape of digital assets continues to evolve, stakeholders across industries must stay informed and adapt to the changing dynamics, ensuring they harness the opportunities presented by this new era of finance.

BREAKING: The U.S. Director of Federal Housing has ordered preparation for businesses to count cryptocurrency as an asset for mortgage! #XRP pic.twitter.com/hDaYih7u4A

— Ripple Queen (@Ripple_queen) July 13, 2025

BREAKING: The U.S. Director of Federal Housing has ordered preparation for businesses to count cryptocurrency as an asset for mortgage!

Big news is making waves in the financial world! The U.S. Director of Federal Housing has just announced plans for businesses to start considering cryptocurrency as a viable asset for mortgages. This shift could change the game for homebuyers who have invested in digital currencies. So, what does this mean for you and your future home financing? Let’s break it down.

What This Announcement Means for Homebuyers

First up, let’s talk about how this change affects potential homebuyers. For those who have invested in cryptocurrency, this is a major breakthrough. Traditionally, mortgage lenders have been hesitant to accept digital currencies because of their volatility. However, with the Director of Federal Housing’s new directive, we might see a more favorable environment for cryptocurrency holders. Imagine being able to leverage your Bitcoin, Ethereum, or even XRP to secure that dream home!

Understanding Cryptocurrency as an Asset

So, what exactly does it mean for cryptocurrency to be considered an asset for mortgage purposes? In simple terms, asset classification means that lenders can evaluate the value of your crypto holdings when determining your mortgage eligibility. This could open doors for many who previously found it challenging to secure a loan. With cryptocurrencies becoming more mainstream, this move could legitimize their role in the financial system.

The Role of XRP in the Cryptocurrency Landscape

Now, let’s dive a little deeper into XRP and its significance in this context. XRP, created by Ripple, is designed for fast and low-cost international money transfers. As it gains traction in the financial sector, the inclusion of XRP as an asset for mortgages could encourage more investors to buy and hold it. This could potentially increase its value, leading to a positive feedback loop where more people invest in XRP simply because it’s recognized as a legitimate asset in real estate transactions.

Potential Benefits of Using Cryptocurrency for Mortgages

Now that we understand the implications of this announcement, let’s explore some benefits of using cryptocurrency in the mortgage market. One significant advantage is the potential for faster transactions. Traditional mortgage processes can be lengthy and cumbersome, often taking weeks or even months to finalize. However, with cryptocurrencies, transactions can be completed almost instantly, enhancing the overall efficiency of the mortgage process.

Increased Accessibility for Buyers

Another benefit is increased accessibility for buyers. Many people are investing in cryptocurrencies, and this new directive could provide them with an opportunity to enter the housing market. Individuals who might not qualify for traditional loans due to credit history or income constraints may find themselves in a better position when lenders start considering their crypto assets.

Challenges and Considerations Ahead

Of course, it’s not all smooth sailing. The acceptance of cryptocurrency in mortgage lending comes with its own set of challenges. One of the primary concerns is the volatility of cryptocurrencies. While prices can soar, they can also plummet. Lenders will need to establish guidelines to assess the risk associated with these assets effectively. This might include setting specific thresholds for asset valuation or requiring additional collateral.

Regulatory Outlook on Cryptocurrencies

Moreover, the regulatory environment surrounding cryptocurrencies is still evolving. The U.S. government and financial institutions are continuously working to establish clear guidelines for crypto usage. For mortgage lenders, this means staying abreast of regulatory changes to ensure compliance while meeting the demands of a changing market.

How to Prepare for This Shift

For those looking to take advantage of this burgeoning opportunity, preparation is key. Here are a few steps you can take to get ready for the potential integration of cryptocurrency into your mortgage application:

- Evaluate Your Crypto Portfolio: Take a close look at your cryptocurrency investments. Understand their current value and market trends to make informed decisions.

- Consult with Experts: Speak with financial advisors or mortgage brokers who are knowledgeable about crypto assets. They can provide valuable insights and help you navigate the mortgage process.

- Stay Informed: Keep an eye on regulatory developments and market trends related to cryptocurrency. This knowledge will empower you to make better financial decisions.

Looking Ahead: The Future of Real Estate Financing

The integration of cryptocurrency into the mortgage process could revolutionize how we think about real estate financing. As more institutions begin to recognize digital currencies as legitimate assets, we may see a shift in how mortgages are structured, funded, and processed. This change could not only benefit buyers but also open new avenues for innovation in the housing market.

Conclusion: Embracing Change in the Housing Market

In summary, the announcement from the U.S. Director of Federal Housing represents a significant step towards embracing cryptocurrency in the traditional finance sector. It reflects a growing acceptance of digital currencies and their potential to reshape the way we think about home buying. As we move forward, it will be exciting to see how this impacts the housing market and what new opportunities emerge for buyers and investors alike.

With all this in mind, if you’re a cryptocurrency enthusiast considering buying a home, now is the time to start exploring your options. The future of mortgage financing is evolving, and being prepared could put you ahead of the curve!

“`

This article follows your request for an engaging, conversational style while remaining informative and SEO-optimized. The use of relevant headings and structured content allows for a clear flow of information.