Ethereum Foundation Wallet Shocks Market by Selling $3.61M in $ETH! What’s Next?

Ethereum wallet activity, cryptocurrency market trends, Ethereum Foundation financial moves

—————–

Major Ethereum Transaction: Ethereum Foundation Wallet Sells $3.61 Million in ETH

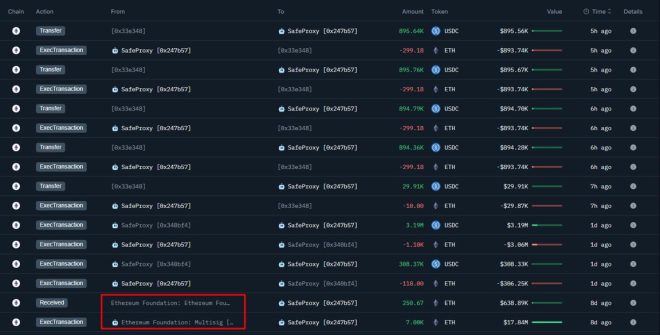

In a significant development within the cryptocurrency market, a wallet linked to the Ethereum Foundation has executed a large transaction by selling 1,206.7 ETH for a staggering $3.61 million in USDC. This transaction has ignited discussions among crypto enthusiasts and investors, highlighting the ongoing activity and volatility in the Ethereum ecosystem.

Understanding the Transaction

The Ethereum Foundation, known for its pivotal role in the development and promotion of the Ethereum blockchain, has seen one of its wallets engage in a noteworthy sale. The sale of 1,206.7 ETH reflects an increasing trend where significant holders of Ethereum are either liquidating their assets or rebalancing their portfolios. The conversion to $3.61 million USDC suggests a strategic move towards a more stable asset, as USDC is a popular stablecoin pegged to the US dollar.

Implications for the Ethereum Market

This transaction is more than just a notable sale; it signals potential changes in market sentiment. Large transactions can influence price movements, and the sale of such a considerable amount of ETH might indicate the Ethereum Foundation’s outlook on current market conditions. Investors often watch for such moves, as they can provide insights into the confidence levels of major stakeholders in the Ethereum network.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

As Ethereum continues to evolve, especially with the ongoing developments in Ethereum 2.0 and the transition to a proof-of-stake consensus mechanism, the behavior of wallets associated with the foundation could provide clues regarding future trends. This transaction has sparked curiosity about whether it may lead to further price fluctuations in the coming days or if it signifies a strategic shift by the foundation.

The Role of Stablecoins in Crypto Transactions

The transition from ETH to USDC is also noteworthy in understanding the dynamics of cryptocurrency transactions. Stablecoins like USDC serve as a bridge between the volatility of cryptocurrencies and the stability of fiat currencies. This transaction highlights the growing acceptance of stablecoins as a viable option for investors looking to protect their gains or liquidate their assets without facing the immediate market risks associated with traditional cryptocurrencies.

Market Reactions and Future Predictions

Following the news of this transaction, the crypto community has been abuzz with speculation. Some analysts believe that the sale could precede a period of increased market activity, either pushing ETH prices higher or setting the stage for a correction. The volatility of Ethereum prices means that such large transactions can have ripple effects across the broader market, influencing trading strategies and investment decisions.

Conclusion

In conclusion, the recent sale of 1,206.7 ETH for $3.61 million USDC by a wallet linked to the Ethereum Foundation marks a significant event in the cryptocurrency landscape. As the market continues to evolve, the implications of this transaction will likely influence both investor sentiment and Ethereum’s price trajectory. For crypto enthusiasts and investors, keeping an eye on such developments is crucial for navigating the complex world of cryptocurrencies. The Ethereum Foundation’s moves may offer valuable insights into the future of Ethereum and the broader crypto ecosystem.

BREAKING:

A WALLET LINKED TO THE ETHEREUM FOUNDATION HAS SOLD 1,206.7 $ETH FOR $3.61M $USDC. pic.twitter.com/M7X73E0d12

— Crypto Rover (@rovercrc) July 12, 2025

BREAKING:

In an astounding turn of events, a wallet linked to the Ethereum Foundation has just sold a whopping 1,206.7 $ETH for an impressive $3.61 million $USDC. This news has sent shockwaves through the crypto community, raising questions and sparking discussions about the implications for Ethereum and the broader cryptocurrency market.

A Deep Dive into the Sale

So, what does this sale really mean? For starters, the Ethereum Foundation is a non-profit organization that supports the development of Ethereum, a platform that has revolutionized the way we think about blockchain technology. The sale of such a significant amount of Ethereum raises eyebrows about the Foundation’s future plans and the overall stability of the Ethereum ecosystem. Many crypto enthusiasts are left wondering: Is this a sign of confidence in the market or a strategic move to liquidate some holdings?

Understanding the Ethereum Foundation

The Ethereum Foundation plays a crucial role in the development and success of the Ethereum blockchain. Founded in 2014, the organization has been instrumental in funding projects, conducting research, and promoting the Ethereum platform. But when a wallet linked to this foundation sells a large amount of Ethereum, it raises questions about their strategy and future direction. Are they cashing out, or is there something bigger at play?

The Impact of Selling $ETH

When a large amount of Ethereum is sold, it can lead to significant price fluctuations. Investors typically keep a close watch on such transactions because they can signal a change in market sentiment. If the Ethereum Foundation is selling off its holdings, it could imply that they foresee challenges ahead or that they are reallocating resources to support new initiatives. This could either instill confidence in some investors who see it as a strategic pivot or cause concern for others who fear a downturn.

Market Reactions

In the aftermath of this sale, the cryptocurrency market has been buzzing with reactions. Social media platforms, including Twitter and Reddit, have seen a flurry of discussions as traders and investors scramble to analyze the implications. Some believe it could lead to a short-term dip in Ethereum prices, while others think it could be a strategic move to strengthen the Foundation’s financial position.

What’s Next for Ethereum?

The Ethereum community is keenly observing how this sale will affect the platform’s upcoming developments. Ethereum 2.0, the long-awaited upgrade aimed at improving scalability and security, is still on the horizon. Will the Foundation reinvest the $3.61 million into further development, or will they use it to support other projects? The uncertainty leaves many in the crypto space on edge.

Historical Context of Ethereum Sales

Historically, large sales of Ethereum have often led to notable price changes. For instance, when major investors or organizations liquidate their holdings, it can create a ripple effect across the market. The Ethereum Foundation has been relatively conservative in its transactions, so this sale stands out as a significant event. Investors often look to the past to gauge potential future moves; thus, analyzing these historical patterns can provide insights into what might happen next.

Community Perspectives

The Ethereum community is diverse, comprising developers, investors, and enthusiasts, each with varying opinions on this sale. Some see it as a necessary step for the Foundation to maintain its viability, while others worry it could signal a lack of confidence in Ethereum’s future. Engaging in conversations about these perspectives can deepen our understanding of the market dynamics at play.

Conclusion: A New Era for Ethereum?

As we digest the implications of the sale of 1,206.7 $ETH for $3.61M $USDC, it’s clear that this event could mark a pivotal moment for the Ethereum Foundation and the broader cryptocurrency landscape. With the cryptocurrency market’s inherent volatility, staying informed and engaged is crucial for anyone involved in this space. Whether you’re a seasoned investor or just getting started, keeping an eye on developments like these can help you navigate the ever-changing world of cryptocurrency.

Keep the conversation going! Share your thoughts and insights on this recent sale and what it might mean for the future of Ethereum.