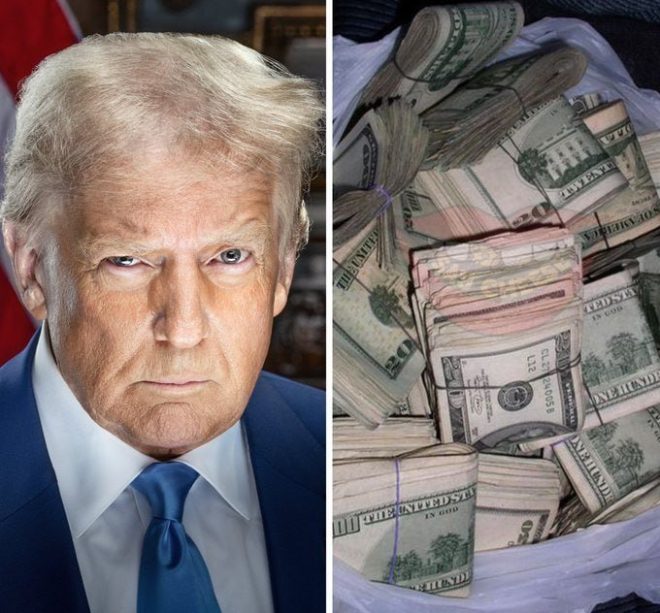

SHOCKING: Trump Proposes Tax Elimination for Sub-$200K Earners! Support or Oppose?

President trump tax plan, income tax cuts, middle class tax relief

—————–

In a recent tweet from the TRUMP ARMY Twitter account, it was revealed that President Donald Trump is proposing to eliminate taxes for individuals making less than $200,000 a year. This bold move has sparked a debate among Americans, with many questioning whether this proposal would be beneficial or detrimental to the economy.

Those in favor of this proposal argue that it would provide much-needed relief for working-class individuals and families who are struggling to make ends meet. By eliminating taxes for those making less than $200,000 a year, President Trump aims to put more money back into the pockets of hardworking Americans, allowing them to spend and invest in their futures.

On the other hand, critics of this proposal raise concerns about the potential impact on government revenue and the overall economy. They argue that eliminating taxes for lower-income individuals could lead to a decrease in funding for essential government programs and services, ultimately harming the most vulnerable members of society.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

As the debate rages on, it is crucial for Americans to consider the long-term implications of President Trump’s proposal. Will eliminating taxes for those making less than $200,000 a year stimulate economic growth and benefit the middle class, or will it create unforeseen consequences that could harm the economy in the long run?

Regardless of where one stands on this issue, it is clear that President Trump’s proposal to eliminate taxes for lower-income individuals has sparked a heated discussion about the future of taxation and economic policy in the United States. As the debate continues to unfold, it is essential for Americans to stay informed and engaged in the conversation to ensure that their voices are heard on this important issue.

BREAKING: President Donald Trump wants to eliminate taxes for anyone who makes less than $200,000 a year.

Do you support this?

YES or NO? pic.twitter.com/FBpA67jfYU

— TRUMP ARMY (@TRUMP_ARMY_) July 10, 2025

In a recent announcement, President Donald Trump has proposed a bold move to eliminate taxes for individuals earning less than $200,000 a year. This decision has sparked a heated debate among Americans, with some supporting the idea and others expressing concerns about its potential impact on the economy and government revenue.

YES

For those who support President Trump’s proposal, the idea of eliminating taxes for lower-income earners is seen as a way to provide much-needed relief to working-class families struggling to make ends meet. By putting more money back into the pockets of these individuals, the hope is that they will have more disposable income to spend on goods and services, stimulating economic growth in the process.

Furthermore, proponents argue that reducing the tax burden on lower-income earners can help address income inequality by ensuring that those at the bottom of the income ladder are not disproportionately burdened by taxes. This, in turn, could lead to a more equitable distribution of wealth and resources within society.

NO

On the other hand, critics of President Trump’s proposal have raised several valid concerns about the potential consequences of eliminating taxes for individuals making less than $200,000 a year. One major worry is that such a move could lead to a significant loss of government revenue, potentially resulting in cuts to essential services and programs that benefit all Americans.

Moreover, opponents argue that eliminating taxes for lower-income earners may not actually benefit those individuals in the long run. Without a tax system in place to fund government operations, there could be negative repercussions for the economy as a whole, such as higher deficits, inflation, and an increased burden on higher-income earners to make up the difference.

Ultimately, the question of whether or not to support President Trump’s proposal to eliminate taxes for individuals earning less than $200,000 a year is a complex and multifaceted issue. It requires careful consideration of the potential benefits and drawbacks, as well as an understanding of the broader implications for the economy and society as a whole.

In conclusion, the decision to support or oppose President Trump’s proposal should be based on a thorough analysis of the facts and a consideration of how it aligns with one’s own values and beliefs. It is a decision that will have far-reaching consequences and should not be taken lightly.

Sources:

– https://twitter.com/TRUMP_ARMY_/status/1943346435501527548?ref_src=twsrc%5Etfw

– https://pbs.twimg.com/media/GvgnJKsWIAAYafk.jpg