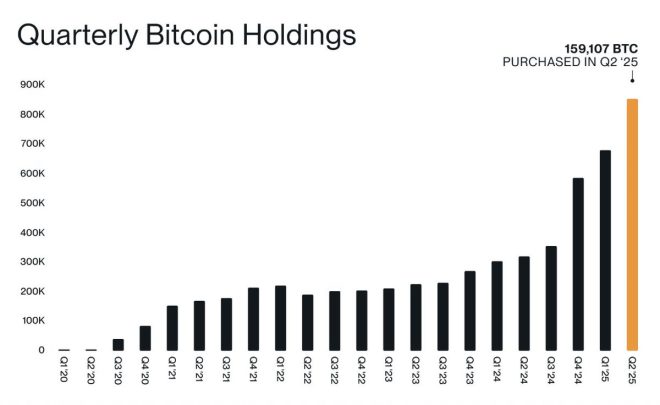

Corporations Hoard 159,000 Bitcoin in Q2: Is This the End of Crypto Freedom?

corporate bitcoin adoption, cryptocurrency investment trends, institutional bitcoin purchases

—————–

In a groundbreaking development for the cryptocurrency market, corporations acquired over 159,000 Bitcoin (BTC) in the second quarter of 2025, marking the highest amount purchased in any quarter to date. This surge in corporate investment not only highlights the growing institutional interest in Bitcoin but also signals a significant shift in how corporations view cryptocurrencies as a valuable asset class.

### The Surge in Bitcoin Adoption

As businesses increasingly recognize Bitcoin’s potential as a hedge against inflation and a store of value, many are opting to include it in their treasury strategies. The staggering figure of 159,000 Bitcoin purchased in Q2 represents a substantial increase in corporate involvement in the digital currency market, reflecting a trend that has been gaining momentum over recent years. With Bitcoin’s market cap continuing to rise, corporations are seizing the opportunity to diversify their assets and enhance their balance sheets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### Why Corporations Are Investing in Bitcoin

Several factors are driving this unprecedented corporate adoption of Bitcoin. Firstly, many companies are motivated by the desire to protect their assets from inflation and economic uncertainty. With traditional currencies losing value due to monetary policy changes, Bitcoin is viewed as a safe haven. Secondly, the increasing acceptance of Bitcoin as a form of payment by major retailers and service providers has further legitimized its utility. As a result, businesses are more inclined to hold Bitcoin as part of their financial strategies.

### Market Implications of Corporate Bitcoin Purchases

The influx of corporate capital into Bitcoin is poised to have significant implications for the cryptocurrency market. With more institutional players entering the space, the overall credibility of Bitcoin is enhanced, likely leading to increased retail interest. This could create a positive feedback loop, driving prices higher and attracting even more investment. Furthermore, as corporations continue to accumulate Bitcoin, the supply available on exchanges may decrease, potentially leading to increased scarcity and value appreciation.

### Future Outlook for Bitcoin

As we look ahead, the future of Bitcoin appears promising, especially considering the current trend of corporate investment. The potential for widespread adoption among businesses could pave the way for Bitcoin to become a mainstream asset class. Additionally, the growing ecosystem of Bitcoin-related financial products, such as ETFs and futures contracts, is likely to facilitate further institutional investment.

### Conclusion

The record-breaking acquisition of over 159,000 Bitcoin by corporations in Q2 2025 is a historic milestone that underscores the increasing institutional embrace of cryptocurrencies. As more companies recognize the advantages of holding Bitcoin, we can expect a continued upward trajectory in its adoption and value. Investors and enthusiasts alike should buckle up for what promises to be an exciting journey ahead in the ever-evolving landscape of digital currencies.

As Bitcoin continues to capture the attention of global corporations, its role as a pivotal asset in the financial markets is increasingly affirmed, ushering in a new era of investment opportunities and financial strategies.

BREAKING: CORPORATIONS BOUGHT OVER 159,000 #BITCOIN IN Q2 – THE MOST OF ANY QUARTER EVER

BUCKLE UP pic.twitter.com/hAZJtcH4hE

— The Bitcoin Historian (@pete_rizzo_) July 10, 2025

BREAKING: CORPORATIONS BOUGHT OVER 159,000 #BITCOIN IN Q2 – THE MOST OF ANY QUARTER EVER

The world of cryptocurrency is buzzing more than ever, and the latest news has sent shockwaves through the financial community. In the second quarter of 2025, corporations made significant moves by purchasing over 159,000 Bitcoin, marking a record-setting quarter. This is no small feat and has everyone from investors to casual observers asking what this means for the future of Bitcoin and the broader crypto market.

With corporations actively buying Bitcoin, it’s essential to understand the implications of such large-scale investments. This trend indicates a growing institutional interest in Bitcoin, which can lead to increased stability and legitimacy for the cryptocurrency. Many are wondering if this could be the tipping point for Bitcoin, pushing it further into mainstream acceptance.

BUCKLE UP

When we say “buckle up,” we mean it. The surge in corporate purchases indicates that something big is happening in the world of Bitcoin. Companies are no longer viewing Bitcoin merely as a speculative asset but as a legitimate part of their financial strategies. This shift in perspective could pave the way for other corporations to follow suit, further driving up demand and, potentially, the price of Bitcoin.

The implications of this massive buying spree are profound. As corporations recognize the value of Bitcoin, they are likely to begin incorporating it into their balance sheets and investment portfolios. This could lead to increased liquidity in the market, as institutional investors are typically more stable than individual traders.

The Impact on Bitcoin’s Price

With over 159,000 Bitcoin being snapped up, one of the immediate questions that arise is: how will this affect the price of Bitcoin? Historically, significant purchases have led to price increases, as the supply of Bitcoin is capped at 21 million. As demand rises with corporate interest, the economic principle of supply and demand suggests that the price will likely follow suit.

Companies like MicroStrategy and Tesla have already paved the way for others by investing heavily in Bitcoin. These moves have not only contributed to a rise in Bitcoin’s value but have also encouraged other corporations to consider Bitcoin as a viable investment option. As institutional buying increases, it could create a more stable market environment, reducing volatility that has often plagued Bitcoin in the past.

Why Are Corporations Buying Bitcoin?

So, what’s driving this sudden corporate interest in Bitcoin? There are a few key factors at play. Firstly, Bitcoin is increasingly being viewed as a hedge against inflation. Many corporations are concerned about the long-term value of traditional currencies, especially given the economic fluctuations witnessed in recent years. By investing in Bitcoin, companies are seeking to protect their assets from potential inflationary pressures.

Secondly, Bitcoin offers a level of diversification that traditional investments may lack. In a world where market dynamics are constantly changing, having a portion of assets in Bitcoin can provide a buffer against volatility in other markets. This strategic move is especially appealing to corporations looking to safeguard their investments in an uncertain economic landscape.

Lastly, the growing acceptance of Bitcoin as a payment method is also a significant factor. As more businesses begin to accept Bitcoin for transactions, the demand will naturally increase. Corporations want to be ahead of the curve, ensuring they are not left behind as the world shifts towards digital currencies.

The Future of Bitcoin and Corporate Investments

Looking ahead, the future of Bitcoin appears bright, especially as more corporations recognize its potential. With over 159,000 Bitcoin purchased in just one quarter, we can expect to see continued interest from institutional investors. This could lead to a snowball effect, where increased corporate buying leads to higher prices, attracting even more investors.

Moreover, as Bitcoin becomes more mainstream, regulatory bodies are likely to take a closer look at its impact on the financial system. While regulation may come with challenges, it could also provide a level of legitimacy that Bitcoin needs to be fully embraced by the mainstream.

The conversation around Bitcoin is shifting from “Is it a bubble?” to “How can we integrate it into our business model?” This transformation is crucial for the long-term sustainability of Bitcoin as an asset class.

How to Get Involved

If you’re feeling inspired by the corporate frenzy surrounding Bitcoin and want to explore this digital currency, here are a few steps to consider:

1. **Educate Yourself**: Understanding Bitcoin and its underlying technology, blockchain, is essential. There are plenty of resources available online, including articles, videos, and podcasts that explain the basics and complexities of Bitcoin.

2. **Choose a Reliable Exchange**: When you’re ready to invest, ensure you select a reputable cryptocurrency exchange. Look for platforms with a solid track record, strong security measures, and user-friendly interfaces.

3. **Start Small**: If you’re new to investing in cryptocurrency, consider starting with a small amount. This approach allows you to familiarize yourself with the market dynamics without taking on excessive risk.

4. **Stay Informed**: The cryptocurrency market is incredibly dynamic, and staying updated on news and trends is crucial. Following trusted sources, like [CoinDesk](https://www.coindesk.com) or [CoinTelegraph](https://cointelegraph.com), can provide valuable insights.

5. **Consider Long-Term Holding**: Many investors believe in the long-term potential of Bitcoin. Rather than trying to time the market, a buy-and-hold strategy may prove beneficial.

Final Thoughts

The recent announcement about corporations buying over 159,000 Bitcoin in Q2 is not just a headline; it’s a signal of a significant shift in how businesses perceive cryptocurrency. The implications of this trend are vast, from price stability to mainstream acceptance.

As we watch this space evolve, it’s crucial for individual investors to stay informed and consider how they might fit into the changing landscape of digital currencies. Whether you’re a seasoned investor or a curious newcomer, the future of Bitcoin is undoubtedly exciting, and the time to engage with it is now. Buckle up and get ready for the ride!